Accounting policy for tax accounting purposes is a set of methods for determining the tax base, calculating and paying taxes - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity. An important element of the accounting policy is the section on value added tax. Of particular interest is the procedure for accounting for VAT in ambiguous situations.

Rules and exceptions

As a general rule, VAT amounts presented upon the acquisition (import) of goods (work, services), including fixed assets and intangible assets, are accepted for deduction. However, there are exceptions. Thus, in accordance with paragraph 2 of Article 170 of the Tax Code of the Russian Federation, VAT amounts are taken into account in the cost of goods (work, services) in the following cases:

- when using goods (work, services) in transactions that are not subject to taxation (exempt from taxation) in accordance with Article 149 of the Tax Code of the Russian Federation;

- when using goods (works, services) in operations the place of sale of which is not the territory of the Russian Federation (Articles 147, 148 of the Tax Code of the Russian Federation);

- in cases of acquisition of goods (work, services) by persons who are not VAT payers or are exempt from paying it in accordance with Article 145 of the Tax Code of the Russian Federation;

- when using goods (work, services) in transactions that are not subject to taxation on the basis of paragraph 2 of Article 146 of the Tax Code of the Russian Federation.

In addition, operations listed in paragraph 3 of Article 39 of the Tax Code of the Russian Federation (subclause 1, paragraph 2, Article 146 of the Tax Code of the Russian Federation) are not subject to VAT (are not recognized as sales).

Taxpayers should also pay attention: Article 167 of the Tax Code of the Russian Federation allows the taxpayer, in case of receipt of payment, partial payment on account of upcoming supplies of goods (performance of work, provision of services), the duration of the production cycle of which exceeds six months (according to the list determined by the Government of the Russian Federation), to accept the moment of determining the tax base as the day of shipment (transfer) of the specified goods (performance of work, provision of services). This right can be applied only if separate records are kept of transactions performed and tax amounts for purchased goods (works, services), including fixed assets, intangible assets, property rights used as part of a long production cycle and other operations.

Let us recall that according to paragraph 5 of Article 149 of the Tax Code of the Russian Federation, transactions that are not subject to taxation are divided into transactions:

- mandatory exemption from VAT (clauses 1, 2 of Article 149 of the Tax Code of the Russian Federation);

- benefits which the taxpayer can refuse (clause 3 of Article 149 of the Tax Code of the Russian Federation).

Please note: paragraph 4 of Article 149 of the Tax Code of the Russian Federation obliges taxpayers to keep separate records of transactions subject to VAT and exempt from taxation. In addition, taxpayers transferred to pay a single tax on imputed income for certain types of activities must also maintain separate accounting (paragraph 6, clause 4, article 170 of the Tax Code of the Russian Federation). In this case, the procedure for separate accounting should be reflected in the company's accounting policy.

Separate accounting

In all cases when a taxpayer, along with activities subject to VAT, carries out non-taxable transactions, he is obliged to keep separate records of them. According to paragraph 4 of Article 170 of the Tax Code of the Russian Federation, tax amounts presented by sellers of goods (works, services), property rights to such taxpayers:

- are taken into account in the cost of goods (work, services), property rights used to carry out transactions not subject to VAT;

- are accepted for deduction in accordance with Article 172 of the Tax Code of the Russian Federation for goods (work, services), property rights used to carry out transactions subject to VAT;

- are accepted for deduction or taken into account in the cost of goods in the proportion in which they are used for the production and (or) sale of goods (works, services), property rights, transactions for the sale of which are subject to taxation (exempt from taxation), - for goods (works , services), including fixed assets and intangible assets, property rights used for the implementation of both taxable and non-taxable (exempt from taxation), in the manner established by the accounting policy adopted by the taxpayer for tax purposes.

Specified proportion determined based on the cost of shipped goods (work, services), property rights, transactions for the sale of which are subject to taxation (exempt from taxation), in the total cost of goods (work, services), property rights reflected for taxable period .

It must be recalled that taxpayers who do not comply with the requirements for maintaining separate accounting are deprived of the right to deduct VAT amounts, as well as to include these amounts in expenses for the purpose of calculating income tax.

From the above it follows that the amount of “input” VAT must be distributed in proportion, the basis for which is the cost of shipped goods (work, services), property rights. The transfer of ownership in this case does not matter. The base should be calculated for the tax period in which property (work, services), property rights intended for taxable and non-taxable transactions were acquired.

Taxable period

Please note that the tax period for VAT is a quarter, which means that the basis for calculating the proportion can be determined only at the end of the quarter (letter of the Ministry of Finance of Russia dated November 12, 2008 No. 03-07-07/121, Federal Tax Service of Russia dated July 1. 2008 No. 3-1-11/150 and dated June 24, 2008 No. ShS-6-3/450@). This procedure should be followed even if a fixed asset or intangible asset used in transactions subject to or not subject to VAT is registered in the first month of the quarter and it is necessary to determine the amount of VAT that is included in the initial cost of this property.

The procedure for assigning VAT to the initial cost of property must be set out in the accounting policy of the enterprise. There may be different options for this (see Example 1).

Example 1

Collapse Show

Option 1. The basis for calculation at the time of registration of property is assumed to be equal to the data based on the results of the previous quarter. Then, at the end of the quarter, when the proportions of shipments for operations subject to and not subject to VAT are known, corrective operations are carried out.

Option 2. The basis for calculation at the time of registration of property is assumed to be equal to a certain average value. Then, based on the results of the quarter (tax period), corrective operations are carried out.

As noted above, the basis for calculating VAT amounts is the cost of goods (work, services) shipped and property rights. Example 2 shows options for calculation formulas for tax amounts to be deducted and included in the purchase price, which should be reflected in the Accounting Policy.

Example 2

Collapse Show

- VAT inc. = VAT total x SOP/OSP,

- VAT inc. - the amount of VAT on goods (works, services), property rights used in VAT-taxable and non-VAT-taxable transactions, which can be deducted;

- VAT total

- SOP - the cost of products subject to VAT, shipped during the period when goods (work, services), property rights were purchased;

- OSB

- VAT due = VAT total x SNP/OSP,

- VAT due - the amount of VAT on goods (works, services), property rights used in VAT-taxable and non-VAT-taxable transactions, included in their cost;

- VAT total - the total amount of VAT on goods (works, services), property rights for the tax period;

- SNP - the cost of products not subject to VAT, shipped during the period when goods (work, services), property rights were purchased;

- OSB - the total cost of products shipped during the tax period.

Five percent barrier

Organizations can avoid the need to maintain separate VAT accounting.

Thus, according to paragraph 9 of paragraph 4 of Article 170 of the Tax Code of the Russian Federation, the taxpayer has the right not to apply the provisions on separate accounting in those tax periods in which the share of total expenses for the production of goods (work, services), property rights, transactions for the sale of which are not subject to taxation, does not exceed 5% of the total value of total production costs (see Example 3). It should be remembered that the taxpayer must reflect this right in the Accounting Policy for tax accounting purposes. Otherwise, the inspection authorities will distribute the amount of “input” VAT based on the above proportion.

Example 3

Collapse Show

The amounts of interest on loans received by the taxpayer from the borrower and not subject to VAT are negligible compared to the amount of revenue subject to VAT. Costs under loan agreements are also significantly less than the amounts of costs attributable to turnover subject to VAT. Despite the obviousness of the accounting procedure in this case, the principle of determining the “five percent barrier” should be reflected in the Accounting Policy.

Officials believe that when calculating the maximum amount of expenses, both direct and general business costs should be taken into account (letter of the Ministry of Finance of Russia dated November 13, 2008 No. ШС-6-3/827@). In a letter dated May 27, 2009 No. 3-1-11/373@, the financial department clarifies that, according to paragraph 1 of Article 318 of the Tax Code of the Russian Federation, production and sales costs incurred during the reporting (tax) period are divided into direct and indirect. For profit tax purposes, general business expenses are included in indirect expenses.

In addition, expenses that reduce taxable profit must be economically justified, expressed in monetary form, documented, executed in accordance with the legislation of the Russian Federation and made for the purpose of carrying out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). Further, the Ministry of Finance concludes that general business expenses that meet all the above requirements are taken into account as a reduction in income, taking into account VAT in the share attributable to transactions not subject to this tax.

Based on the opinion of official bodies, the Accounting Policy for tax accounting purposes should establish the procedure (scheme) for VAT accounting (see Example 4).

Example 4

Collapse Show

Stage 1. Dividing direct costs into costs related to taxable and non-taxable transactions. This can be done by introducing special sub-accounts or using accounting registers. For example, to account 20 “Main production” it is advisable to enter subaccounts “Expenses for the production of taxable products”, “Expenses for the production of non-taxable products”, “Expenses for the production of taxable and non-taxable products”. Similarly, you can keep separate records of materials, goods, as well as “input” VAT.

Stage 2. Determination of criteria for attributing general business expenses to operations subject to and not subject to VAT. At the same time, specific costs are identified, which, according to one or another criteria, only fall on operations that are not subject to VAT.

Let’s say that if a taxpayer, along with taxable transactions, carries out transactions with bills of exchange, then it is possible to establish a list of costs attributable to the latter:

- part of the salary (including personal income tax and insurance contributions) of an accountant (lawyer, manager), based on the proportion of time spent on transactions with bills of exchange;

- the share of depreciation of the equipment on which the accountant works, determined on a similar principle;

- the amount of expenses for telephone, heating, lighting, etc., attributable to non-taxable transactions, can be established based on the criterion of the area occupied by the accountant, etc.

Stage 3. Determination of the amount of total expenses (direct and indirect) for the production of goods (works, services), property rights, transactions for the sale of which are not subject to taxation.

Stage 4. Determination of the percentage of costs attributable to operations not subject to VAT to the total amount of total costs. If this share is less than or equal to 5%, then the taxpayer may not maintain separate accounting (this procedure must be specified in the Accounting Policy).

We are left to discuss the last question regarding separate accounting - does the separate accounting methodology need to be enshrined in the accounting policy? Tax authorities insist that this is necessary. This is exactly the point of view that was expressed by the Moscow Directorate in 2007 in Letter No. 19-11/028237 and duplicated in 2010. Otherwise, you will be denied a deduction for general expenses.

If separate accounting is not maintained (Letter of the Ministry of Finance of Russia dated January 11, 2007 N 03-07-15/02):

VAT is not accepted for deduction and is not included in expenses taken into account when taxing profits only on those resources that are used for both taxable and non-taxable transactions;

VAT is accepted for deduction on resources used exclusively for operations subject to VAT.

At the same time, the courts believe that if the taxpayer applies the provisions of paragraph 4 of Article 170 literally, there is no need to rewrite them into the accounting policy. And the actual maintenance of separate accounting can be confirmed by any means: primary documents, accounting registers, documents independently developed for separate accounting. This is stated in the Decrees of the FAS of the East Siberian District dated January 20, 2011 N A58-2951/10 and the FAS of the Ural District dated December 7, 2010 N F09-9755/10-C2.

However, it is necessary to consolidate in the accounting policy the accepted methodology for determining the 5 percent barrier to non-taxable expenses in general expenses.

This very threshold 5 percent can be determined by simply separating from the costs recorded on account 26 those that are directly related to non-VAT-taxable transactions. That is, compiling a list of specific expenses with the corresponding amounts.

The most radical way is to prove that:

Either there are no expenses associated with VAT-free transactions at all, that is, they are equal to 0;

Or all general business expenses are not “production expenses” at all, since in accounting they are transferred from the credit of account 26 - bypassing the debit of account 20 - immediately to the debit of account 90. Then the “five percent” rule applies only to direct expenses.

Also, the accounting policy should describe the methodology for distributing input VAT between different implementations:

Domestic, taxed at tax rates of 10 and 18 percent;

Domestic and export, taxed at a tax rate of 0 percent.

The Moscow Federal Tax Service in one of its letters justifies this by the fact that the procedure for applying tax deductions for domestic and export transactions differs. This means that it is impossible to do without separate VAT accounting for purchased goods, works, and services. Moreover, the separate accounting methodology should provide the possibility of calculating the part of VAT attributable to resources used for export, based on accounting data and objective criteria chosen by the taxpayer.

Despite the fact that Chapter 21 of the Tax Code in relation to exports does not talk about separate accounting, tax authorities and courts also call it separate. Although it would be more correct to talk about separate, or separate, accounting.

I would like to draw your attention to the very interesting Definition of VAS N 7105/08. It formulates approaches to the formation of provisions for “export” accounting policies. So, acquired resources are divided according to the Tax Code into groups for which VAT amounts should be recorded:

Group 1 - the cost of resources is attributed directly to the cost of those products that are used for operations taxed at a rate of 18 percent;

Group 2 - the cost of resources is attributed directly to the cost of those products that are used for operations taxed at a rate of 0 percent;

Group 3 - the cost of resources is attributed directly to the cost of those products that are used for operations that are not subject to taxation;

Group 4 - the cost of resources cannot be fully attributed directly to the cost of products from the first three groups.

And precisely because the resources of the last group cannot be completely attributed to any operations, the VAT charged on them cannot be distributed otherwise than on the basis of accounting policies. And depending on the specifics of the organization’s activities, it should describe the rules for allocating and limiting resources. And the proportion provided for in paragraph 4 of Article 170 will be applied to this group.

This is what the accounting policy of an exporting taxpayer might look like. I borrowed it from the Resolution of the Federal Antimonopoly Service of the Volga Region dated 07/09/2009 N A57-5373/2008 and creatively reworked it, removing the specifics so that this accounting policy would suit the largest possible number of organizations.

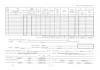

┌────────────────────────────────────────────────────────────────┐

│ Accounting policy for VAT purposes

│Costs are divided into the following groups.

│1 Costs directly attributable to export operations:

│1.1. Agent remuneration

│1.2. Transport costs for exported goods

│1.3. Bank commissions for foreign exchange transactions

│1.4. Customs broker remuneration

│1.5. Customs clearance costs

│2. Costs related to the sale of products in general:

│2.1. Costs of goods and materials and services included in the cost

│products

│2.2. Telephone and Internet costs

│3. Costs not related to export operations:

│3.1. Administrative and management expenses, namely:

│3.1.1. Rental and leasing payments

│3.1.2. Consulting and information services

│3.1.3. Subscription to periodicals

│3.1.4. Costs of maintaining the register of shareholders

│3.2. Costs that, in the opinion of the tax authority, cannot be

│be classified as export operations, namely:

│3.2.1. Product storage costs

│3.2.2. Loading and unloading costs

│3.2.5. Waste disposal costs

│3.3. Costs of maintaining and maintaining facilities

│unfinished construction

│3.4. Costs of natural resource development

│Depending on the allocation of costs to one or another group of amounts

│VAT claimed on them are distributed according to the corresponding

│subaccounts of balance sheet account 19 and are presented for deduction in

│in accordance with current legislation.

└────────────────────────────────────────────────────────────────┘

In conclusion, I would like to remind exporters that:

If a taxpayer exports goods listed in Article 149 of the Tax Code of the Russian Federation, then he does not have the right to tax deductions. VAT must be included in the cost of goods. This was stated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 14, 2004 N 8870/04;

Input VAT can also be deducted if the zero tax rate is not confirmed. This issue is addressed by Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 23, 2007 N 1238/07.

Condition 4: registration

The fact that deductions are possible only for goods accepted for registration is established by paragraph 1 of Article 172 of the Tax Code of the Russian Federation.

Let's look at what "registration" actually means. Arbitration courts have repeatedly stated that this is the acceptance of resources for accounting purposes. Moreover, it does not matter which account the purchased resource will be reflected in. The fact of acceptance for accounting in accordance with accounting rules is important.

When I talk about this condition, I am most often asked the question of what is considered the acceptance of a fixed asset for accounting: its reflection on account 08 “Investments in non-current assets” or 01 “Fixed assets”. I repeat: it doesn't matter. After all, the Tax Code does not contain any requirements in this regard. An example of this approach is the Resolutions of the Federal Antimonopoly Service of the Moscow District N KA-A40/978-10 and the West Siberian District N F04-3674/2009(9190-A67-25).

Here I would like to recall the famous saying of Thomas Hobbes: “If geometric axioms affected the interests of people, they would be refuted.” It was with these words that Lenin began his article “Marxism and Revisionism,” although he forgot to name its author.

Thomas Hobbes (04/05/1588 - 12/04/1679) - English materialist philosopher, author of the theory of social contract.

Considering that the norms of the Tax Code of the Russian Federation affect the interests of taxpayers and the budget, attempts are being made to refute many accounting axioms.

Thus, the Ministry of Finance disputes the acceptance for accounting of materials in transit, the ownership of which, according to the terms of the contract, passed to the buyer at the time of shipment. I'm talking about Letter N 03-07-11/318.

And once upon a time the courts agreed with this, for example, the FAS of the Volga District in 2007 in Resolution N A57-14388/06. The court then noted that PBU 5/01 uses the term “date of acceptance for accounting,” but it is not linked to the moment of transfer of ownership of the goods. To accept assets for accounting, the primary step is to establish control over them. If they have not yet arrived at the organization's warehouse, it does not control them. In this case, only receivables are taken into account, and not goods. Therefore, the court decided that it was impossible to take into account in May 2006 goods that arrived at the warehouse only in June. This means that tax deductions for these goods cannot be claimed until June.

When considering this case, the court ignored paragraph 26 of PBU 5/01. According to it, inventories that belong to the organization, but are in transit, are reflected in accounting. In this case, goods are accepted for registration at the moment of transfer of ownership of them from the seller to the buyer. And this moment is regulated in the purchase and sale agreement; this moment may also be the date of transfer of goods by the supplier to the carrier. And therefore, the deduction can be claimed by the buyer in the period in which the seller handed over the goods to the carrier.

It was this logic that the courts were guided by when making decisions in favor of taxpayers. Here are the details of several of them: Resolutions of the Federal Antimonopoly Service of the Ural District dated 06/03/2009 N F09-3493/09-С2, East Siberian District dated 02/10/2009 N A33-11818/07-F02-152/09, Northwestern District dated 01.11 .2010 N A52-3413/2009. In the last few years I have not come across any contrary solutions. But you and I must be aware that although a deduction can be claimed before actually receiving the goods, a dispute with the tax authority is very likely. Therefore, it is advisable to establish in the accounting policy that the moment of registration of purchased goods is the transfer of ownership rights to them. This helped taxpayers defend their position in the Resolutions of the Federal Antimonopoly Service of the West Siberian District dated March 25, 2010 N A27-13864/2009 and dated October 4, 2010 N A27-975/2010.

By the way, the Federal Antimonopoly Service of the North-Western District, in Resolution N A56-3220/2008, states that the posting of purchased goods on account 90 “Sales” and not on account 41 “Goods” is not an obstacle to tax deduction. Of course, if there are primary documents confirming their registration. That is, even a taxpayer’s violation of accounting rules cannot be a reason for refusing a deduction.

In recent years, problems have also arisen with tax deductions for investors who are also customers-developers for capital construction work, which traditionally, on the basis of standard unified forms KS-2 and KS-3, are reflected in the debit of account 08 “Investments in non-current assets”.

According to the tax authorities, the taxpayer does not have the right to deduct VAT on work registered on the basis of monthly acts of acceptance of work performed in Form N KS-2, but has the right to do this only after the customer has accepted the result of the work performed in full in accordance with the contracts.

But arbitration practice supports taxpayers. A striking example is the Resolution of the Federal Antimonopoly Service of the Moscow District dated 04/07/2011 N KA-A40/2227-11. In it, the court confirmed the legality of accounting for capital construction work on account 08 “Investments in non-current assets”. And the inspectorate’s argument that the signing of acts in the KS-2 form does not mean acceptance of the work by the customer, but is accepted as a breakdown of the volume of work performed for preliminary settlements with contractors, was considered unfounded. After all, the accounting rules establish the obligation to record all business transactions that have taken place, while a unified form KS-2 has been established to formalize the acceptance of work performed.

In other words, an organization that is both a customer-developer and an investor has the right to accept VAT as a deduction for work performed by a contractor, subject to the general conditions of Articles 171 and 172 of the Tax Code of the Russian Federation, without waiting for the readiness of the facility as a whole.

Question. What primary documents confirm registration?

According to Article 9 of the Accounting Law, all business transactions must be documented in primary documents of standard unified forms approved by the State Statistics Committee of Russia.

Tax authorities insist on strict adherence to these standard forms. A favorite pastime of tax officials is refusing a tax deduction if:

The buyer has in his hands an act or invoice for goods of an unspecified form, and not an invoice in the TORG-12 form;

The seller of goods, instead of the TORG-12 form, filled out and submitted the M-15 form, intended not for the sale of goods, but for the release of materials to the outside;

There were errors or omissions in the design of the standard form TORG-12;

The buyer of the goods did not properly document the registration at his warehouse (for goods - this is the TORG-1 form, for materials - M-4).

Yes, taxpayers win all such disputes in the courts. However, I think that it is still easier to ensure the proper level of documentation of business transactions than to waste time on legal proceedings.

Question. Tell me, does taking property off-balance sheet also give you the right to a deduction?

Indeed, the term “registration” does not always imply the transfer of ownership of the goods and its acceptance into the balance sheet account.

For example, the lessee reflects the leased property in off-balance sheet account 001 “Leased fixed assets”. But this does not interfere with the deduction of import VAT on imported leased property. If, of course, it is used in transactions subject to VAT. After all, off-balance sheet accounting is also accounting. This is precisely the point of view that prevails in the courts. You can verify this by reading, for example, Resolution of the Federal Antimonopoly Service of the Moscow District N KA-A41/1065-09 or N KA-A40/6992-08.

By the way, acceptance for off-balance sheet accounting by the debit of account 002 “Inventory assets accepted for safekeeping” is also “acceptance for registration,” which gives the right to a tax deduction. The FAS of the East Siberian District came to a similar conclusion in Resolution No. A19-2776/08-57-F02-5451/08 dated November 6, 2008.

If a company has operations that are taxable and non-taxable with added tax, VAT should be accounted for separately, as required by the fourth paragraph of Article 149. Tax Code of the Russian Federation. The nuances and procedure for performing such accounting should be specified in the accounting policy.

The company can use its acquisitions both in activities subject to added tax and in operations that are exempt from this. In the first case, VAT can be reimbursed from the budget; in the second case, it is included in the cost of acquisitions. If receipts (inventory, fixed assets, intangible assets, services, works) are involved in both types of transactions, then it is necessary to allocate the share of VAT corresponding to non-taxable and taxable transactions.

Since input added tax must be taken into account differently for taxable and non-taxable activities and operations, there is an obligation to create separate accounting.

Accounting policy for separate VAT accounting

The procedure and features of separate VAT accounting are included in the accounting policy; a separate section is devoted to this, which sets out the following points:

- Will it apply "5% rule", which eliminates the obligation to share “input” VAT with a small share of expenses for non-taxable transactions (within 5% of total expenses);

- Will sub-accounts be opened on account 19 in order to separate VAT on various transactions;

- How will VAT be divided on fixed assets and intangible assets purchased in the first or second month of the quarter, which will take part in both taxable and non-taxable activities (by dividing revenue calculated for the month when the object was purchased, or calculated for the quarter in which was received).

In what cases is separate accounting required?

The obligation to maintain such records arises if the company conducts activities to which VAT rates of 10 or 18% are applied, and at the same time carries out some transactions that do not require taxation due to:

- Compliance with Article 149 of the Tax Code of the Russian Federation;

- Falling under UTII;

- Implementation outside the Russian Federation;

- Classification as export.

If the part of expenses corresponding to non-taxable transactions does not exceed 5% of the total amount of expenses, then it is allowed not to take into account VAT on receipts separately from the rest of the tax. However, there is a need to separately account for the costs themselves for various operations.

The need to maintain such records also disappears in the case where the company, along with taxable activities, also receives income that does not correspond to sales and does not require the accrual of added tax. In the situation under consideration, we mean such income as dividends, interest received, and penalties under contracts.

Features of organizing separate accounting

Accounting should be formed in such a way that the tax charged on those proceeds that are used in taxable and non-taxable transactions is taken into account separately.

In this regard, it is most convenient to open additional subaccounts account 19, which will reflect VAT on various objects.

You can open sub-accounts for the following purposes;

- Subaccount O– this will include a tax on revenues used in taxable activities; this can also include a tax on objects for which it is impossible to determine in advance what operations they will participate in. The amount reflected in the debit of this subaccount can be sent for reimbursement to account 68;

- Subaccount N– VAT is allocated here for those objects that do not take part in taxable activities; the amount of tax collected on the debit of this sub-account must be included in the cost;

- Subaccount O/N– here tax will be collected on those objects that are used in taxable and non-taxable activities, the amount collected in this sub-account will need to be divided into 2 parts in proportion to the actual expenses incurred between various operations (part of this tax will be deducted, part will be attributed to expenses );

- Subaccount O/N-OS– fixed assets and intangible assets that are planned to be used in various types of activities should be separately identified. Moreover, it is necessary to separate the data in this subaccount for each received non-current object.

If the objects for which the added tax was recorded in subaccount O were subsequently used in non-taxable transactions, then the VAT on them should be written off as company expenses.

Algorithms for calculating VAT for separate accounting

Division of VAT on the O/N subaccount

Based on the VAT collected in the O/N subaccount, the portion of the added tax that falls on taxable transactions should be calculated and sent for deduction. The balance on this subaccount is included in the cost of receipts. This division must be performed at the end of the quarter.

To allocate a portion of taxes for taxable activities, you need to calculate the revenue for the quarter received from activities with VAT.

You should use the formula:

Share of revenue = (revenue + other income from taxable activities) / (revenue + other income from all operations) * 100%.

The amounts in this formula are based on the results of the quarter; VAT is not taken into account in these amounts.

The following formula is used for this:

VAT = balance of the 19th account * share of revenue from taxable transactions.

The resulting tax value can be sent for reimbursement. The remaining portion of the tax in this subaccount is written off as expenses to account 26 or 25 for manufacturing companies or to account 44 for trading companies.

Division of VAT on the O/N-OS subaccount

VAT on fixed assets and intangible assets is accounted for separately, since for each such asset the share of tax to be reimbursed or attributed to expenses can be calculated differently.

First way:

- The total revenue for the month in which the asset was received is calculated;

- The part of the proceeds corresponding to the taxable activity is considered;

- The part of the VAT corresponding to the revenue received in clause 2 is calculated by multiplying the total amount of the “input” tax by the share of the revenue from clause 2;

- The tax received in paragraph 3 should be sent for reimbursement at the end of the month;

- The remaining part of the VAT relates to the cost of the asset (included in expenses).

The second method is similar to the first, but all parameters are calculated based on the results of the quarter in which the asset was purchased.

5 percent rule

Clause 4, Article 170 of the Tax Code of the Russian Federation allows companies not to apply division in accounting if the following inequality is satisfied:

Expenses for non-taxable transactions / total expenses * 100%< 5%.

In this case, the calculation is carried out based on the results of the quarter. If the company, having carried out the calculation according to the specified formula, finds out that this rule can be used, then the entire tax recorded in the debit of the 19th account on the last day of the quarter can be sent for reimbursement.

Example of separate accounting

The company sold:

- Goods worth 100,000 rubles, the sale of which is not taxed;

- Goods worth 150,000 rubles, the sale of which is subject to VAT;

- The total amount of sales is 250,000 rubles.

- The amount of input tax = 160,000 rubles.

VAT deductible = 150,000 / 250,000 * 160,000 = 96,000 rubles.

VAT charged to expenses = 100,000 / 250,000 * 160,000 = 64,000 rubles.

Postings:

Separate VAT accounting for exports

The simultaneous implementation of transactions in the domestic and foreign markets is the reason for organizing separate accounting of input added tax. This need is explained by the fact that VAT on exports is accepted for reimbursement in a special way.

The peculiarity is the following: export transactions are not exempt from VAT, they are subject to taxation at a rate of 0%, which allows the input tax on them to be reimbursed. However, the moment when the added input tax can be sent to the 68th account for reimbursement corresponds to the moment the tax base is determined - the day the documentation is submitted justifying the possibility of using a 0% rate.

VAT is deducted on the day when documents are submitted to the tax office, indicating the legality of applying this rate. Supporting documentation must be submitted along with the declaration, for which specific filing deadlines are established - no later than the twenty-fifth day of the month following the reporting quarter. In this case, the day for determining the base is recognized as the last day of the quarter for which the declaration is submitted.

The legislation of the Russian Federation stipulates a period of 180 days during which documents must be collected and provided, otherwise the exporting company loses the right to a 0 rate and will have to calculate VAT at the rate corresponding to the type of goods exported (10 or 18 percent).

The different VAT refund mechanism requires separate accounting of input tax on export and other transactions.

The company determines independently how the accounting for the added tax will be organized, consolidating the accepted norms in its accounting policies. The legislation does not provide any recommendations or advice, but the chosen method must clearly distribute the claimed VAT among objects used in domestic operations and those intended for export.

When forming an accounting policy for tax accounting, a special place is occupied by the accounting policy for VAT. Let's take a closer look:

- where and how the VAT accounting policy is set in 1C;

- how to set settings for organizations exempt from VAT;

- how to launch a separate accounting mechanism;

- how to set up shipment without transfer of ownership;

- What options exist for registering advance invoices in 1C?

VAT accounting policy

The VAT accounting policy is set on the tab VAT In chapter Main – Settings – Taxes and reports – VAT tab.

This tab is available for editing only if Tax system organizations- General.

In the VAT accounting policy settings, you need to define:

- Is an organization exempt from paying VAT in accordance with Art. 145 (145.1) Tax Code of the Russian Federation;

- Is there separate accounting of incoming VAT?

- is it necessary to charge VAT at the time of shipment, without waiting for the transfer of ownership;

- procedure for registering invoices for advance payments.

Let's figure out how to set this or that setting in 1C, what it affects, and how it will be reflected in the program.

Exemption from VAT

If an organization falls under exemption from VAT under Art. 145 of the Tax Code of the Russian Federation or 145.1 of the Tax Code of the Russian Federation, then you must check the box The organization is exempt from VAT .

If this checkbox is enabled, then when registering sales documents the following is automatically set:

- % VAT – Without VAT.

Separate accounting of incoming VAT

To be able to maintain separate accounting of incoming VAT in the program, you must check the box Separate accounting of incoming VAT is maintained .

Separate accounting must be maintained if in the tax period there is both income (sales) subject to VAT (18% or 10%) and non-taxable transactions:

- not recognized as an object of taxation (Article 146 of the Tax Code of the Russian Federation);

- not subject to taxation (Article 149 of the Tax Code of the Russian Federation);

- the place of implementation of which is not recognized by the Russian Federation (Article 148 of the Tax Code of the Russian Federation).

Separate accounting of incoming VAT must also be maintained when an organization sells raw materials for export (paragraph 2, clause 10, article 165 of the Tax Code of the Russian Federation).

Checking this box starts the “old” mechanism of maintaining separate accounting on VAT accumulation registers in 1C. Accounting for incoming VAT for distribution is carried out in the accumulation register VAT on indirect expenses .

The distribution of incoming VAT will be made when document VAT Allocation.

When checking the second checkbox Separate VAT accounting by accounting methods a “new” method of separate accounting of incoming VAT is included. It consists in the fact that the accounting of incoming VAT for distribution is not carried out in the accumulation register VAT on indirect expenses , and on the additional subconto VAT accounting method to account 19 “VAT on acquired values”. When the checkbox is enabled, this third sub-account appears in the 1C chart of accounts, which is required to be filled out in receipt documents.

Subconto VAT accounting methods can take the following values:

- Accepted for deduction- for transactions subject to VAT: input VAT will be deducted in the general manner.

- Included in the price- for transactions not subject to VAT: input VAT will be taken into account in the price.

- Blocked until confirmation 0%- for transactions subject to VAT at a rate of 0%, except for the export of non-commodity goods: input VAT will be deducted upon confirmation of the rate of 0%.

- Distributed- for general operations will be distributed. In this case, the input VAT must be distributed, since it is presented on acquisitions that will simultaneously be used in the activity:

- subject to VAT at the rate of 18% (10%),

- or subject to VAT at a rate of 0% (commodities),

- or non-taxable (without VAT).

As a rule, these are general purchases, for example, office rent.

Shipment without transfer of ownership

The need to charge VAT at the time of shipment, and not at the time of transfer of ownership, is set using the checkbox VAT is charged on shipment without transfer of ownership .

If the checkbox is checked, then VAT is charged at the time of shipment of goods and materials to document Sales (deed, invoice) type of operation Shipment without transfer of ownership.

When posting a document for shipment of goods and materials without transfer of ownership, VAT will be charged, and revenue from accounting and accounting records will not be recognized, since it is determined at the moment of transfer of ownership.

Subsequently, the transfer of ownership is formalized using document Sales of shipped goods.

When it is carried out, VAT will not be accrued, since it was calculated at the time of shipment, but revenue will be recognized according to accounting and accounting records.

Learn more with examples:

- Shipment of goods without transfer of ownership

- Sales of goods transfer of ownership

- Sale of real estate (transfer of ownership after state registration)

Procedure for registering invoices for advance payments

Upon receipt of an advance payment, the seller must calculate VAT on the day the advance payment is received (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation). The tax base will be the amount received as an advance, and VAT is calculated at calculated rates of 10/110 or 18/118 - this depends on the object being sold (clause 4 of Article 164 of the Tax Code of the Russian Federation).

Let's look at what options for issuing invoices can be installed in the program:

- Always register invoices upon receipt of an advance.

Advance invoices will be created for all received advance payment amounts except those that were offset on the same day.

- Do not register invoices for advances offset within 5 calendar days.

Invoices for advances will be created only for those prepayment amounts that have not been credited within 5 calendar days after their receipt.

Is it necessary to prepare an advance invoice if the shipment occurred within 5 days after receiving the advance payment? What do tax authorities think about this?

- Do not register invoices for advances credited before the end of the month.

Advance invoices will only be generated for advance payment amounts outstanding during the month in which they are received.

- Do not register invoices for advances offset until the end of the tax period.

Advance invoices will only be generated for prepayment amounts not offset during the tax period (quarter) in which they were received.

- Do not register invoices for advances(clause 13 of article 167 of the Tax Code of the Russian Federation).

This option is intended for organizations whose activities fall under clause 13 of Art. 167 Tax Code of the Russian Federation.

Value added tax is not an absolute charge. A number of business activities are subject to it, while others are exempt from VAT. An organization can do both at the same time. There are also frequent cases when a company has several tax regimes in effect simultaneously, for example, general and UTII, general and patent.

In such cases, accounting and financial records for such types of activities or tax systems must be maintained separately. The main thing is to choose the optimal method for this. Let's consider the principles of maintaining separate accounting for value added tax.

If you don't keep separate records

Separate accounting for VAT is mandatory for a company in the following cases:

- in the parallel conduct of taxable and non-taxable activities;

- when using two tax regimes at once;

- when providing services of both a commercial nature and those whose prices are regulated by the state;

- when working under government contracts;

- when combining commercial and non-commercial activities.

ATTENTION! The first case also includes accounting for “input” VAT for goods (works, services) purchased within the framework of different types of activities (taxable and non-taxable). This applies not only to objects, but also to intangible assets (paragraph 5, paragraph 4, article 170 of the Tax Code of the Russian Federation).

If an economic entity does not introduce separate accounting in these cases, it loses the rights to:

- VAT deductions;

- reduction of the income tax base by the amount of VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation);

- tax benefits (clause 4 of article 149 of the Tax Code of the Russian Federation).

Exceptions: when there is no need to separate accounting

It is better for an entrepreneur to know when keeping separate records makes no practical sense, because without the need to increase the labor costs of the accounting department, it is unprofitable.

There are certain legally established situations in which separate accounting may not be maintained even if the above conditions are met. Among them is conducting trade outside the Russian Federation (a domestic organization operates territorially in another state). In this case, the services provided or goods sold are not the basis for calculating VAT.

IMPORTANT! In this case, reporting is carried out in accordance with the requirements of domestic legislation, however, it is recommended that the contract additionally indicate the place of sale of goods or provision of services (to reduce the likelihood of complications during inspections).

However, if an enterprise wants to keep separate records in cases where this is not provided for by law, no one will have anything against it. The purpose of such accounting can be not only purely commercial (providing VAT for deduction), but also informational, for example, detailing management data. Separate accounting in such situations is a voluntary right of any organization.

5% threshold

This is another rule that justifies the optional division of input VAT. It is justified in paragraph 9 of paragraph 4 of Art. 170 Tax Code of the Russian Federation. This rule can only be applied by those who have VAT benefits that are timely (quarterly) confirmed.

The 5% rule says: Input VAT may not be taken into account separately if the costs of operations supported by benefits do not exceed 5% of general production costs. In this case, it is allowed to deduct the entire input VAT without including it in the cost of goods, works, and services.

ATTENTION! The 5% rule does not apply to separate accounting of income - it is mandatory to maintain it under appropriate conditions.

If an enterprise conducts only non-taxable transactions and purchases goods (work or services) from another party, the 5% rule is not applicable for this situation: VAT cannot be deducted on these acquisitions (Decision of the Supreme Court of the Russian Federation dated October 12, 2016 No. 305-KG16- 9537 in case No. A40-65178/2015).

For a long time, the application of the 5% rule for UTII payers was controversial - the Ministry of Finance of the Russian Federation in a letter dated July 8, 2005 No. 03-04-11/143 and the Federal Tax Service in a letter dated May 31, 2005 No. 03-1-03/897/8@ approved that the 5% threshold does not apply to this tax regime. But the judicial precedent put an end to this issue, and the Federal Tax Service changed its position, reflecting this in letter dated February 17, 2010 No. 3-1-11/117@).

5% threshold in trading activities

The above rule speaks primarily about production costs. But a considerable proportion of organizations and entrepreneurs are not manufacturers, but taxpayers-merchants conducting trading activities. Will this rule be valid for trade?

The Ministry of Finance of the Russian Federation, in a letter dated January 29, 2008 No. 03-07-11/37, allowed the 5% threshold to be extended to trade operations, but did not definitely establish this, but only indicated this possibility.

Meanwhile, there are arbitration precedents establishing the refusal of separate accounting due to the “5% rule” for trading activities. The reason is simple: trade, be it wholesale or retail, is not production; “production” accounts are not used to reflect its operations in accounting.

Accuracy of accounting policies for VAT accounting

The organization is authorized to choose the system for introducing separate accounting. Naturally, the adopted standards should be recorded in the accounting policy (clause 2 of article 11 of the Tax Code of the Russian Federation).

But there may be some incidents that should be taken into account related to VAT benefits and the 5% rule. It is not known exactly how costs will be distributed across activities. This will only be clear based on the results of the quarter. What if the 5% threshold is exceeded and separate accounting was not maintained? You will have to restore it, and in some cases also adjust tax returns, which is expensive and inconvenient. Therefore, you need to make a decision whether to stipulate this norm in the accounting policy or not, and if not, then not to use it, even if such a threshold does arise.

Accounting policies are established for a one-year period. But what if an organization has VAT-free activities after it has been submitted to the tax authorities? Give up the opportunity to save money by avoiding separate accounting? No, it can be formulated and provided addition to accounting policy: this will not be considered a change in it, because such transactions arose for the first time, and at the beginning of the reporting period they were not provided for (clause 16 of PBU 1/98 “Accounting policies of the organization”, approved by order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n) .

FOR YOUR INFORMATION! The accounting policy should list the types of activities that the organization is engaged in: separately - taxable and non-taxable VAT.

Accounts for separate accounting

Information about the processes of accounting for income/expenses including VAT must be displayed on different accounting accounts, namely:

- According to PBU, income from transactions not subject to VAT must be taken into account in accounts 90.01. “Revenue” and 91.01 “Other income”;

- Input VAT for transactions subject to VAT should be reflected in account 19 “Value added tax on acquired assets.”

Calculation of proportions when maintaining separate accounting

Under proportion This refers to the determination of the share of input VAT that falls on taxable and non-taxable transactions. It must be calculated to determine what share of VAT (as a percentage) can be deducted. Expenses need to be grouped:

- expenses for activities subject to VAT;

- expenses for non-VAT-taxable transactions;

- other costs that are difficult to unambiguously attribute to the first or second group.

Formula for calculating the proportion of VAT on taxable transactions:

Far East Region = (In Region_VAT + Dpr Region_VAT / In_VAT + Dpr_VAT) x 100%, Where:

- Far East Region– share of revenue from taxable transactions for the accounting period;

- In the region _VAT– revenue from taxable sales excluding VAT;

- DPR Region _VAT– other income from taxable transactions excluding VAT;

- V_VAT– total sales revenue excluding VAT;

- DPR_VAT– other income excluding VAT for all transactions.

All indicators are taken into account without VAT so that the cost of non-taxable transactions is comparable to preferential ones.

NOTE! The accounting period for VAT is a quarter, which means that the proportion must be calculated quarterly.

To calculate the share of non-VAT-taxable transactions, the same principle of proportion is applied, only the ratio of revenue from non-VAT-taxable transactions to the total amount for the accounting period is sought.

The third group, mixed, is not required to be distributed for separate accounting purposes. It’s easier to attribute it all to either the first or second operations.

What if there is temporarily no income?

In practice, sometimes there are certain periods when the company does not conduct business operations that generate income, while expenses are still incurred. This is often observed, for example, among newly registered organizations. It happens that among expenses transactions there are both VAT taxable and preferential ones. Is it necessary to divide such expenses in accounting? After all, there was no actual sale of goods and services.

Until 2015, the Ministry of Finance of the Russian Federation allowed in such cases to neglect separate accounting due to the lack of transactions with VAT benefits. However, in 2015, he voiced a different position regulating separate VAT accounting in such “non-shipment” periods.

Borrowing operations and separate accounting

Providing loans, selling securities and other similar transactions are subject to VAT. A significant nuance in calculating the proportion for such operations is the indicator of income amounts, which is key in the formula. For operations of one type or another, it will have a different composition, which is influenced by the current provisions of federal legislation. Federal Law No. 420 of December 28, 2013 proposes that for transactions with securities not subject to VAT, the following amount should be considered income:

D = C r – R pr, Where:

- D – tax-free income;

- Ts r – selling price of securities (according to the provisions of Article 280 of the Tax Code of the Russian Federation);

- R pr – expenses for the acquisition of these securities (and/or sale).

If the difference is less than 0 (that is, there will be a loss), then the income is not taken into account.

Proportional calculation method to separate taxable and non-taxable transactions in this situation, it involves calculating the ratio between the cost of all goods sold (both in Russia and abroad) and the item of interest. The amount of income will also include:

- the entity's revenue;

- the cost of its fixed assets;

- his non-operating income.

Currently, there is no consensus on the need to maintain separate accounting for borrowing transactions. However, the Ministry of Finance of the Russian Federation is increasingly inclined to this position due to the introduction of significant changes to the Tax Code of the Russian Federation.

Posting input VAT on preferential activities

In accounting, input VAT will be reflected in account 19 (different subaccounts are used for different transactions). This is what the wiring will look like:

- debit 41 “Goods”, credit 60 “Settlements with suppliers and contractors” - reflection of the receipt of goods from the supplier excluding VAT;

- debit 19 “VAT on acquired values”, credit 60 - allocation of VAT, which can subsequently be deducted;

- debit 68 “Calculations for taxes and fees”, credit 19 - acceptance of input VAT for deduction;

- debit 41, credit 19 - reflection of VAT for non-taxable transactions and included in the cost of the purchased product (service, work).

Depending on the type of activity of the company, you need to use along with account 41 “Goods” and other accounts - 10 “Materials”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses”, 29 “Service production and facilities” and other.

Cost comparison example

The company produces children's shoes, including medical orthopedic boots, the sale of which is exempt from taxation. The accounting records reflect direct costs for the production of autumn boots on account 20 “Direct expenses” - on the sub-account “Boots” and “Orthopedists”. During the reporting quarter, direct production expenses of the enterprise amounted to RUB 9,000,000. (of which 600,000 for boots and 200,000 for orthopedic shoes), general business expenses were also incurred - 4,000,000 rubles, and general production expenses - 3,000,000 rubles.

Let's calculate the cost ratio to determine whether this case falls under the 5% rule. 600,000 / (9,000,000 + 4,000,000 + 3,000,000) x 100% = 3.7%. Since the threshold turned out to be less than the coveted 5%, the accounting department may not keep separate records for input VAT, presenting for deduction the entire amount of value added tax billed by suppliers.

But in the tax return you will need to reflect the direct cost of production with tax benefits - 200,000 rubles.

Checking the correct distribution of expenses

In modern practice, accounting calculations are carried out using special software. The calculation of the proportion for separate accounting is also automated. To check the final data, it is convenient to create special tables from which the entire calculation will be visible: separately for transactions subject to VAT and for non-taxable ones. The table will summarize the main indicators used to calculate the proportion:

- acquisition/sale expenses – transactions not subject to taxation (it is better to list all their types);

- qualifying expenses for taxable transactions;

- total line of direct expenses;

- mixed group of expenses (also list);

- summation.

In order to maintain separate VAT accounting correctly and when it is really necessary, you need to constantly monitor the updating of current information. The rules for maintaining separate accounting for VAT are directly related to updates in the Tax Code of the Russian Federation, which happens constantly, and recently - especially intensively.