In 2016, the rules for processing payment orders changed. In the article you will find current examples of filling out payment orders for the payment of taxes and contributions.

In the article you will find:

Payment order for personal income tax sample filling 2016

Examples of filling out a payment order to the Pension Fund in 2016

Sample of filling out a payment order to the Social Insurance Fund in 2016

Payment orders in 2016 are filled out according to new rules. Changes to the procedure for filling out payment slips were made by order of the Ministry of Finance of Russia dated September 23, 2015 No. 148n. Read more in the article "Changes in payment orders from March 28, 2016."

Let's take a closer look at how to fill out a payment order in 2016. Below you will also find samples of filling out payment orders for taxes in 2016.

Payment order fields in 2016 sample

Rules for filling out a payment order in 2016

Payment orders 2016 can be filled out both electronically (client-bank system or Internet bank) and on paper. Filling out a payment order in 2016 is carried out on the basis of the requirements set out in Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds”. For your convenience, we have presented the procedure for filling out the main fields of the payment order in the form of a table.

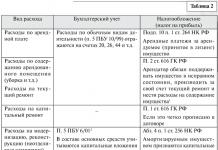

Table. Rules for filling out a payment order in 2016 for taxes and contributions

Field number |

Field name |

What to indicate |

|---|---|---|

|

Payer status |

01 - if the company pays tax for itself, 02 - if the company pays tax as a tax agent, 08 - if the company pays insurance premiums |

|

|

Payer's TIN |

TIN of the organization |

|

|

Payer checkpoint |

Organizations - checkpoint organizations; Real estate - checkpoint assigned to the organization at the location of this property |

|

|

Payer |

Full or abbreviated name of the organization |

|

|

Recipient's TIN |

INN IFTS (fund), to which reporting on the transferred tax (contribution) is submitted |

|

|

Recipient's checkpoint |

Checkpoint of the Federal Tax Service (fund), to which reporting on the transferred tax is submitted |

|

|

Recipient |

When paying tax - UFK MF RF on ______ (indicate the name of the subject of the Russian Federation in which the tax is paid), and then in brackets - the name of the Federal Tax Service. For example, “UFK MF RF for Moscow (IFTS No. 27 for Moscow)”; When paying a fee - UFK for ___________ (indicate the name of the subject of the Russian Federation in which contributions are paid), then in brackets the name of the branch of the Pension Fund of the Russian Federation or the Social Insurance Fund for the subject of the Russian Federation in which contributions are paid. For example, UFK for the city of Moscow (GU - Branch of the Pension Fund of the Russian Federation for the city of Moscow and the Moscow region) |

|

|

Payment order |

||

|

When paying current payments - "0"; About payment of arrears, penalties, fines at the request of the fund - UIN |

||

|

KBK for 2016 to pay the appropriate tax |

||

|

When paying tax (contribution) at your location: Organizations - OKTMO at the location of the organization; Real estate - OKTMO at the location of this property |

||

|

Basis of payment |

When paying current tax payments - TP; Tax arrears on your own - ZD; Tax arrears at the request of the Federal Tax Service - TR; When paying contributions - 0 |

|

|

Taxable period |

If field 106 indicates TR, the date of tax payment upon request. When paying contributions, this field is set to zero. |

|

|

Document Number |

If field 106 indicates TP or ZD - 0. When paying contributions, enter 0. |

|

|

Document date |

If TP is indicated in field 106, the date of signing the declaration on which the tax is paid. If the tax is paid before submitting the declaration, 0 is indicated in field 109; ZD - 0. When paying contributions, enter 0. |

|

|

Payment type |

Not filled out according to Order of the Ministry of Finance dated October 30, 2014 N 126n |

|

|

Purpose of payment |

Text explanations for the payment (for example, Advance payment for income tax for the first quarter of 2016) |

See also "Where to get UIN for a payment order"

Sample of filling out a payment order in 2016 for income tax

Sample of filling out a payment order in 2016 for personal income tax

Sample of filling out a payment order in 2016 at the Pension Fund of Russia

Sample of filling out a payment order in 2016 in the Social Insurance Fund

Sample of filling out a payment order in 2016 at the Federal Compulsory Medical Insurance Fund

How to correctly fill out field 107 in a payment order in 2016?

As you know, in field 107 taxpayers are required to indicate the tax period for which the amount is transferred. This requirement is defined in paragraph 8 of the Rules, approved by Order of the Ministry of Finance No. 107n dated November 12. 2013 But there are exceptions to any rule. Let's look at the rules for filling out field 107 in more detail.

First, let’s remember where this field is located in the payment order.

How to indicate the correct tax period in field 107 in a payment order in 2016?

The tax period consists of 10 characters and is reflected in the format XX.YY.YYYY, where

XX - frequency of tax payment. According to the filling rules, we write MS - monthly payment, CV - quarterly, PL - semi-annual, GD - annual.

YY is the number of the period for which tax is paid. This can be the number of the month (01,02,03...12), quarter (01,02,03,04), half year (01,02). If the tax is annual, write 00.

YYYY is the year for which the tax is transferred.

For example, an organization pays property tax for the 1st quarter of 2016, then in the payment form we indicate: KV.01.2016.

For which payments is the tax period indicated?

We indicate the tax period for payments of the current year and for payments. for which you pay additional tax if the demand has not yet been received.

Sample payment order when filling out field 107 in 2016.

Based on the above, when transferring, for example, VAT, income tax, property tax, transport tax, UTII and simplified tax system, most often field 107 is filled out as follows: “KV.03.2016”. When transferring insurance premiums, enter 0 in field 107.

As for personal income tax payments, there are several opinions. One of them is that the personal income tax payment date is specific. Those. , issued in July 2016, must be transferred by the end of July, indicating the period “07/31/2016”. Second opinion - in field 107 you need to reflect the month in which the employee earned income “MS.07.2016”.

Why do you need to fill out field 107 correctly? This is necessary so that inspectors do not charge penalties and fines when reconciling dates in 6-NDFL and payment slips. Let's look at filling out personal income tax forms in more detail.

Based on the procedure for filling out payment slips, it follows that specific dates are entered in field 107, and for annual payments the code provides for more than one payment period.

For personal income tax, the tax period is defined as a year (Article 216 of the Tax Code of the Russian Federation). At the same time, payers transfer tax several times, and the Code defines maximum payment dates. So, for vacation pay or benefits, the personal income tax payment deadline is the last day of the month. When issuing wages - the day following its issuance (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Thus, according to the Ministry of Finance, a specific date must be indicated in field 107 of the payment order.

Very often, when working with Bank-Client programs, the program does not allow you to enter the required date in field 107. Then, when paying personal income tax, you need to indicate GD.00.2016 or month, for example MS.07.2016. In this case, the payment still goes to the Federal Tax Service, but the inspectors may set a different date for payment, as a result of which you will be charged a penalty. Therefore, it will be necessary to clarify the payment. And you need to write a letter to the bank about the incorrect operation of the client bank.

It happens that a company, when transferring personal income tax from salaries for June, for example, indicated the payment deadline MS.07.2016. In this case, the Federal Tax Service Program will not see the payment for June and will charge penalties. Then you need to write a statement to the tax office to clarify the payment.

Tax authorities’ opinion: when filling out field 107 when paying personal income tax, you need to focus on the month in which the individual received income. So, if an organization issues salaries for June in July, the payment slip must be marked MS.06.2016, and not MS.07.2016, since the date of receipt of income is June 30 (clause 2 of Article 223 of the Tax Code of the Russian Federation).

If an organization issued wages for December in January and wrote MS.12.2015 in field 107 of the payment slip, the tax program will calculate penalties. In this case, you need to write a letter to the Federal Tax Service with a request to recalculate the penalties.

When paying salaries for December in January, payments are reflected in section 2 of the 6-NDFL calculation.

The tax program checks the dates and amounts in Section 2 with the payment information. When reflected in field 107 MS.12.2015, the program will consider that this payment is a tax for the previous year and will throw out payments from this period. As a result, tax authorities charge penalties on taxes withheld in January from 2015 wages. This is illegal, so penalties will need to be recalculated by writing a letter to the Federal Tax Service.

Thus, if the code establishes specific dates, then it is necessary to put specific dates on the bills, so you have to transfer the tax in several payments (letter of the Federal Tax Service of Russia dated July 12, 2016 No. ZN-4-1/12498@).

Free book

Go on vacation soon!

To receive a free book, enter your information in the form below and click the "Get Book" button.

Payment number and date

In the details (3), enter the number in numbers.

In details (4), indicate the date of drawing up the order:

- for - day, month, year, enter numbers in the format DD.MM.YYYY (for example, 01/15/2016);

- in electronic form in digits in bank format (day - two digits, month - two digits, year - four digits).

Please note: in detail (62), the bank employee will indicate the date the order was received by the payer’s bank. And in detail (71) - the date of debiting the funds from the payer’s account.

Information about the payer and his bank details

Payment invoice fields (8)-(12) are provided for information about the payer. This is accordingly:

- name of the payer;

- payer's bank account number;

- payer bank (name and location);

- bank identification code (BIC) of the payer's bank;

- correspondent account number of the payer's bank.

Don’t forget also about fields (60) “TIN” and (102) “KPP”.

In details (101) indicate the status of the organization. In particular:

- 01 - (payer of fees) - legal entity;

- 08 - payer - an institution that pays contributions and other payments to the budget system of the Russian Federation;

- 14 - taxpayer making payments to individuals.

The full list of statuses is given in Appendix 5 to Order No. 107n dated November 12, 2013.

In details (44), the organization (for example, the manager) must put his signature in accordance with the samples declared to the bank on the card.

As for the props (43) “M.P.” As of April 7, 2015, companies are no longer required to use seals in their work. This innovation was introduced by Federal Law No. 82-FZ dated 04/06/2015, which, in particular, amended the federal laws dated 12/26/95 No. 208-FZ “On Joint-Stock Companies” and No. 14-FZ dated 02/08/98 “On Limited Liability Companies” responsibility."

So, printing on a payment slip is required only if it is available. Therefore, if you refused the stamp, then you do not need to put it on the payment order.

Information about the recipient and his bank details

Payment fields (13)-(17) are provided for information about the recipient. This is accordingly:

- payee's bank;

- bank identification code (BIC) of the recipient's bank;

- correspondent account number of the recipient's bank;

- full or abbreviated name of the recipient organization (for an entrepreneur, indicate his full name and legal status, for citizens who are not businessmen - only his full name);

- recipient's bank account number.

Don’t forget also about fields (61) “TIN” and (103) “KPP”.

Type of operation

In field (18), indicate the payment document code 01. This is the code assigned to payment orders (Appendix 1 to the regulation approved on June 19, 2012 No. 383-P).

Payment information

In details (5) indicate the type of payment, namely one of the values:

- "urgently";

- "telegraph";

- "by mail";

- another value set by the bank. The value may not be specified if it is set by the bank.

In electronic form, the value must be indicated in the form of a code established by the bank.

In details (6) indicate the payment amount. Whole rubles are written in capital letters, kopecks are written in numbers. At the same time, the words “ruble” and “kopeck” are not abbreviated. And if the amount is in whole rubles, then you can not indicate kopecks, but enter the payment amount and the equal sign “=” (for example, 2000=).

In details (7), indicate the payment amount in numbers. Separate rubles from kopecks with a dash “-”. If kopecks are not indicated, enter the payment amount and the equal sign “=”.

As a general rule (a different procedure may be established by the bank), the values (19) “Payment date” and (20) “Payment purpose code” are not indicated. So, in particular, in payment orders for the transfer of taxes and insurance premiums, these fields do not need to be filled in.

In details (21), indicate the order of payment in numbers in accordance with the law. We talked in more detail about which queue to specify in certain cases in a separate article.

In detail (22), you must indicate the code of the unique payment identifier (UPI), if it is set by the recipient of the funds and communicated to the payer (clause 1.1 of the Bank of Russia instructions dated July 15, 2013 No. 3025-U). So, when transferring current taxes and contributions in this field, it is enough to indicate the value “0”.

In the attribute (23) “Reserve field” the value is not indicated unless a different procedure is established by the bank.

In details (24), indicate the purpose of the payment, the name of the goods (work, services), numbers and dates of the basis documents in accordance with which the payment is made (for example, details of contracts, acts, invoices).

In details (104), indicate the 20-digit BCC of the payment in accordance with Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. Or - what’s more convenient - take the BCC values for main payments from a convenient table on our website.

In the details (105) indicate the code OKTMO. Keep in mind: when based on or, you need to put the same OKTMO code as in the reporting.

In detail (106) when paying taxes and payments, indicate the payment basis code. In particular:

- TP - payments of the current year;

- ZD - voluntary repayment of debt for expired tax (calculation, reporting) periods in the absence of a requirement for payment;

- TR - repayment of debt at the request of the tax inspectorate.

A complete list of values is given in paragraph 7 of Appendix 2 and paragraph 7 of Appendix 3 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

When making other payments to the budget system, as well as if it is impossible to indicate a specific value for the indicator, put “0”. In particular, this should be done when filling out payment slips for the transfer of insurance premiums (clause 4 of Appendix 2 and clause 5 of Appendix 4 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013).

When making tax payments, indicate the tax period in detail (107). The indication procedure is established in paragraph 8 of Appendix 2 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013. Thus, the first two characters of the code characterize the frequency of tax payment. For example, when paying taxes monthly, the first two characters are “MS”. The fourth and fifth digits are the tax period number. So, if the tax is paid for February, enter “02”. The seventh to tenth signs indicate the year in which the tax period includes. These three groups of signs are separated from each other by dots. Thus, if, say, you are transferring personal income tax or insurance premiums for February 2016, in field 107 you need to indicate “MS.02.2016”.

When paying customs duties, in field (107), indicate the identifying code of the customs authority (clause 8 of Appendix 3 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). When making other payments to the budget system, as well as if it is impossible to indicate the specific value of the indicator, put “0” (clause 4 of Appendix 2 and clause 5 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

In details (108), when making tax payments, indicate the number of the document that is the basis for the payment. For example:

- TR - number of the tax authority's request for payment of tax (fee);

- RS - number of the decision on installment plan.

A complete list of values is given in paragraph 9 of Appendix 2 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

In this case, when transferring current taxes (payment basis “TP”) and voluntary repayment of debt for past periods (payment basis “ZD”), enter the value “0” in field (108).

When paying customs duties, follow paragraph 9 of Appendix 3 to the above-mentioned order.

When making other payments to the budget system, as well as if it is impossible to indicate the specific value of the indicator, put “0” (clause 4 of Appendix 2 and clause 5 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

In details (109), when paying tax payments and customs duties, indicate the date of the payment basis document, which consists of 10 characters. A complete list of values is given in paragraph 10 of Appendix 2 and paragraph 10 of Appendix 3 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013. In this case, when transferring current taxes (payment basis “TP”), in field (109), indicate the date of signing the tax return (calculation). When voluntarily repaying debt for past periods (payment basis “ZD”), enter “0” in field (109). You can also do this if an organization transfers tax before submitting a declaration or finds it difficult to choose an indicator to fill out a field (letter of the Ministry of Finance of Russia dated February 25, 2014 No. 02-08-12/7820).

When making other payments to the budget system, as well as if it is impossible to indicate the specific value of the indicator in field (109), also put “0” (clause 4 of Appendix 2 and clause 5 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

The detail (110) “Payment type” is not filled in. That is, it is left empty.

(With changes from 2015-2017 for filling out payment orders)

Income tax is paid to the federal and regional budgets at different rates and in different payments. Because of this, the BCC of the two payments differs, but nothing else changes. Therefore, we did not separate samples of filling out payment orders for income tax in 2015 by type of budget - the recipient of the funds.

However, to make it convenient for you, examples of transferring the tax itself, as well as penalties and fines, are placed in three different groups under a separate heading. You can find the necessary details for each case in the tables before the photo of sample instructions.

Since 2015, the name of the tax in the purpose of payment has also changed. Now you need to write this: “Organizational income tax, (except for consolidated groups of taxpayers)”, then add the budget to which we transfer the payment.

Be careful when filling out the above details. In 2016, the tax services are distributing the document “REMINDER ON THE TYPES OF TAXES CONTROLLED BY THE FEDERAL TAX SERVICE SINCE 01/01/2016,” which is made from a similar table for 2014, and the names of the taxes there are old, although the BCCs are new.

Attention! On March 28, “DIRECTION N 3844-U dated November 6, 2015 ON AMENDING THE BANK OF RUSSIA REGULATIONS DATED JUNE 19, 2012 N 383-P “ON THE RULES FOR FUNDS TRANSFERS” of the Bank of Russia comes into force. Document, including , cancels the indication of the value zero ("0") in the "110" field of payment orders. This detail is now not filled in at all, that is, we leave it empty.

However, you probably already know how the Russian banking system works, and how the Central Bank interacts with the government, and how commercial banks rush to comply with the instructions of the Bank of Russia and the orders of the Ministry of Finance of the Russian Federation. So, be prepared for various surprises when sending orders to transfer funds to the Russian budget system to banks on paper and electronically.

Instructions for tax and advance payments of income tax

We provide you with sample options for filling out orders for the transfer of advance payments for income tax, as well as tax arrears. Moreover, two situations are possible for paying debts: voluntary payment and on demand. And in the latter case, the UIN identifier may still be present.

Transfer of advance payments for income tax no later than the established deadline is possible in two options: monthly and quarterly payments. Monthly advance payments, in turn, can be paid based on actual profits or for the current month.

Monthly advance payments

Filling out the tax fields of the document is the same, both when making advance payments based on the actual profit for the last month, and for the current month. The main thing is to correctly indicate the period for which the transfer is made. The only difference when paying advances for the current month, the date “109” is never entered, since monthly declarations are not submitted.

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | |

| 106 | Basis of payment | TP |

| 107 | Taxable period | MS.01.2016; MS.02.2016; MS.03.2016, etc. until MS.12.2016 |

| 108 | Document Number | 0 |

| 109 | Document date | 0

(if advance payments are made for the current month; as well as advances based on profits received before filing a tax return). DD.MM.YYYY- date of signing the declaration (current advance payment based on the profit received after the declaration is submitted). |

| 110 | Payment type | 0 |

Advance payment for the current month

In field "107" indicate the current month. The advance must be paid by the 28th of the same month.

Sample payment order for monthly advance payment of income tax 2016 for the current month

For the month based on actual profit

In this case, the advance payment is also transferred no later than the 28th, but it is calculated and paid for the past month. That’s why we put it in the “107” attribute. In field “109” we put zero (“0”) if the declaration has not yet been submitted, and the date of signature of the declaration if you are transferring the advance after its submission.

Sample instructions for income tax in 2016, monthly advance payment based on actual profit after the declaration is submitted

Sample instructions for income tax in 2016, monthly advance payment based on actual profit after the declaration is submitted Download sample in Word or Excel format

Income tax for December with monthly advance payments from actual profits

In the tax period, we still indicate the month (December), although we actually pay income tax according to the calculation in the tax return for the year (for 12 months) using a simplified form that has already been submitted. The example presented below concerns monthly advance payments on the actual profit received for the past month. If the declaration has not yet been submitted, and the deadline for paying the advance for December is running out, then in field No. 109 “Document date” we put a zero (“0”).

This procedure is due to the fact that:

“Reporting periods for taxpayers who calculate monthly advance payments based on actually received profits are one month, two months, three months, and so on until the end of the calendar year.”

Tax Code of the Russian Federation Art. 285

That is, no exception was made for December, and it is included in the reporting period of 12 months and, therefore, the advance payment based on its results must be paid before January 28. And this despite the fact that the deadline for paying income tax for the year is set on March 28, and the reporting period, in this case, coincides with the tax period. You will submit the declaration for the year again on time, but in full form.

Sample income tax order for December 2015, monthly advance payment from actual profit, after filing a tax return for 12 months

Sample income tax order for December 2015, monthly advance payment from actual profit, after filing a tax return for 12 months Download sample in Word or Excel format

Professional accounting for organizations and individual entrepreneurs in Ivanovo . We will relieve you of the problems and daily worries of maintaining all types of accounting and reporting. LLC NEW tel. 929-553

Quarterly advance payments

Please note that in field “107” we always write the quarter number, even if we transfer the tax at the end of the year. Since in this props the frequency of payments must be indicated(quarter), and not the tax period itself (year).

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | TP |

| 107 | Taxable period | KV.01.2016; KV.02.2016; KV.03.2016 and KV.04.2016 (tax for the year) |

| 108 | Document Number | 0 |

| 109 | Document date | 0

(if advance payments are made for the 1st quarter, 6 months, 9 months. and one year before filing a tax return) DD.MM.YYYY- date of signing the declaration (payment after the declaration for the year is submitted) |

| 110 | Payment type | 0 (from March 28, 2016, the value of attribute 110 is not indicated) |

Quarterly advance payments for reporting periods sample

Look at the example of filling out an income tax payment for the first half of 2016 (for the 2nd quarter). In this example, the advance payment is made before filing the declaration.

Sample payment order for income tax for the half year 2016 quarterly payments before filing a declaration

Sample payment order for income tax for the half year 2016 quarterly payments before filing a declaration Download sample in Word or Excel format

Profit tax for half a year with quarterly advance payments sample

In this example, the income tax advance is transferred after the return is filed.

Sample payment order for income tax for the 2nd quarter of 2016 quarterly payments after submitting the declaration

Sample payment order for income tax for the 2nd quarter of 2016 quarterly payments after submitting the declaration Download sample in Word or Excel format

Income tax for the year with quarterly advance payments sample

We have specifically placed this example of filling out a payment order for income tax in the quarterly payments section in addition to the figures above. The fact is that with this mode of payment of advance payments, the tax reporting period for the 4th quarter has not been established. Because of this, many enterprises put the indicator of the tax period GD.00.2015 in the attribute “107” when paying tax for the year.

However it is not right. Here you need to write the period, for which tax is paid, but with mandatory linkage to the frequency of payments. And the last one is a quarter. If the tax were transferred only once per year, then the tax period indicator indicated in the previous paragraph would be correct. Otherwise, the only correct option here would be to write KV.04.2015. Sample in the photo below.

Sample payment order for income tax for 2015 for quarterly payments after the tax return for the year has been submitted

Sample payment order for income tax for 2015 for quarterly payments after the tax return for the year has been submitted Download sample in Word or Excel format

Tax debt paid voluntarily

If you had to make changes to your income tax return for the previous tax period that increased the tax base, a debt arises. The best way out is to voluntarily pay the additional tax before submitting an updated declaration. Then you will be able to avoid tax penalties.

Since the tax period indicator, which is indicated in detail “107,” depends on the reporting period in which accounting changes were made, the corresponding month or quarter must be entered in this field. This is due to the fact that you will have to submit updated declarations for the same periods. If the amendments affected only the last reporting period, then you are paying additional tax for the year. However, in cell No. 107 you do not need to print the value of the year for which the voluntary transfer of debt is made. Write there December or 4th quarter, depending on the advance payment mode you use.

Next point. What to indicate in the details “106” - “ZD” or “TP”? In our opinion, when paying debts for past tax periods, you definitely need to write “ZD” in field 106. If you pay extra or make advance payments for the current tax period, it will not be a mistake to indicate the value “TP” in this detail. All the same, you can only be charged a penalty; there are no other sanctions for late payment of advances.

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | ZD |

| 107 | Taxable period | MS.01.2014 – MS.12.2014; MS.01.2015 – MS.12.2015 KV.01.2014 – KV.04.2014; KV.01.2015 – KV.04.2015 |

| 108 | Document Number | 0 |

| 109 | Document date | 0 |

| 110 | Payment type |

Sample payment order for voluntary payment of income tax debt in 2016 for the 1st quarter of 2015

Sample payment order for voluntary payment of income tax debt in 2016 for the 1st quarter of 2015 Download in or

Income tax debt at the request of the Federal Tax Service

When paying income tax debt at the request of the tax inspectorate, filling out details 106 - 109 is completely different from the sample above. Be careful.

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 (or 20 UIN characters) |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | TR |

| 107 | Taxable period | The date specified in the request as the debt repayment period in the format DD.MM.YYYY |

| 108 | Document Number | Request number from the Federal Tax Service, without dashes and slashes |

| 109 | Document date | DD.MM.YYYY- date of request (next to the number on the form) |

| 110 | Payment type | from March 28, 2016, the value of attribute 110 is not indicated |

If the UIN is not included in the income tax requirements of the Federal Tax Service

Income tax debt for 2015 upon request without UIN sample payment order

Income tax debt for 2015 upon request without UIN sample payment order Download in or

Sample payment slip for income tax debt upon request with UIN

All details are filled in similarly to the example above, with the exception of field No. 22 “Code”. In it we indicate 20 characters of the UIN, which we take from the requirements of the Federal Tax Service (if such a code is there).

Sample of filling out a payment slip for income tax arrears for 2015 upon request, indicating the UIN

Sample of filling out a payment slip for income tax arrears for 2015 upon request, indicating the UIN Download in or

Sample of filling out a payment order for interest on income tax

Two digits in the KBK change in the 14th and 15th digits (count from left to right). Filling out the remaining tax details depends on whether you voluntarily pay penalties on income tax, or at the request of the tax authority. The requirement may or may not include a UIN. Samples are shown for each occasion, please see below.

Voluntary transfer of interest on income tax

After voluntarily paying the income tax debt, you should also voluntarily transfer penalties on it. Penalties are also a debt, in any case. Therefore, when transferring them voluntarily, in the details of the basis for payment, you need to write exactly that: “ZD”.

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011012100110 |

| KBK Regional budget | 18210101012022100110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | ZD |

| 107 | Taxable period | MS.01.2013 – MS.12.2014; MS.01.2014 – MS.12.2015 KV.01.2013 – KV.04.2014; KV.01.2014 – KV.04.2015 |

| 108 | Document Number | 0 |

| 109 | Document date | 0 |

| 110 | Payment type | from March 28, 2016, the value of attribute 110 is not indicated |

Voluntary payment of interest on income tax in 2016 sample payment order

Voluntary payment of interest on income tax in 2016 sample payment order Download in or

Penalties for income tax at the request of the Federal Tax Service

All tax details are different, the BCC is the same as in the previous example. Everything is detailed in the table. However, there are two options for filling out orders - without a UIN code and with it.

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 (or 20 UIN characters) |

| 104 | KBK Federal Budget | 18210101011012100110 |

| KBK Regional budget | 18210101012022100110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | TR |

| 107 | Taxable period | The date specified in the request as the deadline for paying the penalty in format DD.MM.YYYY |

| 108 | Document Number | Request number from the Federal Tax Service (only numbers without spaces) |

| 109 | Document date | DD.MM.YYYY |

| 110 | Payment type | from March 28, 2016, the value of attribute 110 is not indicated |

There is no UIN in the request from the tax office

Penalties for income tax upon request without UIN sample payment form 2016

Penalties for income tax upon request without UIN sample payment form 2016 Download in or

Sample payment slip for interest income tax upon request with UIN

Everything is the same as in the example above. We just rewrite the UIN code from the Federal Tax Service request form. The code is long, it’s clear that it won’t fit in the “22” field in one line. Well, write in two lines and reduce the font.

Sample payment order penalty income tax on demand in 2016 with UIN

Sample payment order penalty income tax on demand in 2016 with UIN

Download in or

Sample payment order for payment of a fine for income tax

Were you unable or did not have time to voluntarily pay the missing amount of tax, or did your company undergo a tax audit, as a result of which additional income tax was assessed, and there was no time left to correct everything? Most likely, tax officials will want to fine the company. On the fine payment slip, one digit in the KBK is changed to a C again.

Income tax penalty if required

Of course, there are also such strange (to put it mildly) companies in which accountants pay fines voluntarily, only after a tax audit report. But this is not normal business behavior, and therefore we do not provide such a sample for filling out a payment order. You should transfer the fine only when you already have a request from the tax authority. Until then, all legal measures should be taken to avoid or reduce staffing.

| Field no. | Props name | Contents of the props |

|---|---|---|

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 (or 20 UIN characters) |

| 104 | KBK Federal Budget | 18210101011013000110 |

| KBK Regional budget | 18210101012023000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | TR |

| 107 | Taxable period | The date specified in the request as the deadline for paying the fine in format DD.MM.YYYY |

| 108 | Document Number | Request number from the Federal Tax Service (only numbers without spaces or dashes) |

| 109 | Document date | DD.MM.YYYY- date of request (next to the number on the stamp) |

| 110 | Payment type | from March 28, 2016, the value of attribute 110 is not indicated |

The request for a fine does not contain a UIN

Income tax fine sample payment order 2016 without UIN

Income tax fine sample payment order 2016 without UIN Download in or

Sample payment form for income tax fine with UIN

Sample payment order for income tax fine in 2016 indicating the UIN

Sample payment order for income tax fine in 2016 indicating the UIN

Download in or

A payment order is a necessary document for conducting non-cash payments between legal entities and individuals through banks or other financial institutions.

A sample form for the Pension Fund, Social Insurance Fund and other funds will help you fill out this document correctly. The Bank of Russia has established a payment order form.

Payment order 2016 sample download.

Payment orders 2016 can exist both in electronic form (client-bank system or Internet bank) and on paper. Filling out the fields of the payment order is carried out on the basis of the requirements set out in the Regulation of the Bank of Russia dated June 19, 2012 N 383-P “On the rules for transferring funds”.

Payments for taxes and other transfers to the budget of the Russian Federation have a number of their own characteristics. Only in them you need to fill out fields 101, 104-110. The payment order form must contain information about the name of the document and the form code, its number and date of preparation, as well as the type of payment. In addition, the document form provides for the indication of the main details of the payer (account number and TIN) and his banking institution (BIC - bank identification code, correspondent account number, sub-account), as well as the main details of the payee and the bank serving the recipient.

Payment order to the Pension Fund sample of 2016

Reporting to the Pension Fund in 2016 is submitted according to new rules. Accordingly, in the Pension Fund of Russia, payment orders in 2016 also need to be filled out in a new way. Below is a sample of filling out a payment order to pay contributions to the Pension Fund.

Please note that if you pay the fees yourself, you must always enter 0 (zero) in the “Code” field. This field should not be empty, since banking programs are configured in such a way that the payment will not be processed if this detail is not filled in.

If an organization pays contributions or fines (penalties) on contributions based on a request, then a unique accrual identifier (UIN) is indicated in the “Code” field. The UIN is assigned by the Fund and is indicated in the request for payment of contributions (fines, penalties). When transferring money at the request of funds, it is necessary to reflect the unique code specified by the fund’s employees in their request. For example, UIN98765432101234567890///. If the identifier is missing, you must enter “zero” as in the case of a voluntary payment.

Sample payment order for individual entrepreneurs without employees (for themselves), lawyers, notaries:

Sample payment order for employers - organizations and individual entrepreneurs:

Payer status in payment order

The payer status in the payment order in 2016 is recorded in field "101". The payer status can take the following values:

01 - if the payer is a legal entity

02 - taxpayer - Tax agent

06 - tax payer - participant in foreign economic activity

08 - organization - payer of insurance premiums and other payments to the budget of the Russian Federation (except for payments administered by tax authorities)

09 - taxpayer or payer of fees - individual entrepreneur

10 - taxpayer or fee payer - private notary

11 - taxpayer or fee payer - lawyer who established a law office

12 - payer - head of a peasant (farm) enterprise

13 - payer of taxes or fees - another individual - bank client (account holder)

14 - taxpayers who make payments to individuals (clause 1, clause 1, article 235 of the Tax Code of the Russian Federation)

Starting from January 1, 2014, when transferring any insurance premiums, indicate status 08 in field 101

Tax period in the payment order 2016

The tax period in the payment order is indicated in field "107". The tax period code can take the following values:

First and second signs

- MS - monthly payments;

- KV - quarterly payments;

- PL - semi-annual payments;

- GD - annual payments.

The fourth and fifth digits contain: for monthly payments - the month number (from 01 to 12); for execution of quarterly payments - quarter number (from 01 to 04); for semi-annual payments - the semi-annual number (01 or 02).

From the seventh to the tenth digit the year for which the tax is paid must be indicated.

Examples: "MS.02.2016" - monthly payment for February 2016; "KV.01.2016" - payment for the first quarter of 2016; "PL.02.2014" - payment for the second half of 2014; "GD.00.2014" - annual payment for 2014; "03/01/2016" - if the legislation establishes specific deadlines for paying taxes or fees.

Payment order: download form

Download payment order form

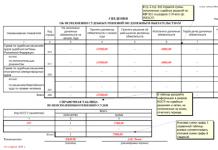

The payment order form on paper is specified in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012, and a standard template is also presented there (form 0401060), which looks like this:

Appendix 2

to the Bank of Russia Regulations

"On the rules for transferring funds"

dated June 19, 2012 N 383-P

Filling out a payment order

Filling out a payment order must be carried out in full compliance with the requirements of Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” and Appendixes 1, 2 and 3 to this regulation. Along with this, filling out a payment order for transferring payments to the budget and extra-budgetary funds must also take into account the Orders of the Ministry of Finance. Thus, from January 2014, Order of the Ministry of Finance of the Russian Federation of November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation” comes into force.

Please note that empty details fields are not allowed. If a specific field cannot be filled in or is not necessary, then a zero is entered in it.

Changes in payment orders

The Federal Treasury provided clarifications on the new requirements for indicating information in a payment order for the transfer of payments.

By Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, new rules for indicating information in payment orders came into force on January 1, 2014.

All organizations must fill out payment orders for payment of insurance fees and taxes in a new way. One of the innovations is that instead of the OKATO code in payment orders it is necessary to put the code from the All-Russian Classifier of Territories of Municipal Entities (abbreviated as OKTMO).

OKTMO in payment orders from January 1, 2016 is indicated in field 105 “Purpose of payment”

In December 2013, the Ministry of Finance presented a table of correspondence between OKATO codes and OKTMO codes of municipalities, as well as their constituent settlements and inter-settlement territories. The full text of the document can be found on the Ministry’s website.

Based on materials from: www.yourbuhg.ru