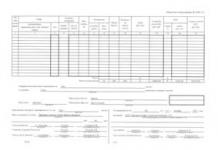

Fill out the form without errors in 1 minute!

Free program for automatically filling out all documents for trade and warehouse.

Business.Ru - quick and convenient completion of all primary documents

Connect for free to Business.Ru

For any business transaction, the organization must draw up a supporting document. It refers to the primary accounting document on the basis of which accounting records are maintained. This document is confirmed by the Federal Law “On Accounting”.

The consignment note is used for the direct release of goods from the warehouse when selling goods to third parties.

The consignment note is drawn up in two copies. The first copy remains with the organization selling the goods and is the basis for their write-off. The second copy is sent to the purchasing organization and is the basis for the receipt of the received values.

The unified form No. TORG-12 was approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

(Submit documents without errors and 2 times faster by automatically filling out documents in the Class365 program)

View TORG-12 sample filling 2016: page 1 page 2

How to simplify work with documents and keep records easily and naturally

See how Business.Ru works

Login to demo version

How to fill out the TORG-12 invoice correctly

This document must be drawn up in 2 copies, the first of which remains with the organization issuing inventory items. The second copy is intended for a third party, and on its basis these inventory items are credited or written off. Responsibilities for drawing up this document are assigned to an authorized person. It should be remembered that such documents are drawn up at the time of the transaction or immediately after the operation. The date of preparation of TORG-12 must coincide with the date of shipment of the goods.

This document requires the following details to be completed:

Name with address and telephone, fax and bank details of the supplier, payer and consignee bank;

. number and date of the waybill;

. position and signature of the person who authorized the release of the cargo and carried out this shipment.

In addition to the signature on the document, transcripts of the signatures of all persons indicated in the delivery note must be provided. All data that will be indicated in the TORG-12 summary table must be entered exactly in accordance with the invoice data.

It is necessary to pay attention to some nuances that are very important to observe at the time of receipt of the cargo.

If the consignee is an authorized person with the seal of the organization, then the consignment note must necessarily reflect his position, signature and its decoding, and seal. If upon receipt of goods or cargo there is no stamp, then filling out the invoice must provide for this moment and indicate the position of the person with a signature and transcript, and a power of attorney with a date and number must be issued to the recipient from the organization.

It is extremely important to comply with all the requirements when filling out this document form, since tax authorities pay close attention to all the nuances, and there is a whole arbitration practice regarding the preparation of an invoice.

Tax authorities often find fault and find various reasons and grounds for this, because such a document can be accepted for registration only if it is correctly and accurately executed. If the TORG-12 was filled out incorrectly, penalties will be applied to the organization and it will incur unforeseen expenses.

Trade invoice-12 refers to documents that allow you to control the release and consumption of material assets. The form in excel form can be downloaded for free.

Primary accounting papers are of enormous importance in an organization. Proper record keeping will eliminate a lot of problems. Invoice bargaining-12 refers to the category of documents that allow you to control the release and consumption of material assets in the institution. Drawing up the act in question does not cause difficulties for specialists. With a free database of forms, templates and samples at your fingertips, it's easy to create the pact you need. There is a special direct link for the invoice form Torg-12 in excel format. It can be downloaded for free without restrictions.

Registration of invoice bargaining-12 is possible in written and electronic versions. The latter is more common today and is used everywhere. The convenience of electronic document management is obvious. Acts are sent instantly to anywhere in the world and viewed on a computer. Primary registration takes place in a specific structural unit by a certain specialist when the need arises to issue goods and materials. Having created a trade invoice-12, the employee signs it and coordinates it with management and accounting.

Mandatory items of the invoice bidding-12

:- At the top of the bidding invoice-12 is the name of the institution;

- Below are the details of the structural divisions that sell the goods;

- Consignee data;

- Below is a table with fixation and specification of inventory items and characteristics;

- At the end of the table are the visas of the parties to the contract;

- It is necessary to affix the papers with seals or a note indicating the authority of the person (power of attorney);

When using unified forms of documentation, the consignment note is drawn up according to the TORG-12 form. The form and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. You can download the form on our website.

If necessary, you can enter additional fields, columns, and details into the form (see also Resolution of the State Statistics Committee of the Russian Federation dated March 24, 1999 No. 20) or use an independently developed and approved form of the consignment note (Part 4 of Article 9 of the Law “On Accounting” dated 06.12 .2011 No. 402-FZ).

Read more about this in the article “Primary document: requirements for the form and the consequences of its violation” .

When and why is the TORG-12 form used?

The unified form TORG-12 is used to register the sale (release) of inventory items to a third party. The main scope of the document is wholesale trade.

The seller issues a delivery note. For him, it is a document on the basis of which the write-off and sale of goods is reflected.

For the buyer, the TORG-12 invoice is one of the documents confirming the acquisition of inventory items and serves as the basis for their capitalization.

What information does the delivery note contain?

The set of sections of the unified form TORG-12 is as follows:

- Information about the delivery participants (seller, consignor, consignee, payer), including their names, addresses, telephone numbers, bank details and OKPO and OKVED codes.

- Details of the contract on the basis of which the delivery takes place, and the waybill.

- Details of the consignment note itself - its number and date.

- Information about the product: name, unit of measurement, quantity, price, as well as cost and VAT charged to the buyer ( Read about filling out the invoice without VAT in the material “How to fill out a delivery note (TORG-12) when working without VAT (sample)” ).

- Information about attachments to the invoice (for example, certificates, passports, etc. for goods).

- The document ends with a section with numerous signatures. On the seller’s side, it is signed by the employee who authorized the release of the cargo, the chief accountant and the employee who directly released the cargo. On the other side, signatures are affixed by representatives of the buyer and consignee. Information about the power of attorney on the basis of which the buyer’s representative accepts the goods is also provided here, and the dates of signing the document by the parties are indicated.

The unified form TORG-12 also provides for the affixing of seals of the parties to the delivery. At the same time, the seal is not a mandatory requisite of the primary document (Article 9 of Law No. 402-FZ), therefore organizations that have officially abandoned the seal may not certify the invoice with it (see also letter of the Ministry of Finance of Russia dated 06.08.2015 No. 03-01 -10/45390).

Number of copies of the delivery note

The invoice is drawn up by an authorized employee of the selling organization at the time of release of goods in 2 copies. One of them remains with the seller, the second is transferred to the buyer.

Electronic consignment note TORG-12

Primary documents can be prepared not only in paper, but also in electronic form (Part 5, Article 9 of Law No. 402-FZ).

Read about what signature you need to use for electronic documentation.

For the electronic consignment note, the format for transmission via TKS has been approved ( from July 1, 2017 - Federal Tax Service order No. ММВ-7-10/551@ dated November 30, 2015), which allows not only to establish an electronic exchange of invoices with counterparties, but also to submit invoices in electronic form at the request of tax authorities.

Sample of filling out the unified form TORG-12

A sample of filling out the unified form TORG-12 can also be seen and downloaded on our website.

Results

The unified form TORG-12 is the primary document on the basis of which the seller sells the goods and the buyer arrives. The form is issued in 2 copies: 1 for each of the parties to the transaction, or sent electronically to the buyer, subject to its certification with an electronic digital signature.

The universal form of consignment note TORG-12, which can be downloaded for free in Excel and Word on this page, is specially designed to competently organize the accounting of trade transactions in any company. Correct completion of the proposed sample in two copies will be the basis for the selling party to write off the released material assets, and for the buying party to capitalize the purchased products. In practice, the bill of lading (BW), acting as a primary document, allows you to legally formalize the transfer of ownership of the specified product from one owner to another.

Purpose of TORG-12

Invoice TORG-12 is a specific form intended for documenting specific operations related to the movement of inventory items (material assets) between individual organizations, on the one hand, including legal entities or individual entrepreneurs, and on the other, both enterprises and private buyers. Filling out the paper version of the primary document is carried out in two copies. One remains with the company (IP) that sells the goods or products, and the second is transferred to the enterprise (IP or individual) that purchases the goods and materials.

Origins and features of UFTN TORG-12

The unified form of consignment note (UFTN) - TORG-12 in Word format, as well as the filling rules, was approved in December 1998 by a special resolution of the State Statistics Committee. And since, according to Art. 9 of the Federal Law “On Accounting” prescribes the mandatory registration of facts of economic activity with primary documents; it must be written out for each shipment (release) or sale of various inventory items.

Since January 2013, the use of a unified form has become optional, with the exception of certain reservations. From this period, on the initiative of the chief accountant, the director of the company (IP) could independently determine a sample of primary documents that were planned to be used for further registration of the economic activities of his organization.

Each enterprise (IE) can use either the version of the UFTN proposed by Goskomstat or independently developed ones, including company forms for sales receipts (TC) and waybills (TN). In this case, adjustments (making changes) are allowed by adding details, fields, columns, lines, etc. Moreover, there are no “strict” requirements either in terms of the number of points or regarding the format of this document. Depending on the specifics of the company’s activities and/or the characteristics of the products sold, you can download and print a book or landscape version of the invoice forms.

At the same time, there are mandatory requirements regarding the independent development of primary documents. The bill of lading of any company (IP) must contain the following points:

- name and number of this document;

- template for filling in the registration date;

- full name of the companies participating in the transaction, indicating all details: TIN, contacts, address in TORG-12, bank account, etc.;

- description of the facts of economic activity in respect of which the current invoice is issued;

- documents on the basis of which the transaction is carried out;

- a list of sold items indicating quantity, unit price, VAT, weight and total purchase price;

- positions of persons who directly carry out the transaction and are responsible for its documentation;

- signatures in TORG-12 and seal.

Since January 2016, in addition to the paper format of invoices in Word, traditionally filled out as carbon copies, it is allowed to use electronic versions on one sheet, generated by Excel, followed by printing and certification with an electronic signature. In this case, one sheet (file) must be sent to the buyer, and the original source remains in the custody of the seller.

What is the difference between a delivery note and a sales receipt?

TN (waybill) is considered a mandatory primary document confirming a transaction made on the basis of a pre-concluded agreement on cooperation between a legal entity and a third-party organization or individual (for example, on supplies). It is issued upon transfer (sale) of products to another organization.

TC (sales receipt) is issued as confirmation of retail sale-purchase without prior conclusion of any documents. At certain points, TN may well replace PM.

Shelf life of TORG-12

According to the requirements of the current acts of the Ministry of Finance of the Russian Federation, the storage period for TORG-12 consignment notes and invoices is 4 years after the end of the reporting tax period in which this primary document was last used. For example, if TN and S-F were “closed” (taken into account in VAT calculations) in the first quarter of 2017, therefore, their shelf life expires in April 2021. However, in the interests of accounting, the period for saving accounting documents is 5 years, so TORG-12 will have to be saved until April 1, 2022.

Innovations from July 1, 2017

In accordance with Order No. ММВ-7-15/329 of the Federal Tax Service of the Russian Federation, from July 1, 2017, all companies and individual entrepreneurs are allowed to draw up primary documents related to the movement of goods and materials in two ways (formats):

- paper : filling out TORG-12 in a Word form, put into effect on January 9, 2016 by order No. 551 of the Federal Tax Service of the Russian Federation dated November 31, 2015;

- electronic : provision on 1 sheet of an electronic version of the primary document along with an invoice in Excel format, put into effect on July 1, 2017 by Order No. 555 of the Federal Tax Service of the Russian Federation dated March 24, 2016.

At the same time, the use of “branded” - personally developed TORG-12 forms, which were applied by Order No. 172 of the Federal Tax Service of the Russian Federation dated March 21, 2102, is formally permitted until the end of 2020. Certified paper copies of such invoices, upon request, will need to be sent to the tax office inspection.

Features of filling TORG-12

The use of established forms of invoices requires compliance with certain filling rules. The preparation of a delivery note can be carried out both by accounting specialists and by storekeepers, sellers and other persons authorized to issue products. The paper version of the primary document must be drawn up in 2 copies, one of which is transferred to the recipient of the goods.

The number and date of the transaction are placed in the header of the UFTN. Here you also fill in the details of the company (IP) selling the goods: full name, address in TORG-12, contacts, current account and other information approved by the director (IP). The fields “Payer” and “Consignee in TORG-12” are formatted similarly. Next, the details of the supply agreement or other documents on the basis of which the current transaction is carried out are recorded.

After this, data on the goods sold is compiled, indicating the list, codes (articles), units of measurement, types of packaging, prices per item, VAT, etc. If the products are shipped in special packaging (containers), it is advisable to fill in the “Gross weight” fields. Sometimes attachments and supporting documents are listed at the end of the form.

The TORG-12 is completed with information about the persons who carry out and control the transaction. Their signatures are usually certified by the company seal.

Download the invoice

If you have not found the answer to your question or there are still misunderstandings, contact a lawyer for a free consultation in the chat on our website

| Consignment note TORG-12 standard form |  |  |

Bill of lading form (Bill of Lading)- used by enterprises that use vehicles to deliver products. This form was approved by Goskomstat Resolution No. 78 in 1997. TTN is the primary document. As a rule, it is issued electronically in order to automate this process as much as possible.

Features of the consignment note

TTN in form 1-t must be drawn up for each individual consignee, each trip. Thus, the driver, in the case of several points of shipment to different companies, will have a corresponding number of TTN.

This form implies four copies.

- the first for the shipper (on the basis of which he will write off inventory items);

- the second - for the consignee (on the basis of which he receives goods and materials);

- the third and fourth copies, with stamps and signatures of the cargo recipient, are intended for the transport company. (In turn, one of the copies of the TTN is intended for the driver’s transport sheet and accounting for transportation in his salary, and another one is for issuing an invoice to the payer who ordered the transportation)

Based on traffic rules, the driver-carrier is required to have a documentary basis for transporting goods. This basis is TTN. This is what must be presented when the car is stopped by a traffic police officer. Otherwise, the traffic police officer has the right to seize the cargo until the circumstances are clarified.

For non-commercial goods that are not included in the warehouse inventory records, a consignment note is also issued, but only in triplicate. Two of them are similarly intended for the transport company, and the third is for the shipper, to account for the volume of work performed on transportation.

Correct filling of the TTN implies the indication of all details, the presence of signatures (shipper and driver) and seals.

Upon receipt of the goods, the consignee signs three copies of the TTN, indicating the time of arrival of the vehicle.

In the TTN, the column “price list number” and “item by price list” are filled in only if the sending organization has numbered price lists. If there are none, this column need not be filled out.

TTN is not required if the agreement between the “seller” and the “buyer” did not provide for the delivery of goods. Arrival in such a situation is issued on the basis