In accordance with the requirements of state or regional authorities, it may be necessary to determine the budgetary effectiveness of the project for budgets of various levels. For this purpose it is determined budget effect project, which then becomes the basis for calculating all the necessary indicators.

The budget effect is determined for each calculated step of the project as the difference between budget income and expenses associated with the implementation of this project.

Budget expenses include:

- funds allocated for direct budget financing of the project. Depending on the form of ownership, only from the budgets of the corresponding levels of the budget system;

- subsidies (equity participation) from budgets of all levels;

- loans from the Central, regional and authorized banks for individual project participants, allocated as borrowed funds subject to compensation from the budget;

- direct budget allocations for surcharges to market prices for fuel and energy resources;

- payment of benefits for people who remain unemployed in connection with the implementation of the project (including when using imported equipment and materials instead of similar domestic ones);

- payments on government securities;

- state, regional guarantees of investment risks to foreign and domestic participants.

Budget revenues include:

- taxes and payments to extra-budgetary funds paid by enterprises participating in the project in part related to its implementation;

- an increase (with a minus sign - a decrease) in tax revenues from third-party enterprises, due to the impact of the project on their financial position;

- customs duties and excise taxes received by the budget on products (resources) produced (expended) in accordance with the project;

- dividends on shares and other securities owned by the state, region and other securities issued to finance the project, as well as income from the sale of these shares;

- receipts to the budget of income tax from wages of employees accrued for the performance of work provided for by the project;

- payments to repay soft loans for the project allocated from budget funds.

Based on the indicators of annual budget effects, project performance indicators from a budget point of view are determined. The list of indicators and the formula for their calculation do not differ from the indicators of the commercial effectiveness of the project.

When determining budget efficiency, the discount rate is used, defined as the sum of the refinancing rate of the Central Bank of the Russian Federation and the risk premium determined from the table given in the previous subsection. If the calculations were performed in constant prices, then the nominal discount rate is additionally reduced to the real rate.

Risk analysis

The section should contain the types and description of the main risks for the project, their assessment (qualitative assessment of the magnitude of the risk and/or quantitative assessment of the likelihood of the risk occurring and the degree of potential damage), methods of risk management (their reduction, distribution between participants) and proposed guarantees to investors.

Analysis methods

Assessing and studying the risks of an investment project should begin with identifying factors that are likely to affect the results of the project and lead to deviation of the project from the planned option. Methods for selecting risk factors depend on the nature of the project and the characteristics of the industry.

Methodology for assessing the budgetary efficiency of a project

- high significance - this factor can significantly influence the results and lead to the failure of the project;

- medium importance – the factor has a noticeable impact on the results of the project;

- low significance - deviations associated with this factor will not have a significant impact on the results of the project as a whole;

and also to one of the probability levels:

- high probability - deviations associated with this factor are expected or very possible, this is an area in which it is difficult to make accurate predictions;

- average probability - deviations associated with this factor are possible, but not very common;

- low probability - it is expected that there will be no deviations for this factor, although theoretically they are possible.

For a detailed analysis, factors are selected that have a sufficiently high significance and probability in the project being studied.

The following can be used as the main methods of risk analysis in business plans:

- drawing up project development scenarios;

- constructing sensitivity graphs and determining the maximum permissible values of uncertain factors;

- calculation of break-even point;

- probabilistic and statistical analysis.

Project development scenarios imply a detailed study and analysis of the project based on several possible options for its development. The creation of scenarios can be based on different market forecasts, different expected results of research and development, options for equipment costs and costs, and different market strategies. Each of the scenarios is analyzed using standard methods, and the totality of the obtained indicators reflects the range of possible project results.

Scenarios can be described either separately, in the risk analysis section, or in the main part of the business plan (in this case, the entire project analysis is carried out with a mention of each of the scenarios).

Sensitivity graphs projects are a variant of scenario analysis in which the value of only one factor varies, and the results of the analysis are presented in the form of a graphical dependence of the final indicator on changes in this factor.

Key sensitivity factors include assumptions (initial data) of the financial model, the actual values of which during the implementation of the project (due to the impossibility of their accurate assessment or their inherent instability) may significantly deviate from the values included in the financial model. The most important of these parameters are:

- volume of sales;

- prices for the products (services) of the project;

- prices for basic raw materials and materials, fuel, labor resources.

Also, typical sensitivity factors include:

- volume of capital expenditures;

- delays in putting the investment facility into operation and reaching its design capacity;

- the amount of fixed operating costs;

- discount rate;

- forecast inflation rates;

- currency exchange rates, etc.

Typical results of financial forecasts that are used as outputs of sensitivity analysis include:

- investment attractiveness indicators (NPV, IRR, PBP);

- financial stability indicators;

- loan repayment period;

- assessment of the company's market value.

If a project has several development scenarios, which are formulated as “baseline”, “pessimistic” or “optimistic” scenarios, then sensitivity graphs are always built only for the base scenario of the project.

The deviation of the factor at which the final indicator of the project ceases to be acceptable is maximum permissible value factor and can be separately considered in the risk analysis. It is recommended to analyze and justify the probability (or impossibility) of changing the uncertainty factor by an amount greater than the maximum permissible.

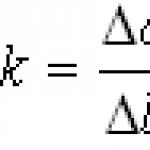

An assessment of the project's sensitivity to changes in sales volumes can be presented as a project break-even analysis. Break-even level can be approximately estimated using the following formula:

where each component of the formula is taken from the corresponding item in the income statement.

The break-even level may vary from project period to period. It is recommended to present in the risk analysis the average break-even level established after production reaches its design capacity. The periods during which the construction and launch of production takes place, as well as the establishment of stable operations, are not used in calculating the break-even level.

A break-even level close to 1 indicates a high sensitivity of the project to fluctuations in demand. A sufficient break-even level depends on the industry and the individual characteristics of the project, but on average a project can be considered resistant to fluctuations in demand if its break-even level does not exceed 0.6-0.7.

In some cases, it is permissible to include the use of statistical and probabilistic analysis methods (such as the Monte Carlo method) in the risk analysis of an investment project. However, one should be especially careful when using these methods and, in particular, limit (or better yet completely eliminate) the use of expert assessments when preparing source data for them.

Risk reduction

An analysis of the impact of risks on project results should be accompanied by a description of the measures planned to reduce these risks. Traditional risk mitigation measures include:

- Risks associated with sales:

o concluding preliminary contracts for supplies;

o attracting consumers as co-investors and project partners;

o use of “take or pay” contracts;

o control over sales channels.

- Risks associated with the amount of costs:

o concluding preliminary agreements with suppliers;

o attracting suppliers as co-investors and project partners;

o vertical integration of production (i.e., concentration in one’s hands of all stages of production and sales from raw materials to the final buyer);

o the use of pricing principles in which changes in certain types of costs are automatically transferred to the cost of the final product (service);

o increasing the share of variable costs (for example, using piecework wages or outsourcing);

o introduction of budget planning mechanisms.

- Risks associated with the investment phase of the project:

o attracting a reliable contractor;

o completion of design and survey work;

o concluding contracts that provide for the contractor’s comprehensive responsibility for construction results;

o engaging a contractor as a co-investor or project partner.

- Risks associated with technological failures and loss of property:

o use of high quality equipment;

o concluding contracts for maintenance and monitoring of equipment;

o property insurance.

- Financial risks:

o use of fixed interest rates on loans;

o increasing the debt coverage ratio.

- Legal risks:

o preliminary obtaining of licenses and permits;

o letters of support from local government representatives.

In addition to measures that reduce the risks of the project as a whole, it is recommended to provide information about measures that can be taken to reduce the risks of individual project participants, primarily the bank.

Such measures may include:

- provision of guarantees and guarantees from the holding to which the project initiator belongs;

- provision of liquid collateral whose market value is not subject to significant fluctuations.

If the project includes these or other measures aimed at reducing risks, they should be mentioned in the business plan.

Appendix 1. Financial model of the investment project

The budget of the investment project is prepared for presentation to potential investors and should provide them with the opportunity to study the details of financial forecasts, independently check the logic of calculations and carry out calculations of interest to them. In this regard, a business plan, as a rule, must be accompanied by a financial model. Below are the main requirements and wishes for this model.

Budget efficiency is assessed at the request of state and/or regional authorities. In accordance with these requirements, budgetary efficiency can be determined for budgets of various levels or a consolidated budget. Indicators of budgetary efficiency are calculated based on the determination of the flow of budgetary funds.

Inflows of funds for calculating budget efficiency include:

- inflows from taxes, excise taxes, duties, fees and deductions to extra-budgetary funds established by current legislation;

- income from licensing, competitions and tenders for exploration, construction and operation of facilities provided for by the project;

- payments to repay loans issued from the respective budget for project participants;

- payments to repay a tax credit;

- commission payments to the Ministry of Finance of the Russian Federation for support of foreign loans;

- dividends on regionally or state-owned shares and other securities issued in connection with the implementation of individual entrepreneurs.

Budget outflows include:

- provision of budgetary resources on the terms of securing in the ownership of the relevant management body part of the shares of the joint-stock company created for the implementation of individual entrepreneurs;

- provision of budget resources in the form of an investment loan;

- provision of budget funds free of charge (subsidies);

- budget subsidies related to the implementation of a certain pricing policy and ensuring compliance with certain social priorities.

- tax benefits reflected in a decrease in revenues from taxes and fees.

Budgetary efficiency of an investment project

In this case, there are also no outflows, but inflows decrease;

- state guarantees of loans and investment risks. There are no outflows. An additional influx is the guarantee fee. When assessing the effectiveness of a project taking into account uncertainty factors, payments under guarantees in the event of insured events are included in the outflow.

A budget cash flow table with definitions of budget efficiency indicators is recommended as an output form. The main indicator of budget efficiency is the budget NPV. In the case of providing government guarantees for the analysis and selection of independent projects for a given total value of guarantees, on a par with the NPV of the budget, a significant role can also be played by the index of profitability of guarantees (IGI) - the ratio of NPV to the value of guarantees (discounted if necessary).

Budget efficiency indicators reflect the impact of project implementation results on the revenues and expenses of the corresponding federal, regional and local budgets. The main indicator used to justify the federal and regional financial support measures provided for in the project is the budget effect. Bt = Dt - RT - that is, the excess of revenues of the corresponding budget over expenses in connection with the implementation of this project for the t-th step.

The integral budget effect is calculated using the formula as the sum of discounted annual budget effects or as the excess of integral budget revenues over integral expenses.

Based on indicators of annual budget effects, additional indicators of budget efficiency are also calculated:

- internal rate of budget efficiency

- payback period for budget investments

- degree of financial participation of the state = integral budget expenses/integral project costs.

BUDGET EFFICIENCY OF AN INVESTMENT PROJECT

Calculation of regional efficiency indicators

ASSESSMENT OF PROJECT EFFECTIVENESS BY HIGHER LEVEL STRUCTURES

Regional efficiency indicators reflect the financial effectiveness of the project from the point of view of the corresponding region, taking into account the impact of the project on the enterprises of the region, the social and environmental situation in the region, the income and expenses of the regional budget.

The calculation is carried out similarly to the calculation of social efficiency, however:

Additional effect in related sectors of the national economy, as well as social and environmental effects (regional externalities) are taken into account only within a given region;

When determining working capital, in addition to inventories, payment delays and liabilities for settlements with the external environment are taken into account;

The valuation of products and resources is carried out at economic prices, with regional adjustments made if necessary;

Cash inflows include cash receipts into the region from the external environment in connection with the project (payment for products, receipts of subsidies and grants, borrowed funds from the federal center, other regions, foreign sources);

Cash outflows include payments to the external environment (to a higher-level budget, to other regions, etc.).

Calculation of industry efficiency indicators. When assessing the effectiveness of an investment project, it should be taken into account that participating enterprises may be part of a broader structure (industry, financial industrial group, holding, etc.). The impact of project implementation on the costs and results of the corresponding structure is characterized by industry efficiency indicators.

When calculating these indicators:

The impact of the implementation of the investment project on the activities of other enterprises in this industry is taken into account (indirect industry financial results of the project);

Mutual settlements between enterprises within the industry are not taken into account;

Interest on loans from industry funds is not taken into account;

Contributions to industry funds are not taken into account.

Calculations of industry efficiency indicators are similar to calculations of the efficiency of enterprises’ participation in the project.

Budget efficiency reflects the financial results of the investment project for the federal, regional or local budgets. The main indicator of budgetary efficiency is the budgetary effect.

Budget effect Bt for t-th step of project implementation is defined as the excess of revenues of the corresponding budget Dt over expenses Pt in connection with the implementation of this project:

Budget revenues and expenses taken into account when assessing budget efficiency are given in Table. 3. It is also necessary to take into account changes in budget revenues and expenses due to the impact of the project on third-party enterprises and the population.

Didn't find what you were looking for? Use the search.

Budget efficiency- a relative indicator of the effect for the budget as a result of the implementation of a state function, the implementation of a program, an investment project, defined as the ratio of the result obtained by the budget to the costs and expenses that determined and ensured its receipt.

Budget efficiency is assessed at the request of state and/or regional authorities. In accordance with these requirements, budgetary efficiency can be determined for budgets of various levels or a consolidated budget. Indicators of budgetary efficiency are calculated based on the determination of the flow of budgetary funds.

The task of increasing budgetary efficiency is solved within the framework of results-based budgeting procedures.

Cash flows for calculating budgetary efficiency

Inflows of funds for calculating budget efficiency include:

- inflows from taxes, excise taxes, duties, fees and deductions to extra-budgetary funds established by current legislation;

- income from licensing, competitions and tenders for exploration, construction and operation of facilities provided for by the project;

- payments to repay loans issued from the relevant budget to project participants;

- payments to repay tax credits (during “tax holidays”);

- commission payments to the Ministry of Finance of the Russian Federation for supporting foreign loans (in federal budget revenues);

- dividends on regionally or state-owned shares and other securities issued in connection with the implementation of individual entrepreneurs.

Budget outflows include:

- provision of budgetary (in particular, state) resources on the terms of securing in the ownership of the relevant management body (in particular, in federal state ownership) part of the shares of the joint-stock company created for the implementation of individual entrepreneurs;

- provision of budget resources in the form of an investment loan;

- provision of budget funds free of charge (subsidies);

- budget subsidies related to the implementation of a certain pricing policy and ensuring compliance with certain social priorities.

- tax benefits reflected in a decrease in revenues from taxes and fees. In this case, there are also no outflows, but inflows decrease;

- state guarantees of loans and investment risks.

There are no outflows. An additional influx is the guarantee fee.

When assessing the effectiveness of a project taking into account uncertainty factors, payments under guarantees in the event of insured events are included in the outflow.

Accounting for costs and benefits to society

When assessing the budgetary effectiveness of a project, changes in budget revenues and expenses due to the impact of the project on third-party enterprises and the population are also taken into account, if the project has an impact on them, including:

- direct financing of enterprises participating in the implementation of IP;

- changes in tax revenues from enterprises whose activities improve or worsen as a result of the implementation of IP;

- payment of benefits to persons who remain unemployed due to the implementation of the project (including when using imported equipment and materials instead of similar domestic ones);

- allocation of funds from the budget for the resettlement and employment of citizens in cases provided for by the project.

For projects that provide for the creation of new jobs in regions with high unemployment, the influx of budget funds takes into account the savings in capital investments from the federal budget or the budget of a constituent entity of the Federation for the payment of relevant benefits.

Budget efficiency indicators

The main indicator of budget efficiency is the net present value of the budget (NPV). In the presence of budget outflows, it is possible to determine the internal rate of return (IRR) of the budget. In the case of providing government guarantees for the analysis and selection of independent projects for a given total amount of guarantees, along with the NPV, a significant role can also be played by the guarantee return index (IGI) - the ratio of the NPV to the value of the guarantees (discounted, if necessary).

Budget efficiency- a relative indicator of the effect for the budget as a result of the implementation of a state function, the implementation of a program, an investment project, defined as the ratio of the result obtained by the budget to the costs and expenses that determined and ensured its receipt.

Budget efficiency is assessed at the request of state and/or regional authorities. In accordance with these requirements, budgetary efficiency can be determined for budgets of various levels or a consolidated budget. Indicators of budgetary efficiency are calculated based on the determination of the flow of budgetary funds.

The problem of increasing budgetary efficiency is solved within the framework of results-oriented budgeting procedures.

Cash flows for calculating budgetary efficiency

Inflows of funds for calculating budget efficiency include:

- inflows from taxes, excise taxes, duties, fees and deductions to extra-budgetary funds established by current legislation;

- income from licensing, competitions and tenders for exploration, construction and operation of facilities provided for by the project;

- payments to repay loans issued from the relevant budget to project participants;

- payments to repay tax credits (during “tax holidays”);

- commission payments to the Ministry of Finance of the Russian Federation for supporting foreign loans (in federal budget revenues);

- dividends on regionally or state-owned shares and other securities issued in connection with the implementation of individual entrepreneurs.

Budget outflows include:

- provision of budgetary (in particular, state) resources on the terms of securing in the ownership of the relevant management body (in particular, in federal state ownership) part of the shares of the joint-stock company created for the implementation of individual entrepreneurs;

- provision of budget resources in the form of an investment loan;

- provision of budget funds free of charge (subsidies);

- budget subsidies related to the implementation of a certain pricing policy and ensuring compliance with certain social priorities.

- tax benefits reflected in a decrease in revenues from taxes and fees. In this case, there are also no outflows, but inflows decrease;

- state guarantees of loans and investment risks.

There are no outflows. An additional influx is the guarantee fee.

When assessing the effectiveness of a project taking into account uncertainty factors, payments under guarantees in the event of insured events are included in the outflow.

Accounting for costs and benefits to society

When assessing the budgetary effectiveness of a project, changes in budget revenues and expenses due to the impact of the project on third-party enterprises and the population are also taken into account, if the project has an impact on them, including:

- direct financing of enterprises participating in the implementation of IP;

- changes in tax revenues from enterprises whose activities improve or worsen as a result of the implementation of IP;

- payment of benefits to persons who remain unemployed due to the implementation of the project (including when using imported equipment and materials instead of similar domestic ones);

- allocation of funds from the budget for the resettlement and employment of citizens in cases provided for by the project.

For projects that provide for the creation of new jobs in regions with high unemployment, the influx of budget funds takes into account the savings in capital investments from the federal budget or the budget of a constituent entity of the Federation for the payment of relevant benefits.

Budget efficiency indicators

The main indicator of budget efficiency is the net present value of the budget (NPV). In the presence of budget outflows, it is possible to determine the internal rate of return (IRR) of the budget. In the case of providing government guarantees for the analysis and selection of independent projects for a given total amount of guarantees, along with the NPV, a significant role can also be played by the guarantee return index (IGI) - the ratio of the NPV to the value of the guarantees (discounted, if necessary).

Effective management- this is a radical increase in accountability, transparency and effectiveness in the activities of state and municipal authorities in all structural divisions, and a reduction in administrative barriers for business. This will be achieved through the introduction of lean manufacturing principles; broad involvement of civil society in the process of managing the socio-economic development of the district; results-based budgeting; a differentiated approach to the development of individual territories of the district, based on the principles of zoning; application of the project approach in the practice of state and municipal management, as well as through the creation of a favorable institutional environment, through the formation of a rational system of norms, rules and regulations for the interaction of civil society, business and government.

Task- this is the effective management of the socio-economic development of the district, increasing the transparency, accountability and effectiveness of the activities of state and municipal authorities.

Spatial development:

From the point of view of effective management, the zoning of the Autonomous Okrug itself will be an important innovation, a spatial form of implementing the concept of the “Lean Region”. From the point of view of the formation of a new social contract, the old-developed zone will be the main arena for the activities of local urban communities as institutions of civil society, the application of the most advanced technologies of urban self-government and self-organization; Of particular importance here will be measures to create a tolerant and safe multinational environment, favorable conditions for innovative development, and the concentration of highly qualified specialists. In the zone of the new frontier, institutional technologies for interaction between government, civil society and big business in the field of ensuring a healthy environment and lean production will be developed. In the zones of the new frontier and the district reserve, the creation of a simplified regime for conducting social and other types of entrepreneurship will continue in order to provide conditions for improving the quality of life; transport and information accessibility will be increased, conditions will be maintained for the preservation and development of culture and traditional economic practices of indigenous peoples of the North.

Expected results of the implementation of Strategy 2030 in the direction of “Effective Governance”:

The implementation of the priority direction “Effective Management” is ensured through the implementation of such measures as a lean region, the implementation of a project approach, and increasing the openness of government bodies. Civil society is widely involved in the process of interaction with authorities at all levels, in decision-making, budgeting, and exercises public control. Non-profit organizations providing socially significant services have received significant development. Effective mechanisms have been developed to coordinate the interests of business, civil society and government bodies at all levels. An effective financial system, including the banking, insurance sectors and pension systems, helps to redirect temporarily available funds into loans and investments aimed at modernizing the district’s economy. As a result of the implementation of this direction, in general, an increase in the efficiency of using budget funds is achieved (which allows saving funds to be used for the development of the economy, human capital and environmental needs), labor productivity increases by 1.5 times, which increases the competitiveness of the district as a whole and creates conditions for improving quality of life. In all districts of the district, conditions have been created for the realization of local potential, conditions have been created for a high level of satisfaction with the activities of government authorities.

Direction “Effective budget”: increasing the efficiency of district budgeting, including the development of participatory budgeting (co-financing of initiative public projects).

Budget planning is an essential element of macroeconomic policy. But how to plan a budget correctly? How to take into account its volume and structure? How to correctly combine budget income and expenses? How to evaluate the effectiveness of budget policy?

The problem of ensuring budgetary efficiency and overcoming the budget deficit has always been one of the central problems of the theory and practice of finance. It is also highly relevant for the Russian economy today. This is what the Minister of Finance of the Russian Federation A.L. Kudrin noted in April 2010 at one of the conferences: “In terms of budget policy, I will say that after a fourfold increase in federal budget expenditures in real terms, there will be a decade without an increase in expenditures. At some point we will even have to reduce costs in real terms. By 2015, according to my estimate, up to 20%. This is a conservative scenario. And by 2020, we will return to approximately 2010 levels of federal spending. This is a very serious challenge. This means that we will not be able to distribute money in the same way or hope that we will achieve some results through extensive opportunities... we will have to rebuild all the work to improve budget efficiency, creating new elements of transparency of the budget system, new institutions.” In my opinion, these new institutions will require a new or at least updated and supplemented system of indicators: indication of the state of the budget, opportunities for the development of individual items and planning the structure of expenditures based on macroeconomic objectives.

The importance of solving this problem is due to the fact that a budget deficit has arisen in Russia, and this imposes special restrictions on the entire financial policy in connection with the formulation of the task of economic modernization. The causes of deficiency, as is known, can be different. In particular, the discrepancy between income and expenses caused by corresponding and poorly predictable changes in the economic system, or incorrect calculation of income and expenses, failures in the tax system, exaggerated assessment of assumptions about income and underestimation of expenditure assignments. Additional extra-budget revenues are needed to cover the budget deficit. With unstable finances, a disordered economy, and irrational financial and economic policies, the necessary income to cover the deficit is usually quite difficult to obtain. A chronic budget deficit is dangerous precisely because it is a reflection of the ineffective structure of the national economy and difficulties in its development and implementation of macroeconomic policy.

To pay off the budget deficit, a standard set of tools is used: consolidated balances from previous budgets (in the case of a chronic deficit over several years, this method does not help much); spending cuts, which could lead to paralysis of the modern economy and intensify the crisis; tax increases; using new sources of income; external and internal loans (increase in debt); alienation of part of state property and money emission (consequences in the form of inflation can cover the benefits of eliminating the deficit and even form the basis for future deficits).

However, I would like to note that the use of budget planning methods, through which it is possible to balance the structure of budget expenditures, can and should be the most important tool for ensuring budgetary efficiency and preventing “chronic” deficits.

Budget efficiency is expressed by the excess of budget revenues over expenses associated with the need to achieve set goals (B E = R - Z, where R - budget revenues, Z - budget expenses; B E > 0 - surplus, B E< 0 - дефицит). Дефицит бюджета можно представить как разницу между правительственными расходами и собираемыми налогами, то есть (G-tY), где t - ставка налога, Y - национальный доход. Даже если величина правительственных расходов и налоговые ставки не изменяются, то бюджетный дефицит может расти в силу действия иных факторов, влияющих на производство национального дохода Y. Таким образом, проблема оценки бюджетной эффективности по расчёту указанной разницы вряд ли отражает подлинное содержание эффективной бюджетной политики и эффективности бюджета. Измерение бюджетной эффективности может приобретать характер определения величины той или иной нагрузки на бюджет (структурный анализ бюджета - постатейная оценка расходов и доходов бюджета). Бюджетная эффективность обеспечивается в рамках бюджетной политики. Применительно к макроэкономическому уровню направлениями такой политики могут быть:

- justification of the amount of expenses for budget items based on criteria reflecting the efficiency of use of budget funds and determined on the basis of socio-economic policy priorities;

- increasing the efficiency of the system for managing public assets and liabilities, which will significantly increase the stability of the budget system, add flexibility to the budget policy, and reduce the risks associated with the structure of public debt;

- improving the budget process, ensuring transparency of the budget and budget procedures at all levels of the budget system, increasing the efficiency of control over the expenditure of budget funds and revenue receipts;

- the formation of a fair, neutral and effective tax system in order to regulate the tax burden on economic entities, depending on the objectives of economic policy and the stimulation of one or another economic activity - sector of the economy;

- ensuring a balanced state budget in the medium term.

The budget deficit and budget surplus are indicators by which conclusions are drawn regarding the effectiveness of budget policy. The budget deficit can be represented as δ= ΔB+ΔM, where ΔB are loans from the population (on the open market), ΔM is the monetization of the deficit, i.e. loans from the Central Bank.

The total government budget deficit, reduced by the amount of interest payments on the government debt, is called the primary deficit.

The accumulated amount of budget deficits represents government debt. In fact, having deficits today means having to pay for them for future generations. Does negative budgetary efficiency today mean the current efficiency of other sectors or areas, the development of which can compensate for this negative result in the present or future? The formation of debt can be prevented, for example, by legislatively prohibiting the government from exceeding budget expenditures over its revenues. However, will this be a way out of the situation, will it ensure the efficiency of the economy?

Apparently, budgetary efficiency must be assessed by how the budget influences economic activity and what positive externalities the budget deficit leads to - whether they outweigh the actual budgetary losses. A separate problem is the budget surplus, which has been observed consistently for several years, as in the Russian economy during 2001-2007. This situation may arise due to the specifics of budget planning, when the government sets the goal of accumulating financial resources to solve strategic development problems, or due to errors in budget planning and managerial pessimism regarding the policies pursued.

The impact of the budget on the economy can be assessed using an indicator called the budget impact index. Tax revenues are brought to a level that corresponds to the equilibrium point (full employment of resources in the economy). Then this amount of income is subtracted from current expenses and the so-called “reduced” budget deficit (G-tY *) is determined, where Y * is the equilibrium amount of income. The index is calculated as the share of the “reduced” deficit to the value Y *, that is, IB=G/Y * -t. With a high real deficit and cuts in government spending, the budget impact index, as well as the impact itself, will decline.

Budget deficits can be structural or cyclical.

Under structural deficit ( B S) understand the difference between current government expenditures and those state budget revenues that would flow into it under conditions of full employment under the existing taxation system (it corresponds to our concept of a “reduced” deficit):

B S =G-tY *

The cyclical deficit (BC) is the difference between the actual and structural deficit:

B C = B-B S = G-tY-(G-tY *) = t(Y * -Y).

Then the cyclical deficit, with the tax system unchanged, is determined by how much actual output in one direction or another deviates from the equilibrium one (at full employment).

The concept of budget efficiency, structural and cyclical deficits is also applicable at the corporate level, however, there is the problem of calculating equilibrium output, and for the macroeconomic system it is solved more conveniently than for the corporation. If Y

Thus, even such a well-assessed type of efficiency from the point of view of financial mathematics as budget efficiency, nevertheless, is “complex” efficiency. It is determined by the interdependence of the elements of the budget system, macroeconomic parameters of the economy (for example, the current account, capital account, inflation, etc.), and in relation to a corporation, it depends on the tasks and competence of management, financial management, financial policy of the corporation and, of course, the state and the dynamics of the markets in which the corporation operates.

From a quantitative point of view, budget efficiency has been shown to be the excess of revenues over budget expenditures. At the same time, it is important how resources are distributed among budget items, how budget funds are used, and how effectively control is established. In this regard, the task of assessing the effectiveness of control and structural effectiveness arises. Moreover, both concepts relate to the establishment of standards for control and distribution of funds between budget items.

The structural formulation of the problem of ensuring budget efficiency comes down to determining the share of expenses for each budget item, and it is necessary to distribute budget funds so that the financial and non-financial return of such distribution is the greatest and the tasks of socio-economic policy are solved. There are at least two main approaches that can be used here. First, you can rely on the performance of various sectors of the economy and budget items that, to one degree or another, relate to these sectors. Secondly, we can proceed from an assessment of the need for each area. If the need for spending is higher than the capacity provided by the collected revenues (the tax system), then is it worth borrowing on the domestic market and attracting external sources, generating a budget deficit?

In the USA, as is known, budget planning covers five years. Table 1 shows the basic budget parameters for the period from 2007 to 2013. The share of the budget in GDP is 18-20%. Expenses exceed income for five years and only in 2012-2013. A budget surplus is expected. At the same time, the value of GDP, and therefore budget revenues/expenses, is steadily increasing (Table 1).

Table 1. US budget for the period 2007-2013. (billion dollars).

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|

| Total budget: | |||||||

| 2,56 | 2,52 | 2,70 | 2,93 | 3,07 | 3,27 | 3,42 | |

| 2,73 | 2,93 | 3,10 | 3,09 | 3,17 | 3,22 | 3,39 | |

| Deficit(-)/Surplus(+) | -162 | -410 | -407 | -160 | -95 | -48 | -29 |

| Gross domestic product | 13,66 | 14,31 | 15,02 | 15,79 | 16,58 | 17,39 | 18,24 |

| Budget in % of GDP: | |||||||

| 18,8 | 17,6 | 18,0 | 18,6 | 18,6 | 18,8 | 18,8 | |

| 20,0 | 20,5 | 20,7 | 19,6 | 19,1 | 18,5 | 18,6 | |

| Deficit(-)/Surplus(+) | -1,2 | -2,9 | -2,7 | -1,0 | -0,6 | +0,3 | +0,2 |

Source: official website of the US Presidential Administration.

The total amount of budget expenditures for each year depends on how much income will be created in the economy and how, given unchanged taxes, it will be collected, more precisely, in what amount. This predetermines the possibilities of spending budget funds for each budget line (direction, sector of economic activity). If at the same time the tax system also changes, and even the main taxes that provide significant revenue collection, then the structure of the budget may even more so undergo changes.

Structural budget analysis involves determining the type of budget structure (balanced, deficit, surplus budget), describing the structural problem (presenting the current and desired budget structure) and specifying the objectives of the budget and budget policy. The structure of the Russian Federation budget is presented in general form in Table 2.

Table 2. Structure of Russian budget expenditures in 2006-2008, %.

| Direction of budget expenditures | 2006 | 2007 | 2008 |

|---|---|---|---|

| National expenditures | 14,96 | 17,18 | 14,34 |

| National Defense | 15,6 | 12,85 | 8,81 |

| National Security and Law Enforcement | 12,68 | 10,33 | 9,03 |

| National economy | 7,95 | 11,18 | 12,15 |

| Department of Housing and Utilities | 0,91 | 4,54 | 0,94 |

| Environmental protection | 0,15 | 0,13 | 0,16 |

| Education | 4,72 | 4,4 | 5,31 |

| Culture, cinema and media | 1,2 | 1,08 | 1,45 |

| Healthcare and sports | 3,49 | 4,24 | 3,66 |

| Social politics | 4,81 | 4,39 | 4,69 |

| Interbudgetary transfers | 33,53 | 29,7 | 39,47 |

Source: website of the Ministry of Economic Development of the Russian Federation.

Based on the data presented, it is clear that in the structure of expenses their relative value in the direction of ensuring national security and defense is decreasing, but the share of expenses on education, culture, and the national economy is increasing. The share in the direction of “interbudgetary transfers” is increasing significantly. With an increase in gross product and a corresponding increase in budget revenues, an increase in the share of expenses in a direction means an absolute increase in expenses. A reduction in share will mean a reduction in costs. However, in the context of a significant increase in national income, the relative share of expenditures may decrease without reducing the absolute value of expenditures in this area. In conditions of growth, this circumstance allows for flexible management of the budget structure. If you enter the desired and actual share for each area of budget expenditures, then you can write the expression:

D i = β i tY - α i B,

where: D i - potential deficit/surplus in the i-th direction of budget expenditures; α i is the actual share of expenses in the i-th direction of the budget; β i is the required (desired) share of expenses in the i-th direction of the budget; tY - budget revenue, t - tax rate, Y - national income taking into account inflation; B - current budget expenses.

When β i =α i, the potential deficit/surplus in the i-th direction will be equal to the real one.

If we assume that the share of collected revenues in one budget area will be α 1 tY 1 and the revenue part is exactly equal to the expenditure part, then, when the share changes from α 1 to α 2 and grows from Y 1 to Y 2, the decrease in the share can be such that the absolute value of expenses in the direction has not changed and so that the following relation is satisfied:

Structural analysis of the budget and the approach to assessing its structural effectiveness can be indicated by using the following indicators I introduce:

- coefficient of synchronization of revenue growth and budget expenditures;

- coefficient of structural uniformity (differentiation) of budget expenditures;

- coefficient (priority) for assessing the main priority of the budget.

Mathematically, the listed indicators take the form:

1) Synchronization factor: ![]()

2) Differentiation coefficient: ![]()

3) Priority factor:

where: b - equal distribution in all areas of the budget, which is the ratio of the total amount of expenses (B) to the number of areas of the budget; b max - the largest amount of budget expenditures; b min - the smallest amount of budget expenditures; Δd is the increase in budget revenues over time t; Δb - increase in budget expenditures over time t; Δd i - increase in budget revenues for the i-th time interval; Δb i - increase in budget expenditures for the i-th time interval; T is the time period under consideration.

Of course, structural analysis of the budget performs an important function, since it allows you to select the most multiplying areas of spending if it is necessary to stimulate the market situation (expansion), or less multiplying ones if restrictions are necessary. However, governments are afraid to use structural modifications of the budget for such purposes, since the flexibility of the budget mechanism should be higher and allow such an instrument to be used in practice.

In relation to the American budget, the calculation of the synchronization coefficient k is presented in Table 3.

Table 3. Dynamics of the US budget synchronization coefficient in the period 2007-2013. (calculation according to Table 1).

| -1,2 | 0,5 | -2,4 |

| 0,4 | 0,2 | 2,0 |

| 0,6 | -1,1 | -0,55 |

| 0 | -0,5 | 0 |

| 0,2 | -0,6 | -0,34 |

| 0 | 0,1 | 0 |

From the calculations carried out, it follows that the increase in income and expenses do not coincide for the American budget, that is, when income decreases, expenses increase, when income grows, expenses decrease. Consequently, the overall synchronization coefficient will be negative and, in relation to the given data, will be K=-1.29, which means that budget revenues/expenses are not synchronized. A positive or negative assessment of this fact depends on what goals are pursued within the framework of macroeconomic policy. However, no matter what goals are pursued, while income increases, the situation of reducing expenses contradicts elementary logic. In this case, expenses, at a minimum, should not be reduced according to budget items.

Table 4. Calculation of structural coefficients for the Russian budget for 2006-2008. (N=11, by expenses).

Differentiation among budget items first decreases, then increases significantly, which is caused by a systematic increase in the priority of budget expenditures. At the same time, from the point of view of planning and implementation of budget policy, as well as to increase its efficiency, it is appropriate to pose the task of determining the most acceptable level of differentiation and priority of budget expenditures as a macroeconomic tool for stimulating the economy and maintaining the most significant areas of activity in a viable state.

By analogy with assessing structural changes in the economy, let us present an indicator that can be convenient for assessing structural modifications of the budget. Mathematically, the intensity coefficient of structural budget modifications will take the form:

where: IB is an indicator of the intensity of structural modifications of the budget (in a relatively short period of time it should not be high); b i (t) is the share of the i-th budget line in total expenses at time t; b i (0) - the share of the i-th budget line in total expenses at the initial point in time; n is the number of budget lines (directions) for which the share of expenses has increased; T - time period for assessing the intensity of structural budget modifications.

Of course, the presented analysis, like the system of indicators, should not be absolute, but, nevertheless, it helps to shed light on the content of budget planning, budget policy and the impact of structural modifications of the budget on the economy. The approach presented here constitutes a unique method for planning the budget structure and assessing its effectiveness.

However, efficiency also has a qualitative dimension. Budgetary efficiency is determined by the structural composition of the budget (items of income/expenses), and also depends on the system of state financial control, since it is not so much the income/expenses ratio that is efficiency, but the use of financial budget funds for specific goals of economic development, and so that these goals are achieved 100% fulfillment. In this sense, the experience of the 1990s. in Russia, when federal state programs were financed by 30% of the required volume, and the experience of the 2000s, when this figure for individual programs increased to 80-90%, but still was not equal to 100%, indicates low budgetary efficiency and ineffective budget policy.

Determining the scale of the state financial control system and assessing the effectiveness of this system are central issues in organizing this system and endowing it with the necessary functions.

Financial control of the state ensures compliance between plans and actual results, which is a necessary condition for making the right management decisions, the main prerequisite for effective strategic planning. State financial control is designed to eliminate errors in the budgetary and financial-economic spheres, and therefore performs the function of ensuring budgetary efficiency.

Literature

- Kudrin A.L. Transcript of the speech at the XI International Scientific Conference on Problems of Economic and Social Development at the State University-Higher School of Economics on 04/06/2010 // www1.minfin.ru/ru/press/transcripts/index.php?id4=9492.

- Milyakov N.V. Budget deficit in the 20s. M. Finance and Statistics, 1993.

- Panskov V.G. On some issues of state financial control in the country // “Finance”, No. 5, 2002.

- Sukharev O.S. Theory of economic efficiency. M.: Finance and Statistics, 2010.

- Sukharev O., Desyatova I. State financial control: efficiency and areas for improvement // “Investments in Russia”, No. 9, 2008.

- Sukharev O.S. Economics of technological development. M.: Finance and Statistics. 2008.