Natalya Beresneva, lawyer

Natalya Troitskaya, auditor of the Russian Federation

Group of companies Telecom-Service IT

When carrying out business activities, almost all organizations are faced with issues arising from lease agreements for buildings, structures, premises concluded in connection with the implementation of production activities.

Legal regulation of rental relations is carried out primarily in accordance with the Civil Code of the Russian Federation (Civil Code of the Russian Federation).

Without going into the civil aspect, this article will discuss the features and specifics of accounting and taxation of rental transactions.

So, “under a lease agreement for a building or structure, the lessor undertakes to transfer the building or structure for temporary possession and use or for temporary use to the tenant” (Article 650 of the Civil Code of the Russian Federation). Let us recall that the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation, published on June 1, 2000, explained that the rules governing the rental of buildings and structures equally apply to non-residential premises located in the building.

The issues of registration of lease agreements, fortunately, have been resolved quite definitely to date: lease agreements for premises concluded for a period of less than a year are not subject to state registration. Also, the right to lease arising from contracts concluded for a period of less than a year is not subject to state registration (see information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 16, 2001 No. 59).

In the agreement, the landlord and the tenant can indicate who bears what costs for maintaining the rented premises in a suitable condition (major repairs, routine). If there are no such clauses in the contract, in accordance with the Civil Code of the Russian Federation (Article 616), responsibilities for major repairs are assigned to the lessor, and for current repairs - to the tenant.

In addition, the parties may stipulate in the contract the obligations to pay for utilities. Let us clarify that public services include heating, water supply, sewerage, gas, electricity, hot water supply (water heating) and others (clause 11 of the letter of the Ministry of Finance of Russia dated October 29, 1993 No. 118 “On the reflection in accounting of individual transactions in housing and communal services farm").

As we will see later, the procedure for distributing responsibilities for maintaining leased property and incurring expenses on it is very important from a tax point of view; correct execution of the agreement in the future can significantly make life easier for accountants.

Accounting for income and expenses under a lease agreement

Accounting and taxation with the lessor

According to PBU 9/99 “Income of the organization” (hereinafter referred to as PBU 9/99), approved by Order of the Ministry of Finance of the Russian Federation dated 05/06/1999 No. 32n, if the subject (type) of the organization’s activity is the provision for a fee for temporary use (temporary possession and use) of its assets Under a lease agreement, revenue is considered to be income received in connection with this activity (rent). Accordingly, revenue is reflected in account 46 “Sales of products (works, services)” according to the old Chart of Accounts (account 90 “Sales” according to the new Chart of Accounts).

Rental revenue is subject to reflection in the credit of account 46 (90) even when the organization’s charter does not indicate that it leases premises, buildings, structures, or other property, but the criterion of materiality has been reached - a situation in which the ratio of the amount received from leasing operations to the amount of income from ordinary activities for the corresponding reporting period is at least five percent (see “Methodological recommendations on the procedure for generating indicators of financial statements of organizations”, approved by order of the Ministry of Finance of the Russian Federation dated June 28, 2000 No. 60n ). Moreover, the criterion of materiality is the only one for establishing the procedure for reflecting certain income as part of income from ordinary activities or as part of non-operating (operating income). Tax authorities often resort to using another criterion, namely “regularity and systematicity”. However, neither the “regular” nor the “systematic” nature of leasing property is provided by tax legislation as a criterion and basis for classifying these incomes as income from sales (see Resolution of the Federal Arbitration Court for the Moscow District dated December 26, 2000 No. KG-440 /5420-00). For generalization purposes, let’s call the option discussed above also a type of activity.

If leasing is not a type of activity of the organization (including the materiality criterion is not met) - in accordance with PBU 9/99, rental income is operating income for the organization. They are reflected in account 80 “Profits and losses” (91 “Other income and expenses”).

As for the costs associated with the maintenance of leased property, their reflection in accounting also depends on whether renting is a separate type of activity or not.

If leasing property is a type of activity of the organization, then the corresponding expenses are reflected in account 20 “Main production”.

In cases where income from the rental of property is reflected in operating income, it is necessary to pay attention to the following:

In accordance with clause 2.7. Instructions of the Ministry of Taxes of the Russian Federation dated June 15, 2000 No. 62 “On the procedure for calculating and paying income tax for enterprises and organizations to the budget”, income received from leasing property is included in income from non-operating operations along with other income from operations not directly related with the production of products (works, services) and their sale. When determining the final financial result, organizations must take into account the important fact that for tax purposes, income from non-operating (operating) operations must be reduced by the amount of expenses for these operations.*

Reflection in the accounting of rental income and expenses, as well as any other financial and economic transactions, should be based on the assumption of temporary certainty of the facts of economic activity (clause 6 of PBU 1/98 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated December 09, 1998 No. 60n; clause 12 PBU 9/99, clause 18 PBU 10/99 “Expenses of organizations (hereinafter referred to as PBU 10/99), approved by Order of the Ministry of Finance of the Russian Federation dated 05/06/1999 No. 33n). The need to apply the assumption of temporary certainty when determining indicators under the article “Income and expenses from non-operating operations” is also confirmed in the Letter of the State Tax Service of the Russian Federation dated August 30, 1996 No. VG-6-13/616 “On certain issues of accounting and reporting for tax purposes.” At the same time, the State Tax Service of the Russian Federation indicates that a similar procedure should be applied for taxation.

In this case, the time certainty for the lessor is determined by the terms, form and procedure for payments under the lease fixed in the lease agreement. Accordingly, the lessor must actually record rental income as it accrues (regardless of whether payment is received or not for the relevant period).

When calculating income tax, you need to keep the following in mind: there are two possible approaches to calculating income tax. The first approach: take into account accrued non-operating income for tax purposes and not have any problems with the fiscal authorities. The second approach is to take into account non-operating income only after receiving the corresponding rent. Let us confirm the possibility of the second approach.

According to paragraph 2 of Article 2 of the Law on Profit Tax, gross profit is the amount of profit (loss) from the sale of products (work, services), fixed assets, other property of the enterprise and income from non-operating operations, reduced by the amount of expenses for these operations. Paragraph 6 of Article 2 of this law determines that income (expenses) from non-sales operations includes income (expenses) from operations not directly related to the production of products (works, services) and their sale. Further, clause 13 of the Regulation on the composition of costs establishes that the final financial result (profit or loss) is composed of the financial result from the sale of products (works, services), fixed assets and other property of the enterprise and income from non-sales operations, reduced by the amount of expenses for these operations. At the same time, the procedure for determining the financial result from the sale of products (works, services) and the financial result from the sale of fixed assets and income from non-sales operations is different. Thus, revenue from the sale of products (works, services) is determined based on the accounting policy chosen by the taxpayer (as it is paid for or as the products (works, services are performed) are shipped and payment documents are presented to the buyer (customer). Determining the financial result based on non-operating income (expenses) is not made so dependent.

Consequently, based on the concept of an object subject to income tax contained in Article 2 of the mentioned law, only income actually received is included in the tax base as part of non-operating income.

The possibility of successfully applying the stated approach when calculating income tax can be confirmed by judicial practice, for example, Resolution of the Constitutional Court of the Russian Federation dated October 28, 1999 No. 14-P, FAS Resolution for the Northern Territory of November 20, 2000 No. A56-8286/00.

With regard to accounting for expenses associated with the maintenance of leased property, we note only the following: based on the definition of the object of taxation by income tax, these expenses can be taken into account only after the corresponding non-operating income is included in the tax base (accounting for rental income).

With regard to the calculation of other taxes, we will briefly dwell only on the issues of calculating the tax on road users. If you follow the provisions (clause 33.5) of the Instruction of the Ministry of Taxes of the Russian Federation dated April 4, 2000 No. 59 “On the procedure for calculating and paying taxes received in road funds,” regardless of how income from leasing property is reflected - as part of income for ordinary types activities on account 46(90) or as part of operating income on account 80(91), this income for tax purposes on road users is considered as revenue from the “sale of services for the provision of property for rent, including under a leasing agreement (except property in state and municipal ownership)”. Although we cannot unequivocally agree with this approach of the tax authorities, since, firstly, the provision of property for rent and the provision of services for a fee have completely different legal natures, and secondly, in cases where renting is not a regular type of activity, as already indicated, income are accounted for as non-operating.

Let us turn to the provisions of Article 5 of the Law of the Russian Federation of October 18, 1991 No. 1759-1 “On Road Funds”. In accordance with Article 5 of the law, the object of taxation on road users is the amount of revenue from the sale of products (works, services) and the amount of the difference between the selling and purchasing prices of goods sold as a result of procurement, supply, marketing and trading activities. Neither Article 5 nor other provisions of the law indicate that for the purposes of calculating the tax on road users, the transfer of property for rent is considered as the sale of relevant services.

In accounting, the indicator of revenue from the sale of products (works, services) accounted for in account 46(90) is given in line 010 of form No. 2 “Profit and Loss Statement”.

Meanwhile, in accordance with paragraph 1 of Article 38 of the Tax Code of the Russian Federation, the objects of taxation are not only transactions for the sale of goods (work, services) and the cost of goods sold (work performed, services rendered), but also income.

An analysis of the concept of “service”, given in paragraph 5 of Article 38 of the Tax Code of the Russian Federation, allows us to conclude that the rental of property does not fall under this concept.

Renting out property for tax purposes can be recognized as a service only if there is a direct indication of this in a specific rule for a specific tax.

As follows from paragraph 1 of Article 11 of the Tax Code of the Russian Federation, institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation, used in the Tax Code of the Russian Federation, are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code code.

According to Article 779 “Contract for paid provision of services” of Chapter 39 “Paid provision of services” of the Civil Code of the Russian Federation, a service is understood as the performance of certain actions or the implementation of certain activities. Such actions (activities) include communication services, medical, veterinary, auditing, consulting, information services, training services, tourism services and others.

For tax purposes, an activity is also recognized as a service (clause 5 of Article 38 of the Tax Code of the Russian Federation).

Leasing of property in the Civil Code of the Russian Federation is considered as a completely different, independent type of obligation, along with purchase and sale, barter, donation, rent, contract, etc.

As already indicated, according to Article 606 of the Civil Code of the Russian Federation, under a lease agreement (property lease), the lessor (tenant) undertakes to provide the tenant (tenant) with property for a fee for temporary possession and use or for temporary use.

The different legal nature and purposes of an agreement for the provision of services for a fee and an agreement for the rental of property are obvious.

When providing services for a fee, the organization providing the services must perform the actions (activities) stipulated by the contract, and it is for the implementation of these actions (activities) that payment is made.

When leasing property, the lessor transfers the property for temporary use, but the payment he receives is payment for the use of this property by the tenant for a period of time specified in the agreement, and not for the transfer of property, that is, the lessor’s performance of actions (activities) to transfer the property.

Thus, in the absence of a rule in the law on a specific tax or in part two of the Tax Code of the Russian Federation providing for the classification of the rental of property as services or the inclusion in the tax base of rental amounts (income from rental property), recognition of the transfer of property for rent as a service, and the amounts rent - revenue from the sale of services by-laws contradicts tax legislation. Therefore, based on legal grounds, we can conclude that the Instruction broadly defines the object of taxation as a tax on road users and, as a consequence, there are no grounds for imposing a tax on road users on income from the provision of property for rent, included in operating income. When resolving a dispute in court, in accordance with Article 11 of the Arbitration Procedure Code of the Russian Federation, the arbitration court, having established during the consideration of the case the inconsistency of an act of a state body, local government body, or other body with the law, including its publication in excess of authority, makes a decision in accordance with the law.

Accounting and taxation for the tenant

When renting premises for production needs, the tenant can attribute the rent to the cost of production in accordance with paragraphs. part) clause 2 “Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for generating financial results taken into account when taxing profits” (hereinafter referred to as the Regulations on the composition of costs) , approved by Government Decree No. 552 dated 05.08.1992.

In this case, the tenant must keep in mind the following:

The tenant's expenses for rent (if it is not a lease from an individual) are, as a rule, taken into account in account 26 “General business expenses”.

Renting non-residential premises from individuals who are not individual entrepreneurs is not a profitable operation for the tenant. This conclusion is based on the position of the fiscal authorities and, in particular, set out in the letter of the Ministry of Taxes of the Russian Federation dated 04/11/2000 No. VG-6-02/271@, as well as the letter of the State Tax Inspectorate for Moscow dated 09/09/1998 No. 30-08/27466. This position can also be adhered to by a taxpayer who does not want to defend the legality of a different position in the courts. How do publicans justify their position?

In accordance with paragraphs. f) and h) of paragraph 2 of the Regulations on the composition of costs for the purposes of calculating income tax, the costs of servicing the production process include the costs of maintaining fixed production assets in working order (costs of technical inspection and maintenance, current, medium and major repairs ), as well as rent for individual objects of fixed production assets.

Resolutions of the Presidium of the Supreme Arbitration Court dated February 27, 1996 No. 2299/95 and dated June 25, 1996 No. 3652/95 indicate that fixed production assets do not include the property of individuals who are not entrepreneurs.

Taking into account the above, the tenant's expenses for rent and maintenance of non-residential premises leased from an individual who is not an entrepreneur are not included in the cost of products (work, services) of the tenant, taken into account for tax purposes.

However, there are now precedents for arbitration courts making decisions according to which it does not matter who the lessor of the property is: an individual, a legal entity or an individual entrepreneur.

Indeed, decisions of the Supreme Arbitration Court of the Russian Federation No. 2299/95 and 3652/95 were made on the basis of the “Regulations on accounting and reporting in the Russian Federation”, approved by Order of the Ministry of Finance of the Russian Federation dated March 20, 1992 No. 10 and “Regulations on the procedure for calculating depreciation charges on fixed assets in the national economy”, approved by the State Planning Committee of the USSR, the Ministry of Finance of the USSR, the State Bank of the USSR, the State Committee for Prices of the USSR, the State Statistics Committee of the USSR and the State Construction Committee of the USSR on December 29, 1990 No. VG-21-D/144/17-24/4-73. Currently, the “Regulations on Accounting and Reporting in the Russian Federation” are in force, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, (as amended by Orders of the Ministry of Finance of the Russian Federation dated December 30, 1999 No. 107n, dated March 24, 2000 No. 31n).

Regulation No. 34n and PBU 6/01 “Accounting for fixed assets” (including the previously in force PBU 6/98 dated 09/03/1997 No. 65n), approved by Order of the Ministry of Finance of the Russian Federation dated 03/30/2001 No. 26n, relates the assignment of tangible assets to basic production means with the possibility of their use in carrying out business activities as means of labor for a long time in the sphere of material production and in the non-production sphere.

At the same time, neither the Law of the Russian Federation “On the Profit Tax of Enterprises and Organizations” nor other legislative acts on taxes directly indicate that leased property can be registered as a fixed asset only if this property was taken into account in such quality from the lessor - another taxpayer.

The legislation on taxes and fees does not stipulate the possibility of including in expenses (attribution to the cost of products, works, services) the costs of maintaining fixed production assets in working order by how this asset was taken into account by the lessor - another taxpayer. The legal status of the lessor (legal or natural person, individual with or without the status of an entrepreneur) also does not matter when checking the legality of including in the expenditure side the costs associated with the extraction of taxable income. In this regard, restricting the taxpayer’s rights depending on who the lessor is is not legal. This position is reflected in the decisions of the Federal Arbitration Courts by district, in particular: resolutions of the Federal Arbitration Court of the North-Western District dated 04/17/2001 No. A56-1887/01, dated 03/27/2001 No. A56-25466/00; Resolution of the Federal Arbitration Court of the Ural District dated December 20, 2000 No. F09-1775/2000-AK.

Accounting for utility bills

Landlord

When determining the rent, the lessor takes into account the costs it incurs in fulfilling its obligations under the lease agreement. These include depreciation amounts, utility bills and other expenses directly related to the payment and maintenance of leased property.

In practice, there are 2 common options for paying utility bills: including utility bills in the rent; as well as billing the amounts of utility bills, telephone payments in addition to the rent, in a separate amount.

Option 1. The agreement between the lessor and the tenant provides for the covering of all expenses (including utility bills) associated with the leased property, the rent established by the agreement.

If the provision of property for a fee for temporary use is a type of activity for the lessor, then the lessor’s expenses for paying utility bills related to the property leased are classified as expenses for ordinary activities and are recorded on account 20.

In cases where the provision of property for rent is not a type of activity of the lessor's organization, these expenses are reflected as operating expenses in the debit of account 80(91).

Option 2. The lease agreement provides for reimbursement of utility bills by the tenant in addition to the rental amount established by the agreement.

From the point of view of the tax authorities, business transactions related to utility payments are reflected in the accounting records of the lessor using account 46 if, in accordance with current legislation, the lessor has the right to perform the functions of providing utility services (Articles 544, 545 of the Civil Code of the Russian Federation, clause 4 of the Rules for the provision of telephone services, approved by Decree of the Government of the Russian Federation of September 26, 1997 No. 1235). This approach is set out in the letter of the State Tax Service of the Russian Federation dated October 27, 1998 No. ШС-6-02/768 “Methodological recommendations on certain issues of profit taxation” and in the letter of the State Tax Inspectorate for Moscow dated September 9, 1998 No. 30-08/27466.

When does the landlord have the right to provide utility services? As you know, energy supply relations are regulated by articles. 539-548 Civil Code of the Russian Federation. At the same time, according to Art. 548 clause 2, to relations related to the supply of gas, oil and petroleum products, water and other goods through the connected network, the rules on energy supply contracts apply unless otherwise established by law, other legal acts or follows from the essence of the obligation.

Article 545 of the Civil Code of the Russian Federation allows the transfer by a subscriber of energy received from the energy supply organization through the connected network to another person - a sub-subscriber. This transfer is possible only with the consent of the energy supply organization.

Thus, if the lessor has the right to connect subsubscribers, in fact, he has the right to provide utility services. It is quite reasonable to consider this activity as another type of activity of the lessor. And if in relation to the lease itself there is sometimes a choice: reflect through 46 (90) accounts or count as operating income, then utility payments received from the tenant are revenue from the sale of utilities. Accordingly, in this case, the costs of utility bills of the landlord himself are expenses for ordinary activities.

In fact, the Civil Code of the Russian Federation does not allow us to draw an unambiguous conclusion about what essentially happens when energy is transferred to a sub-subscriber by the subscriber. The subscriber receives ownership of a certain amount of energy, and then transfers it to the sub-subscriber for ownership? Art. 545 speaks of the transfer of energy accepted by the subscriber, but it is not at all clear from the context whether the energy is being resold or whether the lessor acts as an agent (commission agent).

If we turn to the Rules for the use of electrical and thermal energy, approved by order of the USSR Ministry of Energy dated December 6, 1981 No. 310, and which are currently canceled by order of the Ministry of Fuel and Energy of the Russian Federation dated January 10, 2000. No. 2, we will see that in these Rules, the transfer of energy to a sub-subscriber was considered as resale (clauses 1.1.7., 1.1.3., 1.1.4).

Since the tax authorities consider the receipt of payment for utilities by the lessor as payment for the sale of services, the question quite reasonably arises about the possibility of the lessor providing energy supply services without an appropriate license.

According to the old Federal Law “On Licensing of Certain Types of Activities” dated September 25, 1998 No. 158-FZ, which was in force until the new Federal Law of the Russian Federation dated August 8, 2001 No. 128-FZ came into force, activities to ensure the operability of electrical and heating networks are subject to licensing. According to the new Law, this type of activity is also licensed. The regulation on licensing activities to ensure the operability of electrical and thermal networks was approved by Decree of the Government of the Russian Federation dated April 5, 2001 No. 267. The Regulation (clause 3) states that the activity to ensure the operability of electrical and thermal networks is understood as a set of measures to ensure such a state of electrical facilities and heating networks, in which the values of all parameters characterizing the ability of these objects to perform specified functions comply with established norms and rules, as well as the requirements of technical, design and construction documentation. At the same time, clause 4 provides a list of works included in this complex: design, installation, adjustment of equipment, buildings and structures of electrical and (or) heating networks; dispatch control, as well as collection, transmission and distribution of electrical and thermal energy.

If the lessor sells energy received from the energy supply organization, we can talk about energy transfer, however, he does not perform any other work, there is no special equipment for the distribution and transmission of energy. Then we cannot speak unequivocally about the need for licensing. Still, licensing is justified when professional activities are carried out in this area. The landlord doesn't do this. It grants the right to use the received energy to the lessee insofar as this is necessary for the maintenance of the leased property.

So, we have examined the procedure for reflecting rental transactions from the lessor from the point of view of the position proposed by the tax authorities, namely the reflection of received utility payments on account 46 (90).

Let us justify the possibility of a different approach. This approach is to consider the transfer of energy to a sub-subscriber as a situation where, with the consent of the energy supplying organization, the lessor “withdraws” from the contract with the energy supplying organization as a direct consumer of energy, the tenant becomes the consumer, and the lessor acts as an intermediary (commission agent, agent) between the energy supplying organization and tenant. Yes, energy is transferred through the lessor’s connected networks, but he does not become its consumer, the “owner” and the lessee becomes the consumer. The landlord-commission agent acts on his own behalf, but at the expense of the tenant. He also participates in calculations. Roughly, this can be compared to the purchase of goods for a buyer under a commission agreement (in this case, the goods are directly energy - heat, electricity, gas). And if so, then the settlements should be reflected as settlements under a commission agreement, namely: on the credit of account 76 “Settlements with various debtors and creditors” the funds received from the subsubscriber on account of the supplying organization are reflected, on the debit of account 76 - accordingly, the amount of expenses with the supplying organization. In addition, as already mentioned, both tax and civil legislation under the provision of services mean actions (activities) stipulated by the contract. The lessor does not perform any actions, but is only an intermediary between the supplying organization and the tenant-consumer in terms of making payments for energy resources. The fact that this approach has the right to exist can be confirmed by arbitration practice, in particular, as examples, we refer to the decisions of the Federal Arbitration Courts for the North-Western District dated July 18, 2000 No. A56-639/00, dated October 23, 2000 No. A05- 4338/00-258/11, according to the Moscow District dated December 26, 2000 No. KG-A40/5420-00.

I would like to note one more point. Very often, when it comes to reimbursement of utility bills in excess of the rent, it is customary to say that the rent is formed from two components - constant and variable. The variable part is formed by the lessor on the basis of invoices issued by energy supply organizations and the telecom operator. From the point of view of civil law, the parties, at their discretion, can establish the procedure for determining the price of the contract. But then there is no need to talk about utility bills at all, they are only a criterion for determining the variable part, and the generated amount is nothing more than rent and is reflected either in account 46 (90) or in account 80 (91) - see Option 1.

Regarding communication services (telephone calls), the following should be taken into account.

According to the Federal Law of February 16, 1995 No. 15-FZ “On Communications” (Article 15), the activities of individuals and legal entities related to the provision of communication services are carried out on the basis of a license duly obtained and issued for this purpose. Accordingly, the lessor can reflect the fee received from the lessee for telephone calls through the 46 (90) account only when operating in the field of providing communication services on the basis of an appropriate license, which, as a rule, the lessor does not have. Generally speaking, the arguments against reflecting the compensation received from the tenant for the use of telephone communications (payment for calls) can be given the same as above, in terms of reflecting utilities. But, since the tax authorities in this matter resort to “additional” arguments, we will refute them too.

In the letter of the State Tax Service of the Russian Federation dated October 27, 1998 No. ШС-6-02/768, the tax authorities refer to paragraph 4 of the Rules for the provision of telephone services, approved by Decree of the Government of the Russian Federation dated September 26, 1997 No. 1235). This clause states that telephone services are provided on the basis of an agreement for the provision of telephone services concluded between the telecom operator and the subscriber (client).

The rights and obligations of the parties under the agreement may be transferred to other persons only in the manner established by the legislation of the Russian Federation and these Rules. What kind of order this is is not yet entirely clear. The Rules themselves specify the procedure for re-issuing a contract only for citizens. And the Rules themselves were adopted in pursuance of the Law “On the Protection of Consumer Rights” and there are no grounds for expanded application in terms of regulating relations with business entities, especially since these rules cannot influence either the formation of accounting registers or, especially, tax legal relations. Moreover, the landlord cannot reflect the payment for telephone calls through the 46 (90) account, since he does not have a license and, within the framework of the rental relationship, actually carries out the “transit” of payments between the tenant and the telecom operator.

In practice, the problem of construction between the tenant, landlord and telecom operator is often resolved in the following way: temporarily (for the period of validity of the lease agreement for the premises) re-issue the contract for the provision of communication services to the tenant, which entails additional monetary costs.

Tenant

Speaking about the specifics of reflecting the payment of utility bills from the tenant, we can say the following: Since the issue is directly related to the reduction of the tax base for income tax, the tax authorities pay very close attention to the issue of the possibility of including the amounts of utility bills billed to reimburse the corresponding expenses of the landlord in accordance with terms of the lease agreement in excess of the rent. If these payments are not allocated as a separate line (in a separate invoice), but are included in the rent, then utility payments as part of the rent are included in the cost of production.

If bills for utility bills and payments for telephone calls are issued separately, the tenant may have problems.

The letter of the Ministry of Taxes and Taxes of the Russian Federation No. ШС-6-02/768 states: “as for the expenses of the tenant organization for payment of utility bills, based on the nature of these expenses, as expenses directly related to the production and sale of products (works, services), they are subject to inclusion in the cost of products (works, services) of the tenant, regardless of the type of activity of the lessor’s organization, determination of the amount of rent in accordance with the agreement and subject to the conclusion of agreements for the receipt of utilities by the tenant in accordance with the current legislation of the Russian Federation.” Following this letter and a number of others, the tax authorities accepted the attribution of utility payments by the tenant to expenses only in the case when the tenant entered into direct agreements with energy supply and other similar organizations. In turn, these organizations were in no particular hurry to conclude agreements with tenants.

However, if we compare the part of the letter concerning the landlord, according to which the landlord reflects incoming utility payments through 46 (90) account, if he has the right to perform the functions of providing utility services, and the part that talks about the possibility of attributing the costs of paying utility bills to the cost price , - we come to the completely logical conclusion that if we include in the lease agreement the possibility of the tenant receiving utilities in accordance with Art. 544 and 545 of the Civil Code of the Russian Federation, we will thereby fulfill the requirements of the tax authorities contained in the letter. We will have an agreement with the relevant organization (lessor) that transfers services to the sub-subscriber!!!

Taking into account the provisions of the Civil Code of the Russian Federation governing the law of obligations, as well as special provisions establishing the obligation to obtain the consent of the supplying organization to connect a sub-subscriber, the lessor can confirm the competence to perform the functions of providing utility services by sending a notification to the supplying organization about connecting the sub-subscriber in accordance with the lease agreement and proposals on the procedure provision of services and settlements with the specified subscriber-lessor. The specified document includes a condition that the proposal is considered accepted if there is no objection from the supplying organization.

In support, one can cite the position set out in letters of the Department of Tax Administration for Moscow dated December 27, 2000 No. 03-12/61590, dated April 21, 2000 No. 03-12/16517.

The position is as follows: if the lease agreement for the premises provides for the landlord to provide the tenant with the right to use energy, heat, water supply and telephone services in the rented premises with the imposition on the tenant of reimbursement of the lessor's expenses for payment for energy, heat, water supply and telephone services in addition to the rental fees, the tenant can attribute to the cost of products (works, services) the costs of reimbursing the lessor for the above-mentioned services when these costs are confirmed by the relevant primary documents - the lessor's invoices, drawn up on the basis of similar documents issued by the energy supply organization and the communication operator organization in relation to the actually occupied the tenant of the premises and the heat and power networks and telephone lines used by the tenant.”

That is, in order to attribute utility bills to cost, the tenant must:

An indication in the agreement that the landlord grants the tenant the right to use energy, water, etc. supplies

Consent of the energy supplying organization given to the lessor to provide services to the sub-subscriber.

Lessor's invoices compiled on the basis of similar invoices received from resource supply organizations.

It should be noted that although the clarifications in the letter dated December 27, 2000 were given at the request of the tenant bank, nevertheless, they are of a general nature and are quite applicable to all tenant organizations. These letters were published in the magazines “Moscow Tax Courier”, No. 11, 2000; No. 5, 2001.

The position set out in the letters of the Department of the Ministry of Taxes of the Russian Federation for Moscow is applicable both in the case when the lessor is a person providing services, and in the case when we consider him as an intermediary (commission agent).

In conclusion, we will express our opinion on this vital issue for tenants. In our opinion, regardless of the absence or presence of direct contracts with energy, heat, water supply organizations and communications companies, as required by Art. 539, 545 of the Civil Code of the Russian Federation, whether the consent of the relevant organizations to connect the sub-subscriber has been received or not, the basis for attributing these costs to cost in accordance with the Regulations on Accounting and Reporting are primary documents. In addition, the absence of direct contracts with supplying organizations and communication companies is not a basis for excluding these costs from the cost of products (works, services) of the tenant, since the very fact of using the leased space in the management and production process is the basis for inclusion in the cost of products (works) , services) costs for maintaining these premises, if these costs actually occurred. The requirements for the existence of relevant contracts are not established by the provisions of the Law on Profit Tax and the Regulations on the Composition of Costs. And, as always, we will confirm our claim with arbitration decisions: Resolution of the FAS Central District dated November 25, 1999 No. A09-3086/9912, FAS Moscow District dated November 13, 2000 No. KA-A40/5134-00.

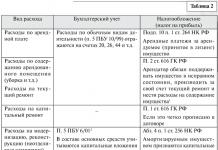

Routine repairs of rented property

As we have already indicated, the parties to the agreement distribute responsibilities for the repair of the leased property. In the absence of such instructions in the contract, as a general rule, the costs of current repairs of the leased property are borne by the tenant (Article 616 of the Civil Code of the Russian Federation).

Thus, the following options for distributing costs for routine repairs of buildings, structures, and premises are possible.

The contract places the responsibility for repairs on the tenant.

Expenses for ordinary activities in accordance with clause 18 of PBU 10/99 are recognized in accounting in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity) when fulfillment of the conditions given in clause 16 of PBU 10/99.

Costs for repairs of leased fixed assets, made in accordance with the terms of the lease agreement at the expense of the tenant, in accordance with clause 78 of the Methodological guidelines for the accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated July 20, 1998 No. 33n, and the Instructions for the use of the Chart of Accounts are reflected in accounting in the debit of account 20 in the amounts of the cost of repair work and spent material.

The regulation on the composition of costs (clause e) clause 2) provides for the inclusion in the cost price of costs for technical inspection and maintenance, for current, medium and major repairs.

In order to evenly include upcoming expenses for the repair of fixed assets in the production or circulation costs of the reporting period, the organization, on the basis of clause 72 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n and clause 77 of the above Methodological guidelines may create a reserve of expenses for the repair of fixed assets (including leased ones). When creating a reserve of expenses for the repair of fixed assets, production (circulation) costs include the amount of deductions calculated on the basis of the estimated cost of repairs. When inventorying the reserve for repairs of fixed assets (including leased facilities), excess reserved amounts are reversed at the end of the year.

If there is a lack of repair fund amounts, unforeseen repair expenses can be taken into account as a debit to account 20.

The agreement provides for routine repairs to be carried out by the lessor at his own expense.

In this case, if the rent is reflected on account 46(90), accordingly, the costs of repairing the premises leased out - expenses for ordinary activities - are reflected through account 20.

In the case where rental income is operating expenses for the lessor, accordingly, expenses for current repairs are operating expenses and are taken into account in account 80(91).

So, in this article we examined the main problematic issues that arise when renting non-residential premises for industrial needs.

Of course, in practice you can encounter other issues related to rent. We will talk about them in our subsequent articles.

* Before Chapter 25 of the Tax Code of the Russian Federation comes into force, i.e. Before January 1, 2002, in accordance with the provisions of the Law “On Profit Tax,” the object of taxation is defined as gross profit, i.e. the amount of profit (loss) from the sale of property by the organization and income from non-operating operations, reduced by the amount of expenses on them, that is, there must be a direct connection between income and expenses. From January 1, 2002, in accordance with the provisions of Art. 247 of the Tax Code of the Russian Federation, the object of taxation is the profit received by the taxpayer. Moreover, profit is recognized as income reduced by the amount of expenses (for the most significant changes in the taxation of profits, see the article “Tax Revolution...”)

Lease of property, despite the term of the contract, the amount of income received from such operations, requires careful documentation and correct reflection in the accounting accounts. In this article, we will consider how equipment rental accounting is carried out for each of the parties to the agreement.

How to register rental transactions?

All operations related to the receipt of income or expenses from renting property must have documentary confirmation from both the tenant and the lessor. Property rental transactions require the mandatory execution of the following documents:

- lease agreements;

- invoices for the amount of rent.

The actual date of transfer of equipment is confirmed by the acceptance certificate. This document can be signed at the same time as the lease agreement. If, during the transfer of equipment, one of the parties for any reason refuses to sign the document, then the lease agreement will be terminated, since the actual fact of transfer of property has not been established.

This document should indicate the name of the transferred object and its characteristics. Before signing the transfer and acceptance certificate, the landlord cannot demand the transfer of rent. The absence of such a document does not allow the tenant to include rental costs in the list of expenses to determine the financial result.

Since the lessor is a VAT payer, the obligation to draw up invoices for the amount of rent remains. The absence of such a document is a violation of accounting rules, entailing penalties. If an invoice is not issued, then the tenant has no grounds for deducting the amount of VAT on the rent or for attributing this amount to production costs (see →).

When renting is part of ordinary activities

When renting is a normal activity of a legal entity, account 90 is used to account for such transactions. During the month, the lessor collects all costs associated with the provision of equipment for rent in accounts 20, 23, 26, 44. At the end of the month, such costs are written off to score 90.

Such expenses may include rent charged by the lessor on the fixed assets handed over, costs of repairing equipment carried out at his expense.

To account for income from the provision of property for rent, account 90 is also used in correspondence with account 76. At the end of the month, by comparing the debit and credit of account 90, the financial result from rental transactions is determined.

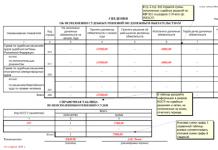

| Account correspondence | Contents of operation | |

| Dt | CT | |

| 20,23,26,44 | 10, 70, 69, 02 | |

| 90 | 20,23.26,44, 68 | |

| 76 | 90 | |

| 99 | 90 | |

| 90 | 99 | |

When the lease is not part of the ordinary course of business

When the provision of equipment for rent does not relate to the permanent activities of the organization, then to account for such operations it is necessary to use account 91, not 90. Costs associated with rent are shown as a debit to the account, and income - as a credit. It is important to remember that the provision of fixed assets for rent requires mandatory VAT calculation and payment.

| Account correspondence | Contents of operation | |

| Dt | CT | |

| 20,23,26,44 | 10, 70, 69, 02 | Expenses for equipment repairs, depreciation of leased property |

| 91 | 20,23.26,44, 68 | Write-off of expenses for leased equipment at the end of the month, VAT |

| 76 | 91 | Income from rental property |

| 51 | 76 | Received funds to pay for property rental |

| 99 | 91 | Received a loss from the provision of equipment for rent |

| 91 | 99 | Profit received from providing equipment for rent |

Reflection of equipment rental from the tenant

The rented equipment is shown by the tenant in the balance on account 001 in the amount fixed in the lease agreement. For such fixed assets, the tenant does not accrue depreciation.

The rent paid by the tenant for the use of equipment is included in his expenses and, like the owner, includes VAT. After the end of the contract, the equipment returned to the owner will be written off from off-balance sheet account 001.

| Account correspondence | Contents of operation | |

| Dt | CT | |

| 001 | Rented equipment accepted for accounting | |

| 20,44 | 76 | Rental fees charged for the use of equipment |

| 76 | 51 | Transferred for equipment rental to the owner |

| 19 | 76 | VAT allocated |

| 68 | 19 | VAT on rent is deductible |

| 001 | Rented equipment was deregistered and returned to the owner | |

Equipment repair costs

- Dt 20, 44 Kt 10, 70, 69, 76 – expenses associated with the repair of leased equipment are reflected;

- Dt 19 Kt 76 – for the amount of VAT on the cost of repairs that were carried out by contract;

- Dt 68 Kt 19 – VAT deductible.

If repairs under the contract must be paid for by the lessor, then their cost can be taken into account against future rent.

The tenant who has completed the repairs reflects expenses on accounts 20 or 44, and then writes them off to account 76: Dt 76 Kt 20, 44

When rent is received in advance

If the payment is received from the lessor

There is often a situation where the rent is paid in advance by the tenant. In this case, the property owner must take it into account as deferred income and use account 98 for this.

For example, an enterprise signed an agreement to lease its equipment for a period of 12 months, according to which the rent is 72,000 rubles for the entire period (including VAT 12,000 rubles). The tenant transferred the entire amount one-time to the owner’s bank account when transferring the equipment for rent.

The lessor must make the following entries in accounting:

- Dt 51 Kt 76 = 72000 – received to the current account for rent;

- Dt 76 Kt 68 = 12000 – VAT is charged, payable on the rent transferred in advance;

- Dt 76 Kt 98 = 60000 – reflects the amount of rental income received in advance;

- Dt 98 Kt 90 = 5000 – for the amount of revenue from the provision of equipment for rent. Postings are performed monthly throughout the lease term;

- Dt 68 Kt 76 = 1000 – for the amount of restored VAT. Posting is carried out monthly.

If payment is received from the tenant

When paying rent in advance, the amount of such expenses for the tenant should be shown on account 97. Let's consider this using the previous example:

- Dt 76 Kt 51 = 72000 – paid for equipment rental in advance;

- Dt 97 Kt 76 = 60000 – rent paid in advance is shown as part of deferred expenses;

- Dt 19 Kt 76 = 12000 – VAT allocated;

- Dt 20 Kt 97 = 5000 – part of the rental payment is included in the costs of the current month;

- Dt 68 Kt 19 = 1000 – VAT related to the monthly rent.

Subsequent purchase of leased property

When purchasing a leased property, the owner must first transfer the purchase price of the property:

Dt 76 Kt 51.

After that, the object is accepted for balance. All expenses associated with the receipt of such property must be reflected in account 08. The amount transferred to the lessor when purchasing the property must be listed as the debit of account 08:

Dt 08 Kt 76.

The rent that was transferred to the owner before the purchase of the equipment is also taken into account in account 08 and is depreciation:

Dt 08 Kt 02.

After all costs for the purchase of leased equipment are collected on account 08, upon commissioning they are written off to account 01:

Dt 01 Kt 08.

Answers to questions about equipment rental accounting

Question No. 1. The lease agreement does not indicate the cost of the equipment being leased. How can a lessee evaluate an object, and at what cost should it be reflected on the balance sheet?

In such a situation, you can choose one of three options:

- You can evaluate the property yourself. The assessment is based on the amount of material damage that the owner will have to compensate if the equipment is damaged by the tenant. This cost must be reflected on account 001 and in the explanatory note to the statements.

- You can show the amount of rental payment for the entire term of the contract as the cost of equipment.

- It is possible to estimate the value of property leased at the minimum conditional value.

Question No. 2. Who takes inventory of leased equipment?

Since it is possible to count equipment only at the location of its actual location, this means that inventory must be carried out by the tenant. In this case, it is necessary to make sure that the primary documents for the leased property are available and complete. These may be copies of inventory cards received from the property owner.

The results of the audit of leased equipment are recorded in a separate inventory, compiled for each lessor in triplicate. Two copies of the document remain at the enterprise, and the third is provided to the lessor. In this way, the owner is notified of the availability and condition of the leased property from the tenant.

Question No. 3. How to properly register the rental of equipment in an LLC under a simplified taxation system?

Regardless of what taxation system the tenant uses, the main document defining the relationship between the parties to this process is the lease agreement. Therefore, having a well-drafted lease agreement is mandatory. This document should specify the object of the agreement, its validity period, the amount and timing of the transfer of rent.

When transferring equipment, you must leave an acceptance certificate.

The lessee records the leased objects on the balance sheet in account 001. Expenses that were incurred by the lessee to maintain the equipment in a condition suitable for operation are included in expenses for ordinary activities. Rent expenses reduce the tax base when calculating the simplified tax.

Head of the Internal Audit Department of the BEST group of companies. Real estate management"

General rental provisions

Typically, an office lease refers to the lease of one or more premises in a building that are intended to be used for office purposes. In accordance with paragraph 1 of Article 130 of the Civil Code, immovable things (real estate, real estate) include everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including buildings and structures. Thus, a separate room in a building is real estate.

The procedure for concluding and executing a real estate lease agreement is regulated both by the general provisions of the Civil Code on rent, contained in paragraph 1 of Chapter 34 “Rent,” and by the rules of paragraph 4, which regulates the lease of buildings and structures. In this case, the norms of paragraph 4 of Chapter 34 of the Civil Code have priority, since they are special in relation to the general norms. These rules fully apply when renting individual premises.

A lease agreement, like any transaction, at least one of the parties to which is a legal entity, must be concluded in simple written form (subclause 1, clause 1, article 161 of the Civil Code of the Russian Federation).

Under a lease agreement, the lessor undertakes to provide the tenant with property for a fee for temporary possession and use or for temporary use (Article 606 of the Civil Code of the Russian Federation). The tenant is obliged to use the leased property in accordance with the terms of the lease agreement (Clause 1, Article 615 of the Civil Code of the Russian Federation). The tenant is obliged to maintain the property in good condition, carry out routine repairs at his own expense and bear the costs of maintaining the property, unless otherwise provided by law or the lease agreement (Clause 2 of Article 616 of the Civil Code of the Russian Federation). If the tenant has made inseparable improvements to the leased property at his own expense and with the consent of the lessor, the tenant has the right, after termination of the contract, to reimburse the cost of these improvements, unless otherwise provided by the lease agreement (Clause 2 of Article 623 of the Civil Code of the Russian Federation).

Under a lease agreement for a building or structure, the lessor undertakes to transfer the building or structure for temporary possession and use or for temporary use to the tenant (clause 1 of Article 650 of the Civil Code of the Russian Federation). The transfer of a building or structure by the lessor and its acceptance by the tenant is carried out under a transfer deed or other transfer document signed by the parties (Article 655 of the Civil Code of the Russian Federation).

Upon termination of the lease agreement, the leased building or structure must be returned to the lessor in compliance with the rules arising from the transfer of the building or structure by the lessor to the lessee.

According to paragraph 1 of Article 654 of the Civil Code, the lease agreement for a building or structure must provide for the amount of rent. In the absence of a condition agreed upon in writing by the parties regarding the amount of rent, the lease agreement for a building or structure is considered not concluded. Moreover, in cases where the rent for a building or structure is established in the contract per unit area of the building (structure), the rent is determined based on the actual size of the building or structure transferred to the tenant (clause 3 of Article 654 of the Civil Code of the Russian Federation).

In practice, the amount of rent when leasing an office is in most cases set exactly this way: a certain amount of rent per month or per year per square meter.

Registration of the agreement

In accordance with Article 4 of the Law of July 21, 1997 No. 122-FZ “On state registration of rights to real estate and transactions with it,” transactions with real estate are subject to mandatory state registration. This provision is also contained in Article 131 of the Civil Code. However, paragraph 2 of Article 651 of the Code clarifies that a lease agreement for a building or structure concluded for a period of at least a year is subject to state registration and is considered concluded from the moment of such registration. Thus, a lease agreement concluded for a period of less than a year is not subject to mandatory registration. This is confirmed by the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 1, 2000 No. 53.

In practice, lease agreements for individual premises, in order to avoid unnecessary hassle associated with the need to register the agreement, in the vast majority of cases are concluded for a period of less than one year; upon expiration of the contract, a new contract is concluded.

In accordance with Article 19.21 of the Code of Administrative Offences, failure to comply with the established procedure for state registration of rights to real estate or transactions with it entails the imposition of an administrative fine on legal entities from 30 to 40 thousand rubles.

Preparation of documents for accepting payments for expenses

In practice, when leasing property, the question often arises: what primary documents confirming the landlord’s income and the tenant’s expenses are necessary? Is the landlord obliged to sign a monthly certificate of work performed (services rendered) with the tenant? In large business centers, where the number of tenants amounts to hundreds, signing with each of them the “Act of provision of rental services” requires a large amount of time and labor resources. However, accountants of tenant companies sometimes fear whether they have grounds to attribute rent to expenses for accounting and tax purposes in the absence of such an act? Let's try to figure it out.

In the Civil Code, rental relations are regulated by Chapter 34, and provisions on the provision of paid services - by Chapter 39. Paragraph 2 of Article 779 of the Civil Code explains that the rules of Chapter 39 apply to contracts for the provision of communication services, medical, veterinary, auditing, consulting, information services , training services, tourism services and other services. Chapter 34 does not contain any reference to the fact that certain provisions of the contract for the provision of services may apply to lease agreements. Consequently, rent is not a service, but a separate type of business activity.

This was confirmed, for example, by a letter from the Ministry of Finance dated October 26, 2004 No. 03-03-01-04/1/86, signed by Deputy Director of the Department of Tax and Customs Tariff Policy A.I. Ivaneev. According to the Ministry of Finance, rental payments paid under a lease agreement for non-residential premises are subject to inclusion in other expenses, provided they are justified and confirmed by relevant primary documents (lease agreement, transfer and acceptance certificate, invoices for payment of rental payments, payment orders, etc.) . As you can see, the act of work performed (services rendered) is not listed among the required documents.

About a year later, a letter from the Federal Tax Service of the Russian Federation dated 09/05/2005 No. 02-1-07/81 “On confirmation of business transactions with primary accounting documents” appeared, which says the following: “If the contracting parties have concluded a lease agreement and signed an act of acceptance and transfer of property, being the subject of a lease, it follows that the service is sold (consumed) by the parties to the agreement, and, therefore, organizations have a basis for including in the tax base for income tax the amounts of income from the sale of such a service (from the lessor) and expenses in connection with with service consumption (from the tenant).

These grounds arise for organizations regardless of the signing of the service acceptance certificate, especially since neither the Tax Code nor the accounting legislation provides for the requirement to compulsorily draw up acceptance and transfer certificates for services in the form of lease.”

Despite the fact that the Federal Tax Service called rent a service, it still admits that drawing up a bilateral act is not required here.

However, most recently, the Ministry of Finance issued another letter dated 06/07/2006 No. 03-03-04/1/505, in which it expressed the opinion that the monthly preparation of an act on the provision of services for the rental of real estate is mandatory. Note that this letter was also signed by Mr. A.I. Ivaneev. During this period (1 year and 7 months), there were no changes in civil legislation relating to rental relations. In paragraph 1 of Article 252 of the Tax Code, the law of June 6, 2005 No. 58-FZ made changes that made it possible to confirm expenses not only with documents drawn up in accordance with the legislation of the Russian Federation, but also with documents indirectly confirming expenses incurred. Thus, compliance with strict rules when preparing documents is no longer a prerequisite for recognizing expenses; it is enough to submit any documents confirming the expenses incurred. Therefore, the latest letter from the Ministry of Finance against the backdrop of these positive changes for taxpayers looks strange, to say the least.

In terms of issuing invoices to tenants, traditionally a rental invoice is issued on the last day of each month.

Landlord's income and expenses. Accounting and Taxation

Income

Accounting

If the lessor is an organization for which leasing office space is the main (or one of the main) activities, its income can consist of both the rent itself and income from providing additional services to tenants (for example, office cleaning services ). Accounting for income from rent and the provision of additional services is kept in account 90 “Sales”. In accordance with paragraph 5 of the Accounting Regulations “Income of the Organization” (PBU 9/99), approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n (hereinafter referred to as PBU 9/99), these incomes are recognized as income from ordinary types activities. If the rental of premises is of a one-time, random nature, these incomes are operational (clause PBU 9/99) and are recorded in account 91 “Other income and expenses”.

Value added tax

If the lessor is a VAT payer, then his income from rent and the provision of additional services is subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). If the tenant of the premises is a foreign citizen or a foreign organization accredited in the Russian Federation, then the rent will not be subject to VAT (clause 1 of Article 149 of the Tax Code of the Russian Federation).

However, this provision applies in cases where the legislation of the relevant foreign state establishes a similar procedure in relation to citizens of the Russian Federation and Russian organizations accredited in this foreign state, or if such a rule is provided for by an international treaty (agreement) of the Russian Federation. The list of foreign states to whose citizens and (or) organizations the norms of this paragraph are applied is determined by the federal executive body in the field of international relations jointly with the Ministry of Finance of the Russian Federation. The Letter of the Federal Tax Service of the Russian Federation dated May 18, 2005 No. KB-6-26/409@ “On the application of exemption from value added tax for rental services provided to foreign citizens and organizations accredited in the Russian Federation” explains what documents establish relevant lists that should be followed at the present time.

Income tax

Income from the rental of property is taken into account as income from sales if the rental of premises is the main (or one of the main) activities (clause 1 of Article 249 of the Tax Code of the Russian Federation). In other cases, these incomes are non-operating (clause 4, article 250 of the Tax Code of the Russian Federation).

Expenses

Organizations that rent out office space on an ongoing basis typically have a variety of expenses. These include:

- utility costs (payment for electricity, water, heat supply services under contracts concluded directly with energy supply organizations or as a sub-subscriber through an connected network (Article 545 of the Civil Code of the Russian Federation));

- expenses (cleaning, minor repairs, window washing) for the maintenance of rented premises and common areas (halls, corridors, toilets);

- costs of servicing complex units and systems located in the building (elevators, escalators, ventilation systems, alarm systems, etc.);

- expenses for payment to specialized organizations for sanitary treatment of premises (deratization, disinfection, disinfestation);

- expenses for current and major repairs of premises and common areas;

- security costs;

- rental expenses (if the landlord himself is a tenant of the premises and subleases them);

- expenses for paying land tax or renting a land plot in the amount of your share (if the lessor is the owner of the premises);

- expenses for real estate insurance;

- other expenses for maintaining the premises and the building in which they are located.

Let's dwell on the most general and relevant points. In accordance with paragraph 5 of the accounting regulations “Expenses of the organization” (PBU 10/99), approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n in organizations whose subject of activity is the provision for a fee for temporary use of their assets under a lease agreement , expenses for ordinary activities are considered to be expenses the implementation of which is associated with this activity. In other cases, in accordance with paragraph 11 of PBU 10/99, these expenses are operating expenses.

For tax accounting purposes, they can be accepted only if they are justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation). If the activity of leasing premises is of a permanent nature, these expenses relate to expenses associated with production and sales on the basis of subparagraph 2 of paragraph 1 of Article 253 of the Tax Code (costs for maintenance and operation, repair and maintenance of fixed assets and for maintaining them in in good condition). In other cases (expenses for the maintenance of property transferred under a lease agreement), these expenses are classified as non-operating expenses (subclause 1, clause 1, article 265 of the Tax Code of the Russian Federation).

In practice, sometimes a situation arises (most often, if renting out premises is not the main activity of the landlord) when the landlord “reinvoices” to the tenant part of his utility costs for electricity, water, heat and issues an invoice to him. According to the Ministry of Finance, expressed in letter No. 03-04-15/52 dated March 3, 2006, this is illegal, since the landlord cannot be the energy supply organization for the tenant, since as a subscriber he himself receives electricity to supply the building from the energy supply organization. These expenses cannot be accepted from the tenant for income tax purposes, and VAT on them cannot be deducted. The lessor may increase the rent based on the amount of electricity, water, and heat consumed by the tenant.

When accounting for expenses for accounting and tax accounting purposes for the repair and maintenance of the building as a whole and its engineering systems, questions sometimes arise in cases where the lessor is not the sole owner of the building, but owns individual premises in it, while the remaining premises belong to other owners (one or several). If these expenses are borne by one of the owners, they can hardly be considered fair and justified in full. In this case, you should conclude a joint activity agreement (simple partnership agreement) with the remaining owners and be guided by Chapter 55 of the Civil Code and the Accounting Regulations “Information on participation in joint activities” (PBU 20/03), approved by order of the Ministry of Finance of the Russian Federation dated November 24. 2003 No. 105n.

Tenant expenses. Accounting and Taxation

Income tax

The tenant also incurs expenses in connection with renting an office. Let's look at some of them.

Inseparable improvements to leased fixed assets have been included in depreciable property since 2006 (Law No. 58-FZ dated June 6, 2005). In accordance with paragraph 1 of Article 258 of the Tax Code, capital investments in leased fixed assets made by the lessee with the consent of the lessor, the cost of which is not reimbursed by the lessor, are depreciated by the lessee during the term of the lease agreement based on depreciation amounts calculated taking into account the useful life determined for leased fixed assets in accordance with the Classification of fixed assets. This means that if, at the end of the lease agreement, the useful life of the capital investment does not end, then at the end of the lease agreement, the lessee must still stop accruing depreciation on the depreciable property in the form of capital investments in the form of inseparable improvements. If the lease agreement is extended, the organization can continue to accrue depreciation in the prescribed manner.

If the cost of inseparable improvements is reimbursed to the lessee by the lessor, then depreciation on them is charged by the lessor. In accordance with paragraph 2 of Art. 259 of the Tax Code of the Russian Federation, the calculation of depreciation on depreciable property in the form of capital investments in leased fixed assets, which in accordance with this chapter is subject to depreciation, begins for the lessee from the 1st day of the month following the month in which this property was put into operation. Explanations on these issues are contained in the letter of the Ministry of Finance of the Russian Federation dated March 15, 2006 No. 03-03-04/1/233.

|

Shelest LLC rents office space from Delovoy Tsentr LLC and in May 2006, with the consent of the landlord, made inseparable improvements in the rented premises (installed a fire alarm costing 30,000 rubles, including VAT - 4,576 rubles). In accordance with the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, fire alarms belong to the fourth group. Useful life is from 5 to 7 years. The Commission established a useful life of 61 months. The lease agreement expires after 3 years (36 months). The accounting entries will include the following:  |

Procedure for paying VAT when renting state property

If the lessor (and the owner of the property) are state authorities, local governments and state property is leased (federal property, property of constituent entities of the Russian Federation or municipal), the tenant becomes a tax agent and is obliged to calculate the tax base for VAT (Article 161 of the Tax Code of the Russian Federation) . According to paragraph 3 of Article 161, the tax base is defined as the amount of rent including tax. In this case, the tax base is determined by the tax agent separately for each leased property. In this case, tax agents are tenants who are obliged to calculate, withhold from income paid to the landlord, and pay the appropriate amount of tax to the budget.

The amount of tax payable to the budget is calculated and paid by tax agents in full (clause 4 of article 173 of the Tax Code of the Russian Federation). In this case, tax amounts paid by buyers - tax agents on the basis of documents confirming the payment of tax amounts (Article 171 of the Tax Code of the Russian Federation) are subject to deductions.

Buyers - tax agents registered with the tax authorities and acting as taxpayers - have the right to these tax deductions. According to paragraph 1 of Article 172 of the Tax Code, tax deductions are made on the basis of documents confirming the payment of tax amounts withheld by tax agents.

|

The organization has been renting office space in the building, which has been state property since January 2006. The rental amount including VAT is RUB 23,600. per month. The VAT amount is transferred to the budget simultaneously with the rent. The following transactions are made in January: Debit 20, 26 Credit 76 - 20,000 rub. — monthly rent accrued; Debit 19 Credit 68/A — 3,600 rub. (RUB 23,600 x 18/118%) - VAT is charged on rent; Debit 76 Credit 51 - 20,000 rub. — monthly rent is listed; Debit 68/A Credit 51 - 3,600 rub. — transferred to the VAT budget (fulfilled the duties of a tax agent). In the same month, circumstances arose for the deduction of VAT, which was reflected by the posting: Debit 68 Credit 19 - 3,600 rub. — the amount of VAT is accepted for deduction based on the invoice issued by the tenant. This amount is reflected in the declaration for January 2006 in the “Tax Deductions” section, line 260. |

We have industrial and office premises in the lease agreement. Do we need to account for them separately in accounts 20 and 26? If so, then how do we divide utility bills if they are billed as a total amount for all premises? (OSNO) ?

Expenses in the form of rental payments are reflected in accounting depending on the purposes of use of the leased property. Expenses in the form of payment of utility costs for leased property are reflected in a similar way.

Each organization determines the list of direct and indirect (general production and general business expenses) by cost item, as well as the procedure for assigning them to cost. on one's own, based on the peculiarities of production organization.

Thus, expenses for rent of production premises and utility costs for them can be taken into account as part of general production expenses (account 25). The costs of renting office premises and utility payments for them can be included in general business expenses (account 26). In this regard, if the accounting policy provides for such a division of costs into general and general production, rent for the use of production and office premises should be reflected in the corresponding cost accounts. The organization has the right to contact the landlord with a request to provide information on utility payments by type of rented premises. In the event of failure to provide such information, the procedure for distributing utility costs for attribution to accounts 25 and 26 can be established by the organization independently (for example, based on the proportion of the area of the rented premises).

The rationale for this position is given below in the materials of the Glavbukh System

Rent

In accounting, expenses in the form of rent are recognized monthly (clause 18 of PBU 10/99).

Depending on the purpose of use of the leased property, reflect:

- or expenses for ordinary activities, if the leased property is used in business activities (for example, rental of production equipment) (clause 5 of PBU 10/99);

- or other expenses if the leased property is used for non-production purposes (for example, renting a holiday home for employees) (clause 11 of PBU 10/99).

Make the following entries in accounting:

Debit 20 (23, 25, 26, 29) Credit 60 (76)

– reflects the rent for property that is used in the main activities of the production organization;

Debit 44 Credit 60 (76)

– reflects the rent for property that is used in the main activities of the trading organization;

Debit 91-2 Credit 60 (76)

– reflects the rent for property that is used for non-production purposes.

This accounting procedure is based on the provisions of the Instructions for the chart of accounts.

Oleg Horoshiy

Reflection in the tenant's accounting of transactions related to reimbursement of utility costs depends on the chosen method of payment for utilities:

- the tenant pays the landlord utilities as part of the rent;

- The tenant, in a separate payment, compensates the landlord for the cost of utilities (on a separate invoice).