A taxpayer under OSNO (some details about this regime can be found in the article at the link: Taxation under OSNO - types of taxes) requires an invoice (Article 169 of the Tax Code of the Russian Federation) to receive a VAT deduction. This document can be issued: So, upon receipt of a request, the counterparty can submit on its own behalf a certificate-letter about the OSNO tax system according to the sample, which can be downloaded in completed form from the link: Sample of filling out an information letter-notification on the application of OSNO.

Letter on the application of the simplified tax system for the counterparty

Demand or ask?

What document confirms the use of the simplified tax system?

However, the tax inspectorate has no obligation to confirm that you have switched to the simplified tax system; it does not send you in response either a permit or a notice of application of the simplified tax system.

To receive this letter, the simplifier must send a request to the tax office with a request to confirm the fact of application of the simplified tax system.

Accordingly, this information letter, its certified copy or a copy of the title page of the tax return under the simplified tax system may be documents confirming the status of a simplified person (Letter of the Ministry of Finance dated May 16, 2011 No. 03-11-06/2/75).

Letter on application of the simplified tax system: sample

LLC “Trading company “Uyut””

TIN 7717655123 / KPP 771701001

129626, Moscow, st. 3rd Mytishchinskaya, no.

We hereby notify you that LLC “Trading Company “Uyut”” applies a simplified taxation system in accordance with Chapter. 26.2 of the Tax Code of the Russian Federation from 01/01/2018, which is confirmed by a copy of the information letter of the Federal Tax Service of Russia No. 17 for the city.

Moscow dated 02/03/2019 No. 3270.

General Director _____________ Krasin E.A.

Chief Accountant ____________ Gribova O.Kh.

Certificate about the applied taxation system

So you will have to compose the letter yourself.

- your company name, details;

- information about registration with the tax authority (in accordance with the registration certificate);

- information that the company is a payer of value added tax, for example.

In addition, you can attach a copy of the VAT return and documents confirming payment of tax to the budget. The letter must be signed by the general director, indicating the position and full name, and a seal.

Is there a specific sample of a certificate about the applicable taxation system? What features should taxpayers consider in 2019?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

It is known that the Russian Federation does not have a unified tax system. The parties to a transaction can work in completely different modes, which is not always convenient for them.

It happens that a company simply does not know what system their partner is using. Then the question arises - how to find out the system being used?

Is it possible to get a sample of filling out a certificate about the applicable taxation system somewhere? When is such a document necessary?

General information

First, let's look at the nuances of taxation in different systems. Who can use a certain type of regime, in what cases are such rights lost?

Mode selection

Every entrepreneur and company with legal entity status has the right to use one of the taxation systems proposed by the government if it meets the requirements specified in the regulatory documentation.

It is possible to switch to one of the special modes or the traditional system - OSNO. Let's list the special modes:

When choosing a tax system, firms take into account:

- activities;

- the number of employees who work at the enterprise by or;

- profit-cost ratio;

- availability of OS;

- participation in the authorized capital of the founders.

Influencing factors are also the location of the company, the amount of turnover, etc. In order not to make mistakes with the tax regime, it is worth making preliminary calculations and comparing the results.

Who has the right to what?

Let's look at the features of each tax system and who can use them.

BASIC

There are no restrictions on types of activities. When using the regime, payers are required to calculate tax:

It is also necessary to pay insurance contributions to extra-budgetary funds (to the Social Insurance Fund and Pension Fund) and other taxes (on land, transport, for the use of water bodies, for the extraction of minerals, etc.).

The advantages of OSNO include:

- Can be used by any company;

- it is convenient for large enterprises;

- VAT reimbursement is allowed when conducting a certain type of activity (when exporting, importing goods, leasing, etc.);

- the costs of the production process can be taken into account when determining the amount of the company's income tax.

Main disadvantages:

- you need to hire an accountant due to the large amount of paperwork and complex accounting;

- it is worth submitting reports every month to the structures of the Pension Fund, Social Insurance Fund, and the Compulsory Medical Insurance Fund;

- Every quarter reports on other types of payments are submitted.

In accordance with Ch. 26.2 of the Tax Code, the right to use this regime arises when the following conditions are met:

Simplified payers have the right not to pay:

Other taxes and contributions are transferred according to the general rules ().

Firms have the opportunity to choose one of the objects (according to):

Payers using the simplified tax system pay taxes every quarter and submit reports once a year. The right to apply the regime arises after submitting the appropriate notification to the tax office ().

The advantages include:

- low tax rates (described in);

- ease of reporting;

- minimal accounting;

- no need to submit reports to the Social Insurance Fund or Compulsory Medical Insurance Fund.

But there are also factors that are not in the favor of companies and individual entrepreneurs:

- You cannot use a simplification when conducting activities referred to in;

- when opening a branch or separate division, the right to use is lost;

- transition to the simplified tax system is possible only from the beginning of the tax period (if no notification was submitted when registering the organization);

- with the simplified tax system with the object “Income”, the calculation is made without taking into account costs;

- under the simplified tax system “Income minus costs”, it is worth providing evidence of expenses.

UTII

It is worth relying on the order prescribed in Chapter. 26.3 NK. This taxation system is used when conducting those types of activities that are approved by the government of the constituent entities of the Russian Federation. It is not possible to work on UTII in all regions of Russia.

Taxes paid:

- a single tax calculated taking into account basic profitability, coefficients and physical indicators;

- insurance premiums;

- Personal income tax when performing the duties of a tax agent;

- taxes mandatory for all enterprises - land, water, etc.

Types of activities for which imputation may be used are reflected in. Reporting must be submitted every quarter ().

Advantages of working for UTII:

The disadvantages include:

- limits on the physical indicator were approved, above which the company cannot use UTII;

- It is possible to operate only within the region where the LLC or individual entrepreneur became the payer of the imputation.

Unified agricultural tax

The use of the system is regulated by Ch. 26.1 NK. Manufacturers of agricultural goods who are engaged in crop production, livestock farming, as well as companies that are engaged in breeding and fishing ().

Those companies that are engaged only in primary or industrial processing do not have the right to work on the Unified Agricultural Tax.

Video: basic tax system

Payers may not calculate such taxes ():

- on the profit of the company, except in cases where payment is made from dividends and other debt obligations;

- on property;

- VAT (except imports).

The transition is voluntary (clause 5 of Article 346.2 of the Tax Code) on the basis of a notification provided to the tax authorities. It will be possible to use this tax regime from the beginning of the new year (after submitting documents on the transition).

The main requirement, by fulfilling which an organization will be able to work for the Unified Agricultural Tax, is that the profit from activities in the agricultural industry should not be less than 70%.

LLCs and individual entrepreneurs that produce excisable goods, operate in the gambling industry, as well as state-owned, budgetary and autonomous enterprises do not have the right to use the system.

This regime can be used exclusively by individual entrepreneurs.

An individual entrepreneur can work for PSN if the following conditions are met:

- The number of employees should not exceed 15 people ().

- There is no activity carried out in accordance with agreements of simple partnership and trust management of property objects (clause 6 of Article 346.43 of the Tax Code).

A person is exempt from the following taxes:

- Personal income tax.

- For property.

Entrepreneurs who have a patent do not have to file a declaration. You can switch to the regime voluntarily, but applications should be submitted no later than 10 days before the activity ().

The simultaneous use of PSN and another regime is allowed (Article 346. 43 of the Tax Code).

Normative base

We list the current documents:

- The normative act that approved the forms of documentation was approved by.

- 1 Article 346.45 Ch. 26.5 Tax Code (on approval of the patent form).

Certificate of applicable taxation system (sample) in 2019

How to prove that you work on a specific type of taxation? Is there a document that will confirm the use of OSNO, simplified tax system or another regime?

When simplified

The tax authority does not have objective information at the time of submitting an application for a certificate about the regime used. In view of this, the Tax Authority has no reason to submit such documents.

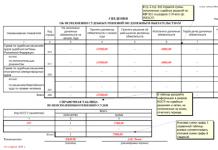

But the regulatory document dated April 13, 2010 No. ММВ-7-3/182@ approved, which contains the date of filing the notification of the application of the simplified tax system, information about the presentation for those periods in which the simplified system was used.

Please note that this is no longer issued. That is, in the case when a company requests to issue a certificate confirming the use of the simplified tax system, the inspector will submit an “Information Letter”.

The payer draws up an application for a certificate in free form.

UTII

When working for UTII, a company cannot obtain a certificate from the tax authorities that would confirm the fact of using the imputation.

In the event that you are required to provide such a document, you can show a photocopy of the certificate of registration as a single tax payer on imputed income.

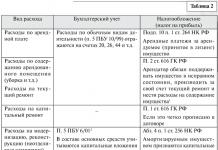

Under a general taxation system

There are no certificates that prove the application of the general taxation system.

If counterparties request any document from you to verify the application of OSNO, you can write a letter stating:

- name of the enterprise;

- information about registration with tax authorities (in accordance with the registration certificate);

- is a value added tax payer?

Next you will need to sign and seal. If you want to find out what mode the counterparty operates in, you can ask for a certificate of settlements with government agencies, which reflects all taxes paid in accordance with the tax system.

You can obtain such a document from a Tax Service representative by writing an application. The representative will issue you such a document as a sample certificate of the applicable OSNO tax system.

Another option to prove the application of OSNO is to present the latest value added tax declaration, payment documents confirming the payment of VAT amounts to the budget.

Other modes

Sometimes counterparties issue documents with the inscription “excluding VAT”. Thus saying that they have a simplified special regime. But how can you verify the veracity of this statement and ask for confirmation of the application of special tax conditions? We will tell you how counterparties can prove the justified absence of VAT in their transactions and provide sample letter on application of the simplified tax system for a counterparty.

Ask or demand?

Today, the tax legislation of the Russian Federation does not provide that companies and individual entrepreneurs using the simplified taxation system are required to show their counterparty any type of documents on the application of the simplified tax system. Thus, there is no legal rule to demand this from simplifiers.

Understanding this confuses a taxpayer unprepared for legal nuances. However, you can express your need in the form of a request for letter on the application of the simplified taxation system (sample see below).

In order to avoid tensions in relations with those applying the simplified tax system, when they are sent a package of documents on the transaction, a request for permission to apply a simplified procedure when calculating tax liability is simultaneously attached. It's better than quarreling with partners.

What document confirms the right to special treatment?

Notification

If a company or individual entrepreneur switches to the simplified tax system, then they should send a notification to their Federal Tax Service about the transition to the simplified system. This is form No. 26.2-1 (approved by order of the Federal Tax Service dated November 2, 2012 No. MMV-7-3/829).

According to the provisions of paragraph 1 of Art. 346.13 of the Tax Code of the Russian Federation, this should be done before the beginning of January, in order from that moment to legally have the status of a tax payer under the simplified tax system.

However, you should know that tax authorities are not required to provide any additional documentary evidence of the transition to a simplified tax system. The situation seems hopeless. After all, the tax inspectorate has the right not to send any permitting or notification letters to the counterparty. And where then can I get the answer to letter on application of the simplified taxation system?

Information letter

By order of the Russian Tax Service dated November 2, 2012 No. ММВ-7-3/829, another form of interest to us was approved - No. 26.2-7. This is an information letter. And not just a letter, but a very necessary document through which tax authorities confirm:

- receiving a notification from a company or individual entrepreneur about a change in their tax status and switching to a simplified tax system (in the letter form it is called an application);

- receiving reports under the simplified taxation system. Although information about submitted declarations may not be visible if the day for their submission has not yet arrived, and the information letter is already ready.

The form of this letter looks like this:

To receive such a letter, the simplifier should make a request for confirmation of the fact of application of the simplified tax system. And it is this document (its certified version) that will become the evidence that will confirm the status of a simplifier.

Declaration

In the end, the status of your counterparty as a simplified person can be confirmed by the title page of a fresh declaration under the simplified tax system. In addition to the information letter from the Federal Tax Service, attention is drawn to this by the letter of the Ministry of Finance dated May 16, 2011 No. 03-11-06/2/75.

Example letter

In order to provide stronger evidence of his status on the simplified tax system, a simplified person can accompany a copy of the entire information letter or the title page of the declaration with a simple letter about the application of the simplified tax system. Sample for the counterparty might look like this.

Every taxpayer has the right to switch to the simplified tax system subject to the conditions listed in Art. 346.12 and 346.13 of the Tax Code of the Russian Federation.

In order to switch to the simplified tax system, the company needs to notify the tax authorities about this by filling out form No. 26.2-1 (approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829@).

Check out the example of filling out the form in the material“Notice on the transition to a simplified taxation system” .

To do this, you should send a request letter in any form to the Federal Tax Service. The response to the request must be provided within 30 calendar days. Such a letter containing information about the date of submission of the notice of transition to the simplified tax system will be a certificate of the simplified tax system confirming the taxpayer’s right to use this simplified regime.

An information letter from the Federal Tax Service can be received in person, via mail or using electronic document management services.

Results

The legislation does not provide for the mandatory availability of a supporting document for the application of the simplification, subject to the taxpayer filing a notification. Nevertheless, for external contractors and for their own peace of mind, the taxpayer has the right to request an information letter, which replaces the certificate of application of the simplified tax system.

The state regularly updates the legislative foundation. The number of applications and forms with permissions and rejections takes up free space from living office employees.

But there is a pleasant exception - the notification of the Candidate for a simplified tax regime fills out a single form that does not require answers or double-checks.

The simplified tax system tool is convenient for an individual entrepreneur.

Why is “simplified” needed?

When companies and individual entrepreneurs summarize the first results and display on paper the amounts of upcoming tax expenditures, businessmen are overwhelmed by a range of feelings ranging from “bewilderment to indignation.” The amount and reasons for calculating tribute do not fit on the fingers of two hands.

Notification allows you to optimize taxes and reduce the paper flow of reporting. The potential payer will no longer have to calculate income tax or pay property tax on fixed assets used in the production process. VAT is disappearing from the horizon.

The “Simplified” mode is established for the enterprise as a whole. It is impossible to formalize one type of activity under simplification and leave another under the general regime.

There have been recorded cases where they work with “simplified” people without enthusiasm because of VAT.

The result is formed by the supply market. If a product, service or work is in demand, then the notification form for the application of the simplified tax system in the contract package will not turn into an obstacle to business relations.

Entry price

The annual income threshold was indexed. For 2017, the amount of the defining transition parameter was 112 and a half million Russian rubles.

The law establishes that until 2020 the amount will not be revised. The price of oil and the dollar exchange rate will in no way shake the benchmark.

The amount of annual income is indicated in a special field in the notification of the transition to the simplified tax system.

Prelude of transition

Before filling out the notification form, it is useful to check the cash register. Payment upon delivery of goods or services, advance amounts for future deliveries - this is income. This also includes income from the rental and sale of your own property.

If money for a low-quality product and poorly provided service had to be returned to the customer within a year, then the returned amount will be minus.

Income includes proceeds from sales: those posted through the current account and through the cash register.

A company is allowed to switch to simplified tax accounting rules if the amount of income is less than or equal to 112.5 million rubles. But not in a year, but in nine months. The annual threshold is 150 million.

It’s easier for an entrepreneur - for individual entrepreneurs, the notification of application of the simplified tax system does not require entering information about income. But the responsibilities for perfect compliance with the general rules of cash transactions remain. As well as the need to submit statistical reports.

Having decided on the cash content, you should carefully compare the statutory work of the organization or the declared employment of the entrepreneur with the list from the Tax Code. Briefly, this list looks like this: banks and microfinance, brokerage services; bookmakers; investment funds; manufacturers of excise goods; private notaries and lawyers. They have their own yoke of taxes.

If income and types of business do not interfere, then check the number of staff. Offices and entrepreneurs exploiting hired labor with more than 100 employees are not allowed to enter the simplified regime.

The presence in the list of shareholders - “legal entities” with a share of 25% of the authorized capital puts an end to the dream of a flexible and convenient tax policy regime.

To expand the sales market, the organization opens branches in other cities. This is good for revenue, but the transition to a simplified method of settlements with the state is prohibited. Even if the volume of rubles mined does not exceed 150 million per year.

An application for issuing a notice of application of the simplified tax system to the Federal Tax Service is not required. A company or entrepreneur just needs to fill out a notification form and send it to the tax office. There is no need to wait for confirmation. Because “simplification” is voluntary. But situations arise when confirmation of application is required by the counterparty. Then the “simplified” person applies in writing to the tax office, where within 30 days they will prepare a letter confirming the legality of working under the simplified tax system.

Simple and clear business form

For each sneeze there is a specific “be healthy” message. When filling out the cells and lines of the notification form for the application of the simplified tax system, you should strictly adhere to the notes under the table.

Situation 1. An organization or entrepreneur is already operating according to the general regime.

The company indicates the INN, KPP, full name, as in the Charter. The indicator of the existing payment mode is equal to 3. The transition indicator is equal to 1.

An individual entrepreneur fills out the TIN, last name, first name and patronymic. Enter 3 into the code cell of the current regime. Enter 1 into the desired “simplified” cell - the transition code from the first day of the next year.

Situation 2. An organization or entrepreneur submitted a tax registration kit without an application for the simplified tax system.

The newly formed participants in economic battles have a chance to correct the situation in thirty days. The correct values are:

- the first code is assigned the value 2 - a sign of a newly created organization.

- the second code cell is filled in with the number 2 - which means “from the date of tax registration.”

Situation 3. The application for simplified registration and registration were submitted simultaneously.

Names and surnames are entered as in previous situations. The codes are given meaning:

The first code is 1 - a sign of simultaneous submission of two applications;

The second code is 2 - a sign of a newly created organization.

When should I announce my wishes for 2018?

In order to meet and work out the year of the Yellow Earth Dog using a simplified tribute regime, you must inform the supervisory authority - the Federal Tax Service - in time. The Talmud of directors and accountants says: the inspection records the arrival of an application before the last strike of the New Year's chimes. But the year ends on Sunday. The tax office is resting. According to the accepted rules, the last day for submitting an application is postponed to the next first working day.

As a result, the deadlines for filing a notice of application of the simplified tax system are as follows:

- can be submitted either in the remaining days until December 31st,

- or on the upcoming “Bloody Sunday”.

Rules for individual entrepreneurs

To issue a notification about the application of the simplified tax system, impeccable compliance with the rules of Article 346 of the Tax Code is required:

1. A newly organized individual entrepreneur has the right to apply the simplified tax system from the moment he registers with the tax office.

2. It doesn’t matter whether an “old” or “new” individual entrepreneur claims to be “simplified”. The activities of a participant in the economic market should not be included in the “forbidden” list.

3. Pleasant information: for individual entrepreneurs there are no restrictions on the maximum amount of annual income. You just need to remember that income consists of means of sales and amounts of non-operating transactions.

4. The last step: submit a neatly completed and signed application to the publicans. There is no need to wait for an answer. There is also no need to ask again and clarify whether you received it and whether you agree. The application is of a notification nature. He warned the individual entrepreneur about the transition to another regime and can calmly work and pay taxes according to the rules.

5. The transition to the simplified tax system means that the entrepreneur is freed from the obligation to pay personal income tax for himself on business profits. The merchant pays a tax of 6% on the chosen “income” method and 15% on the “income minus expenses” method. But an individual entrepreneur for hired labor is endowed with the functions of a tax agent and is obliged to accrue and pay personal income tax to the treasury from the remuneration of hired personnel.

How to simplify the transition to "simplified"?

Situation: in the middle of the year the need to optimize tax payments becomes obvious; The Code allows for a change of orientation; but accounting under the new conditions is possible only from January 1 of the next year. The eternal Russian question “What to do?” has a positive answer.

If the calculations of income and expenses are correct, then it is pointless to stand idle for six months. Financial recovery gurus advise: liquidate an existing enterprise or individual entrepreneur and register a new one immediately with a simplified tax rigmarole. This procedure with reconciliations and checks, calculations and offsets will take a couple of months. Four months of savings are worth it.