Designed to summarize information about the status and dynamics of amounts planned for subsequent even write-off of expenses for various production needs. Let's figure out how reserves for future expenses are accounted for, what costs are accumulated on it and what records are used to record their write-off .

Reserves for future expenses: account 96

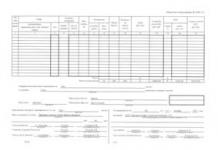

The creation of reserves (fact and criteria) are fixed in the accounting policies of the organization. Reservations of amounts documented by relevant calculations and accounting forms are reflected in the account. 96, corresponding with invoices for production and sales of products: D/t 20, 23, 51, 69, 70, 76, 91, 97, 99 - K/t 96.

So, the amounts of reserves are recorded in this account, divided according to items of planned future expenses. Most often, companies practice creating reserves for:

- Payment of vacations (+ insurance contributions to funds) in the coming periods;

- Payment of annual remuneration based on length of service;

- Expenses for seasonal work;

- Costs for repairs of environmental protection, land reclamation, environmental protection measures;

- Costs for warranty repairs and maintenance of facilities, etc.

Actual expenses incurred, included in the previously formed reserve, are reflected in the account. 96 and are written off to production costs in correspondence with cost accounts.

Analytical accounting by account. 96 is carried out separately for each created reserve. The correctness of the formation and use of reserve amounts is periodically checked in accordance with calculations, estimates and other accounting documents. If necessary, their sizes are adjusted. At the end of the year, an inventory of reserve transactions is required.

Reserves for future expenses in the balance sheet: line and its name

The reserves for future expenses formed by the company in the balance sheet are recorded in the lines of estimated liabilities:

- In the 4th section “Long-term liabilities” - page 1430;

- In section 5 “Short-term liabilities” - page 1540.

Created reserves are reflected in the indicated lines as part of long-term or short-term liabilities, based on the period of their circulation. For example, the accrued reserve for personnel leave of the current year will be fully used in the reporting period and, therefore, is considered as a short-term estimated liability, reflected in line 1540. Long-term liabilities include operations on restructuring production, i.e. those planned to be carried out over a period exceeding 12 months.

Reserves for future expenses: postings

Accounting for reserves for upcoming expenses and payments begins with creating a reserve:

|

Operation |

Account correspondence |

Base |

|

|

Accrual of a reserve for upcoming expenses for main production (production, payment of vacations in future periods, contributions to funds) |

Product production plans, personnel vacation schedule, accounting certificate - calculation of the amount of costs |

||

|

Provision for expenses for auxiliary production |

Estimate and technical documentation Help-calculation |

||

|

Creation of a repair fund |

|||

|

Monthly payments for service production (29), for example, upcoming expenses for repairs of leased property, expenses for selling in trade (44) |

|||

|

Formation of a material incentive fund within the company |

Mark in the UE, certificate - calculation |

||

|

Transferring the amounts of contributions for major repairs to the reserve |

Plans for the formation of targeted contributions |

||

|

Creation of a reserve from other income receipts |

Economic justification, calculations |

||

|

Accrual from deferred expenses |

|||

At the end of the reporting period, based on documented transactions, the accountant makes an itemized write-off of production costs, ensuring their uniformity and based on the calculation methodology adopted by the company. The basic accounting entries are:

|

Operation |

Account correspondence |

Base |

|

|

Write-off of expenses for completed current repairs (stages) |

Certificates of completed work |

||

|

Write-off of costs for auxiliary and service production |

|||

|

Covering the cost of depreciation of fixed assets |

|||

|

Accrual of vacation pay to staff from reserve funds |

Vacation schedules, personnel orders, personal accounts |

||

|

Insurance premiums have been calculated for this amount of vacation pay |

Calculation of deductions |

||

Reserves for future expenses: account closure

During the production process, the size of the created reserves may change, so by the end of the year there may be an overexpenditure of reserve funds or an excess of actually incurred expenses over the reserve. Excess of the reserve may be written off against current expenses (with appropriate justification). If at the end of the year there is a balance of reserve funds, it is reversed or transferred to the next financial year. It is important to consolidate the operations of maintaining and closing the 96th account in the accounting policies of the organization.

Name of the reserve Purpose Accounts used in accounting To pay for vacations Funds are allocated to provide vacations to employees during the year 70, 69 To pay benefits to employees for length of service and others Creation of reserves for one-time payments to employees, allocation of funds to pay seasonal workers 70, 69 Repair of OS Possible amounts required for routine maintenance (repair) of property and equipment are determined 20.23 Land reclamation Intended for environmental protection measures 20.23 Warranty repairs and maintenance Reimbursement of expenses to customers for malfunction of purchased goods under warranty service 51 Accounting account 96: typical entries In the figure Below is accounting account 96 “Reserves for future expenses” and its typical entries. To enlarge the picture, click on it.

Postings to account 96 - reserves for future expenses

Description of the posting Document-basis 20 96 27 086 Reflects the amount of the reserve for payment of vacation pay to employees Accounting statement Example 2. Creation of a reserve for payment of vacation pay based on average earnings The accounting policy of Zima LLC reflects the creation of a reserve for payment of vacation pay based on average earnings and the number of unused vacation days. The salary of employees for the past 2016 was RUB 2,750,000.

The rest of the vacation for 2016 is 30 days. The average number of days per month in 2016 is 29.3 days. To calculate the reserve, we use the formula: (average daily earnings + insurance premiums) * vacation balance.

Account 96: reserves for future expenses. example, wiring

Postings for creating a reserve: Dr Kt Amount Description of transaction 20.1 96.1 100000 A reserve is created for vacation pay 20.1 96.1 22000 A reserve is created for insurance contributions to the Pension Fund 20.1 96.1 2900 A reserve is created for insurance contributions to the Social Insurance Fund Creation of a reserve for the repair of fixed assets The reserve for repairs is calculated on the basis the total cost of fixed assets and deduction standards. A reserve for repairs of fixed assets is created on accounts 20, 23, 26, 44, etc. The annual amount of the reserve should not exceed the arithmetic average of the amount of actual repairs for the previous 3 years.

Having calculated the annual amount, we find the amount of regular contributions to the reserve. If these contributions are made monthly, then the annual amount is divided by 12. If once a quarter, then the annual amount is divided by 4.

Let’s say the amount of the reserve for the repair of fixed assets for our organization is determined as 150,000 rubles.

Account 96 in accounting: reserves for future expenses

The NU should be closed in the same way as the accounting account; after the month is closed, it turns out that the amounts are not entered into the NU account 96. Therefore, the question arose: if the program does not do this, maybe it should not be, and if such a situation is possible, does it mean to register it manually? Snovy 6 - 23.11.07 - 11:01 That is. You do not deploy cost analytics for fixed asset repairs.

Then your life will be easier. In general, when calculating the plan, you manually write entries d25/26-k96. When receiving repair services from third-party organizations, you need to make postings d96-k60, when using your own materials for repairs d96-k10 (there is a big ambush here - if you transferred your materials to a contractor for repairs, then you need to use 10.7 with subsequent debit to account 96 , but in 1C they haven’t even heard about it).

Account 96 "reserves for future expenses"

Creating a reserve for warranty repairs How reserves for future expenses are formed The organization's reserves for future expenses consist of:

- Upcoming costs of paying vacation pay to employees;

- Costs for current repairs of equipment and fixed assets;

- Costs for warranty service and repairs;

- Other expenses of the organization.

An enterprise has the right to independently establish the procedure for calculating the reserve for the payment of vacation pay to employees, indicating in the accounting policy, taking into account paragraphs 15 and 16 of PBU 8/2010: When determining the calculation base of the reserve for the repair of fixed assets or equipment, it is necessary to take into account data on the sale of products in the reporting period, estimated percentage of defects, statistics in the field of warranty repairs, and so on.

Closing the month

After analyzing product sales, it was revealed:

- 12% of goods sold are subject to repair;

- 8% of goods sold are subject to replacement;

- The average cost of repairs per unit of goods is 650 rubles;

- The average cost of replacing a product is 4,500 rubles;

- During 2017, it is planned to produce 5,000 units of goods.

Thus:

- Calculation of the reserve amount for 2017: (5,000 * 12% * 650) + (5,000 * 8% * 4,500) = RUB 2,190,000.

- The amount of monthly charges to the reserve is equal to: 2,190,000 / 12 = 182,500 rubles.

Postings to account 96 to create a reserve: Dt Ct Amount of posting, rub.

Attention

Snovy 2 - 11/23/07 - 10:12 96 standard accounts are not serviced at all. This is the first. Second - what do you have on 96 - there is a lot of stuff there and each of them is closed in different ways colnishko 3 - 11/23/07 - 10:16 I have a reserve on 96 for repairs. Snovy 4 - 11/23/07 - 10:29 I'm sorry, I don't envy you. Not only is the analytics extensive (for good reason, the plan and the fact must be taken into account for each OS), but also for the second year there is a butting “there are temporary differences in repairs.

Fonda or not? Many experts (including myself) claim that temporary differences in repairs. there is not and cannot be a fund; others believe that since planned accruals differ from actual ones, this is the basis for the formation of a temporary fund. difference. And another question - you have a rem. fund only in BU? Is there one at NU too or not? colnishko 5 - 11/23/07 - 10:39 NU also has it.

Also, the costs of auxiliary production need to be written off from credit 23 to debit 96 and a bunch of other operations for debit 96. You don’t need to close the month, because account 96 is closed only once at the end of the year - if there is no one that is transferred to the next one. year of the reserve, then the balance of account 96 needs to be reset - the credit balance must be reversed, the debit balance must be added to the debit of accounts 25-26 (it’s strange why you don’t have 20 and 23). In NU, the amount of planned accruals may differ from the accounting system, because it has its own methodology for calculating the total annual reserve amount. Then PR and VR arise there. Similar to BU 96, the account in NU is also closed only at the end of the year. colnishko 7 — 11/23/07 — 11:07 thank you, it’s nice to listen to such an intelligent person. My chief accountant and the economist just talked and came to the conclusion that this is such a crap 96 account. so for now they are deciding what and how they will do, and for now I will wait for their decision.

Postings for creating a reserve: Monthly write-off to the reserve: Dr Kt Amount Description of transaction 23 96 12500 Creation of a quarterly deduction to the OS repair reserve Write-off of reserves Write-off of the vacation reserve (example) In our example, a vacation reserve was created in the amount of 124,900 rubles (100,000+ 22000+2900). During the first month, the amount of expenses for vacations of employees of the production division amounted to 60,000. The amount of contributions to pension insurance for these vacations was 13,200, insurance contributions to the Social Insurance Fund - 1,740.

Postings for writing off the vacation reserve Dr Kt Amount Description of transaction 96.1 70 60000 Accrued vacation to employees 96.1 69.2 13200 Accrued contributions to the Pension Fund 96.1 69.1 1740 Accrued contributions to the Social Insurance Fund Postings for writing off the reserve for the repair of fixed assets A fixed asset was repaired in the amount of 56,000 rubles.

Dt Kt Amount Description of transaction 96.2 10.1 31600 The cost of materials used was written off against the reserve 96.2 70 20000 Wage costs were written off against the reserve 96.2 69.2 4400 Written off against the PFR accrual reserve Closing account 96 You need to understand that the amounts of reserves cannot be calculated with absolute accuracy. The salary reserve, for example, may change for reasons such as:

- dismissal of employees;

- salary changes;

- changes in the actual vacation schedule, etc.

If the reserve is exceeded, the amount “on top” is written off against current costs. If the reserve is not completely spent, it is carried over to the next year or reversed. For the reserve for OS repairs, the unspent balance can be closed to account 99.1 at the close of the year, if the repairs are not completed in the current year.

Creation of a reserve for payment of vacation pay based on wages The accounting policy of Vesna LLC reflects the creation of a reserve for payment of vacation pay to employees based on wages. In this case, the reserve is accrued at the end of each month. To calculate the reserve, we use the formula: (OT + insurance premiums) / 28 * 2.33, where

- 28 – the number of vacation days per year for each employee, according to the collective agreement;

- 2.33 – number of vacation days for 1 month worked.

Hence:

- Insurance premiums - 30.2%;

- Salary in January - 250,000 rubles;

- January reserve: (250,000 + 75,500) / 28 * 2.33;

- Vesna LLC created a reserve for vacation pay in January in the amount of RUB 27,086.

Postings to create a reserve in Vesna LLC for deferred holidays on account 96: Dr. Ct Posting amount, rub.

Content

- 1 Creation of a reserve

- 1.1 Creation of a reserve for future holidays

- 1.2 Postings for creating a reserve:

- 1.3 Creation of a reserve for the repair of fixed assets

- 1.4 Postings for creating a reserve:

- 2 Write-off of reserves

- 2.1 Write-off of the vacation reserve (example)

- 2.2 Postings for writing off the vacation reserve

- 2.3 Postings for writing off the reserve for repairs of fixed assets

- 3 Closing 96 accounts

Creating a reserve Creating a reserve for vacations of a future period A reserve for vacation pay is created as follows:

- the amount of the vacation reserve is calculated;

- based on the amount of the vacation reserve, the amount of insurance premium reserves is calculated;

- The vacation reserve is created quarterly or monthly.

There are several ways to create a reserve.

Due to the requirements of current legislation (local regulations, court decisions, agreements), in the course of the company’s actions, the latter may be faced with obligations in relation to which the amount and period are not defined.

We are talking about estimated obligations, which are reflected in PBU 8/2010. Used for accounting account 96 “Reserves for future expenses”.

What it is

The account is used in in order to create a reserve of planned costs. This ensures an even distribution of expenses for the purpose of paying income tax and other areas. There are subaccounts for personnel remuneration, seasonal work, equipment preparation activities, repair work on fixed assets, etc.

With proper account management 96, an enterprise is given the opportunity to avoid problems with legislation and rationally plan its own budget.

The word "reserve" has French roots and is translated as reserve. Within the framework of modern accounting practice, it has been in use since the 19th century and involves the share of an asset that is written off as an expense, i.e. it must always be filled with funds presented in the balance sheet asset.

If the corresponding content is missing, then use the contract account. The formation of a reserve is an indisputable right belonging to the owner of the enterprise. But this direction should not involve affecting all budget interests.

What is it used for?

Account 96 is intended to use and bring into general form information related to the status and movement of amounts reserved for the purpose of including expense areas in certain cost categories.

Account 96 is intended to use and bring into general form information related to the status and movement of amounts reserved for the purpose of including expense areas in certain cost categories.

By loan certain amounts are reserved, and debit— regulation of actual expenses for which a reserve was previously formed.

The correctness of formation and application is regularly checked on the basis of these calculations, estimates and rules.

Count 96 wears passive character. Formation is carried out by credit, write-off - by debit.

Accounting procedure

To recognize and reflect estimated liabilities within the framework of accounting, take into account a number of conditions, mandatory to comply with:

- the organization, in the course of past circumstances, arose an obligation that urgently must be fulfilled;

- there is a high probability of a reduction in the economic benefits required to fulfill this responsibility;

- a reasonable estimate of the amount of the estimated liability.

If each position is met, the account reflects obligations for:

- payment of vacation pay to employees;

- expenses for repair work related to fixed assets;

- costs for warranty service of commodity items;

- court proceedings;

- restructuring of the company.

The legislative framework

In the process of carrying out activities, the accountant is guided by norms and features:

In the process of carrying out activities, the accountant is guided by norms and features:

- local regulations adopted within the enterprise;

- orders and order documents from superiors;

- government regulations;

- regional conclusions;

- accounting rules (PBU).

All laws are broad and require consideration of the situation from several perspectives.

Formation, write-off, standard accounting entries

Based on the nature of the estimated liabilities, the amount is allocated to expense areas by type of activity, as well as to other costs. As for maintaining analytical accounting for the account, it is carried out according to the areas of obligations. The credit balance is reflected in the liabilities side of the balance sheet line 1430.

By debit

- Dt 96 Kt 23– write-off of expenses for completed current repairs, write-off of costs that are aimed at auxiliary production.

- Dt 96 Kt 28– displaying the write-off of costs for eliminating defects.

- Dt 96 Kt 29– costs of service production are written off due to preliminary formation.

- Dt 96 Kt 51— increase in the RPR current account based on the bank statement.

- Dt 96 Kt 52— increasing expense reserves using cash.

- Dt 96 Kt 70– calculation of payment for vacation pay to workers.

- Dt 96 Kt 97– write-off of expenses for repair work.

- Dt 96 Kt 99– accrual of an excess amount for the repair of fixed assets.

- Dt 96 Kt 10-1– write-off of the cost of materials used.

- Dt 96 Kt 69-3– calculation and payment of tax contributions.

- Dt 96 Kt 91-1– assignment to financial results of amounts accrued in the current year.

By loan

In the credit direction, the account includes a large number of transactions.

- Dt 20 (23) Kt 96— reflection of contributions to the reserve intended for the repair of fixed assets.

- Dt 20 Kt 96– accrual of monetary amounts, formation of reserves for vacation pay and reflection of deduction amounts for subsequent repairs of fixed assets.

- Dt 23 Kt 96- accrual has occurred.

- Dt 29 (44) Kt 96— reflection of the amount of monthly deductions for repair operations on fixed assets.

- Dt 44 Kt 96– payments for repair work on the tenant’s fixed assets are reflected.

- Dt 84 Kt 96– formation of a financial assistance fund within the enterprise.

- Dt 86 Kt 96– contributions from the capital repair fund.

- Dt 97 Kt 96– a reflection of the fact that actual costs for repair work exceed the reserve that was created for OS repairs.

In practice, a large number of entries are used that should be taken into account and taken into account in accounting activities.

Features of closing account 96

The reserve amount is calculated not 100% accurate. It changes due to exposure a number of factors:

- dismissal of employees;

- changes in salary and auxiliary contributions;

- changes in the actual vacation schedule;

- other prevailing circumstances.

When the reserve is exceeded, the amount “over” must be written off through current expenses. If the expenditure is not completed in full, it is transferred to the next year or reversed.

What conclusion can be drawn

Account 96 plays an important role within the balance sheet and the activities of the organization as a whole. Has sub-accounts that operate in different areas of expenses, and is responsible for the enterprise’s reserves in order to properly allocate the budget.

The account corresponds with a large number of other areas and is used in the formation of transactions. They characterize the principles of the enterprise’s activities and accounting.

Accounting account 96 is an account introduced to reflect the movement of reserves for future expenses of the organization. What regulatory framework governs such reserves? How can an accountant accurately enter account 96 data into the balance sheet? What are the nuances when preparing accounting entries for account 96? We will answer these questions in the article.

Normative base

Accounting account 96 reflects estimated liabilities. The definition of this concept is given in PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”. From paragraph 4 of this document it follows that an estimated liability is an obligation of an organization with an uncertain amount and deadline, arising as a result of legislative acts, court decisions, contracts, as well as based on business customs or as a result of the organization’s actions that indicate to other persons that that she has undertaken certain obligations that she will subsequently fulfill.

Clause 8 of PBU 8/2010 states that estimated liabilities are reflected in account 96 “Reserves for future expenses.”

It should be noted that paragraph 3 of PBU 8/2010 states that this provision may not be used by organizations that have the right to use a simplified method of accounting. This is a right, not an obligation of the organization. Thus, simplifiers independently determine whether to create reserves for upcoming expenses, and if so, for which expenses, and be sure to reflect their decision in their accounting policies.

Characteristics of account 96 and reflection in the balance sheet

Account 96 of accounting is a passive synthetic account included in Section VIII “Financial Results” of the Chart of Accounts. A passive account can only have a credit balance. That is, the accountant, creating a reserve for future expenses, credits account 96 with this amount in correspondence with the cost accounts. The accountant reflects the write-off of the reserve in the debit of account 96. Thus, it is impossible to write off more from the reserve than was deposited there, which is why the account has a credit balance. The full correspondence of accounts is indicated in the Instructions for using the Chart of Accounts.

Analytical accounting for account 96 - Reserves for future expenses is maintained for each created reserve. For these purposes, you can open subaccounts. For example:

- 96.01.1 “Reserve for payment of vacation pay to employees”;

- 96.01.2 “Reserve for payment of insurance premiums”;

- 96.02 “Reserve for warranty repairs and warranty service”;

- 96.03 “Other reserves”, etc.

Reserves are created monthly, quarterly or annually. The frequency should be approved in the accounting policy. The accountant creates a reserve on the last date of the reporting period for the next reporting period.

Before this, the balance of account 96 must be reconciled with the reserved amounts, with the data of estimates and calculations and, if necessary, adjusted.

Usually having a non-zero balance at the end of the year, account 96 in the balance sheet is reflected in the liability on line 1540 “Estimated liabilities”.

Postings when creating a vacation reserve

The method for calculating the amount of the vacation reserve is not strictly established, so it must be specified in the accounting policies of the organization.

Here is one calculation option:

- We divide all employees into groups in accordance with the cost accounts to which their salaries fall.

- We sum up all unused vacation days accruing to everyone included in the group at the end of the period.

- We calculate the average daily earnings for the group by dividing the wage fund (payroll) of the group for the period by the number of calendar days in the period and by the number of employees in the group.

- We calculate the reserve by multiplying average earnings by the amount of unused vacation days.

An example of a calculation with postings can be downloaded.

Don't know your rights?

If the reserve is not fully spent at the reporting date, it is carried over to the next period. That is, for the new period we calculate the reserve according to the above rules and form it by crediting account 96 - Reserves for future expenses (subaccount “Reserves for payment of vacation pay to employees”), the difference between the calculated reserve and the balance in subaccount 96.01.1. Thus, on the reporting date we again have the current amount of the reserve on the credit of subaccount 96.01.1.

We do the same with subaccount 96.01.2 “Reserves for the payment of insurance premiums.”

The continuation of the previous example with this posting option can be downloaded from the link.

If the reserve is not enough, then the amounts of vacation pay in excess of the reserve are accrued in the usual way and are charged to the appropriate expense accounts.

Reserve for warranty repairs and warranty service

Similarly, with the creation of a reserve for vacations, the methodology for calculating the reserve for warranty repairs is fixed in the accounting policy of the organization.

The reserve is calculated as follows:

- We calculate revenue excluding VAT from the sale of goods/products that are covered by warranty repairs over the past three years. If the sale takes place in less than three years, then we take the proceeds from the sale for the actual period of sale. If an organization has just started selling warranty goods/products, then it has the right to create a reserve for warranty repairs in the amount of expected costs for warranty repairs.

- We calculate the actual costs of warranty repairs for the same period for which we calculate revenue.

- Percentage of deductions to the reserve = expenses for warranty repairs / revenue excluding VAT from the sale of warranty goods.

- The amount of the reserve is determined as follows: reserve = revenue excluding VAT of guaranteed goods for the reporting period × percentage of contributions to the reserve.

An example of calculating the reserve and processing transactions for warranty repairs can be downloaded.

At the end of the reporting period it is necessary to make an adjustment to the reserve amounts. To do this, we calculate the amount of the reserve for the next period. If there is a balance on subaccount 69.03, that is, the reserve is not fully used, it can be transferred to the next period, adjusted if necessary.

If the reserve was not enough, then in the reporting period warranty repairs are carried out in the usual manner and are reflected in the cost accounts.

Creating a reserve for unprofitable contracts

There are often situations when an initially profitable contract becomes unprofitable. And at the same time, unilateral termination of the contract entails considerable sanctions. In such a situation, it becomes necessary to create a reserve for unprofitable contracts. In this case, the reserve is created in the month when the fact of unprofitability of the contract is discovered.

See an example of transactions when creating a reserve for unprofitable contracts.

If the reserve was not enough, then the excess amount is written off in the general manner, attributed to expenses for ordinary activities or other expenses.

If a large amount was reserved, the credit balance of the reserve for unprofitable contracts is written off to other income, that is, to the credit of account 91.01.

Account 96 “Reserves for future expenses” is used to reflect estimated liabilities. The use of this account is not mandatory for business entities that are legally allowed to conduct simplified accounting. This is a passive account that may have a balance at the end of the period and is reflected in the balance sheet on line 1540 “Estimated liabilities”. The credit of the account reflects the creation of the reserve, and the debit reflects its use.