PKO and RKO are the main documents that are used to reflect the flow of funds in the cash register. They are needed in almost any organization, and in this article I will tell you how to work with them in the 1C: Enterprise Accounting 8 edition 3.0 program. In addition, we will talk about how to check the correctness of cash transactions and how to set a limit on cash balances in the cash register.

So, in order to reflect the receipt of funds at the cash desk, you need to go to the “Bank and Cash Desk” tab and select the “Cash Receipt (CCR)” item.

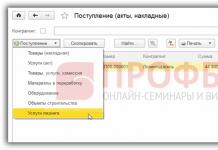

Add a new document using the "Create" button. In the form that opens, you must select the correct type of operation; the composition of the document fields that need to be filled in depends on this. We will reflect the transaction "Payment from buyer".

Then we select an organization (if there are several of them in the database), a counterparty (if necessary, create a new one), indicate the amount and account. We add a line to the tabular part and indicate the agreement, cash flow item, amount, VAT rate, settlement accounts. If the payment needs to be attributed to different contracts, you can add several lines. The “Base” field must also be filled out in order for this information to be reflected in the printed PQR form.

When posting a document, in our case, a movement is generated on the accounts Dt 50 Kt 62.

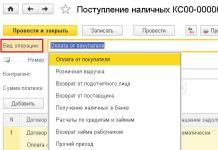

In order to reflect the expense of funds in the program, you need to select the “Cash withdrawal (Cash)” item on the “Bank and cash desk” tab.

In this document you also need to select the type of operation; we will consider the operation “Payment of wages according to statements”.

Select an organization and add a row to the table section. If a payroll slip has already been created, you need to select it, or you can create a new pay slip directly from the current document.

The list can be filled out automatically for all employees by clicking the appropriate button, or you can manually add the required people.

Click “Post and close”, the amounts in the “Cash Withdrawal” document are entered automatically based on the created statement. All that remains is to select the cash flow item in the field located under the tabular part.

This document creates the posting Dt 70 Kt 50.

I also recommend setting a limit in the program for cash balances in the cash register, which will be used when checking the correctness of cash transactions. If it is exceeded on any day, the program will report this. But this operation may not be performed by small businesses and individual entrepreneurs, who, in accordance with the new procedure that came into force on June 1, 2014, do not have the obligation to control the limit.

Everyone else needs to go to the “Main” tab, select “Organizations”, click the “More” button and “Cash balance limits”.

In the table that opens, click the “Create” button to indicate the limit and the date from which it is valid.

In order to check the correctness of accounting at the cash register, you need to use the “Express check of accounting” processing, which is located on the “Reports” tab.

In the processing form, you must set the verification period, click the “Show settings” button and check the “Cash transactions” checkbox. Then click “Run check”.

The program will tell you if there are errors in this section of accounting, and will also provide information about them, if any.

If you still have questions, you can ask them in the comments to the article or on our forum.

And if you need more information about working in 1C: Enterprise Accounting 8, then you can get our book onlink.

Working with cash registers and cash documents is an integral part of accounting activities. It includes setting a cash limit, accounting for the receipt of funds through a cash receipt order (PKO) and accounting for expenses through an expenditure cash order (RKO). Let's consider each type of operation in order.

Cash limit

Every large organization that works with cash must set a cash limit - this is regulated by the Directive of the Bank of the Russian Federation. The exception is small companies and entrepreneurs. The established cash limit cannot be exceeded, but can be changed monthly; this must be documented, signed by management. Otherwise, you may receive a fine from the tax inspector.

The cash register limit or cash balance limit in the cash register is the maximum allowable amount of cash that can be kept in the cash register at the end of the working day.

Now let's find out how to set a cash limit in the program. To do this, go to the “Directories” menu tab, the “Enterprise” section, and the “Organization” directory. Go to the organization’s settings and in the top panel click “More”, select the item “Cash balance limits”:

We get into filling out the document. Press the “Create” button. In the window that opens, enter the date from which this setting will be effective, and enter the size of the cash register limit, that is, indicate the amount of cash that may be in the cash register.

Click “Save and close.” The limit is specified. This is a periodic adjustment. If, for example, we want a different limit to be in effect in a month, then we create a new document with the required date, indicate the size of the limit and apply it. All documents can be viewed in the journal:

Let’s now go to the “Bank and Cash Desk” menu tab and see what magazines the “Cash Desk” section includes:

- Cash documents are incoming and outgoing cash orders;

- Payments with payment cards are acquiring;

- Advance reports – allow reporting to accountable persons;

- Managing the fiscal registrar – allows you to close a shift, make an X-report and a Z-report;

- Acquiring terminal management – allows you to configure this terminal.

Receipt cash orders

Now let's look at the cash documents in detail. Let's start with cash receipts. They are issued through the “Receipt” button. With the help of PCO, a large number of operations can be performed. This is determined by the item “Types of operations”:

- Retail revenue;

- Return from supplier;

- Receiving cash from the bank;

- Receiving a loan from a counterparty;

- Repayment of the loan by the counterparty;

- Repayment of a loan by an employee;

According to the document, the posting Dt50.01 - Kt62.01 is generated - receipt from the buyer.

After posting the document, the “Printing form details” setting appears at the bottom. Here you can specify the information that will be displayed when printing the PQ:

- Adopted from - name of the organization;

- Basis – document name and number;

- Application;

- A comment.

Printing is done through the key at the top of the “Cash receipt order (KO-1)” screen. We print it and send it for signature.

If a fiscal registrar is connected, then through the “Print check” button, which is located on the top panel, you can print a check. Please note that you can add an unlimited number of rows to the PKO. This was done so that payment could be divided either according to contracts or according to cash flow items. For example, let’s add another line, divide the amount of receipt and indicate the DDS item - “Other receipts”. And the settlement account is 62.01.

Let's review the document and see the generated transactions. The only thing that has changed is that this amount is divided into two parts:

- Dt50.01 - Kt62.01 – payment from buyers;

- Dt50.01 - Kt62.01 – other receipts.

Type of operation “Retail revenue”

Fields to be filled in:

- Type of transaction – retail revenue;

- The number and date are generated automatically;

- Warehouse – indicate the retail warehouse;

- Amount of revenue;

- DDS item – retail revenue.

We check, we carry out. If necessary, we send it for printing and submit it for signature.

Type of operation “Return from an accountable person”

Here we fill in:

- Number and date – skip;

- Accountable person – enter the data from whom we accept the refund;

- Sum;

- If necessary, fill in the item “Printing form details” - it will be displayed when printing the PQR.

We print it and send it for signature.

Wiring for this type will look like this: Dt50.01 - Kt71.01.

Type of operation “Return from supplier”

To be filled in:

- Type of transaction – return from an accountable entity;

- Counterparty – the name of the organization from which we accept returns;

- Amount of payment;

- Agreement;

- Everything else is filled out by the program itself;

- If necessary, fill out the “Print Form Details”.

- We carry it out, print it, and send it for signature. Wiring Dt50.01 - Kt60.01 is formed

Type of operation “Receiving cash at the bank”

In this case, you only need to enter the type of transaction and the amount, and the program will fill in all other parameters automatically. All that remains is to check and post the document. We print it and send it for signature. If you look at the posting, you will see the movement of funds from the current account to the cash desk: Dt50.01 - Kt51:

Type of operation “Receiving a loan from a counterparty”

Fill in:

- Type of operation;

- Counterparty – from whom we receive the loan;

- Amount of payment;

- Agreement – must be other;

- DDS article – obtaining credits and loans;

- Settlement accounts – 67.03.

We carry it out, print it, and send it for signature. Let's look at the entries: Dt50 - Kt67.03 – receiving a cash loan/credit.

Type of operation “Obtaining a loan from a bank”

Fill in the same way as the previous form, only in the “Counterparty” field you need to indicate the name of the bank. The counterparty must be entered in advance. The accounting account is entered here by default.

Type of operation “Loan repayment by counterparty”

Fill in:

- Type of operation;

- Counterparty

- Amount of payment;

- Agreement – in this form it should be “Other”;

- Settlement accounts – 58.03 (Loans provided).

We carry it out. If necessary, fill out the “Print form details”, send it for printing and submit it for signature.

Type of operation “Repayment of loan by employee”

This type is filled out in the same way, only we indicate not the counterparty, but an individual. We write down the amount. We carry out and fill out the settings of the printed form if necessary. We print it and send it for signature. The posting will display Dt50.01 - Kt73.01 - receipts from loan repayments.

Type of operation “Other receipt”

Here you can specify any account, any analytics. Using the “Other receipt” operation, you can process all those transactions that were considered earlier.

If there is a need to capitalize the receipt of funds in foreign currency, then you need to enter account 50.21 (Cash of the organization in foreign currency). The choice of currency that is needed becomes available. At the cash desk, similar to bank documents, currency is revalued and exchange rate differences are calculated.

Expense cash orders

Now let's look at expense cash orders (RKO). They are drawn up in the “Cash Documents” journal, using the “Issue” button. Filling is similar to PKO, only the operation is reversed. With the help of RKO you can draw up the following documents:

- Payment to the supplier;

- Return to buyer;

- Issuance to an accountable person;

- Payment of wages according to statements;

- Payment of wages to the employee;

- Payment to an employee under a contract;

- Depositing cash into the bank;

- Repayment of the loan to the counterparty;

- Repayment of the loan to the bank;

- Issuing a loan to a counterparty;

- Collection;

- Payment of deposited wages;

- Issuing a loan to an employee;

- Other expenses.

RKOs differ from PKOs in certain types of operations. Let's focus on them.

Type of operation “Payment of wages according to statements”

Type of operation “Payment of wages to an employee”

Type of transaction “Payment to an employee under a contract”

Fill in the same way for a specific recipient. The DDS item will be indicated - payment to suppliers (contractors):

The postings will display Dt76.10 - Kt50.01:

Type of operation "Collection"

Type of operation “Payment of deposited wages”

Deposited wages are wages that an employee for some reason could not receive on time within the period established by the organization. Filled out.

To register cash register operations in 1C Accounting 8.3, the following documents are used: cash receipt and expenditure order. The journal for registering outgoing and incoming cash orders in 1C is located in the “Cash documents” item of the “Bank and cash desk” menu.

In order to create a new document, click on the “Receipt” button in the list form that opens.

The set of fields and transactions displayed directly depends on the value specified in the “Type of Operation” field.

Let's look at each type in more detail:

By default, the debit account is 50.01 – “Cash of the organization”.

Account cash warrant

To create cash settlements in the list of cash documents 1C 8.3, you must click on the “Issue” button.

The execution of this document is practically no different from receipt at the cash desk. The set of details also depends on the selected type of operation.

The only thing worth noting is that when choosing the type of salary payment transactions (except for work contracts), in the document you must select a statement for paying salaries through the cash register. The repayment documents also indicate the type of payment: repayment of debt or interest.

Cash balance limit

To set a cash register limit, go to the section of the same name in the “Organizations” directory card. We have it in the “More” subsection.

This guide indicates the limit amount and validity period. This functionality has made life much easier for accountants to comply with the law.

Cash book

The 1C:Accounting program implements the functionality of creating a cash book (form KO-4). is in the journal PKO and RKO. To open it, click on the “Cash Book” button.

In the report header, indicate the period (the default is the current day). If your program maintains records for more than one organization, it must also be indicated. In addition, if necessary, you can select a specific division for which the cash book will be generated.

For more detailed report settings, click on the “Show settings” button.

Here you can specify how the cash book will be generated and some of the settings for its design in 1C.

After you have made any changes to the settings of this report, click “Generate”.

As a result, you will receive a report with all cash movements at the cash desk, as well as balances at the beginning / end of the day and balances.

Cash inventory in 1C 8.3 Accounting

The procedure for conducting a cash register inventory is described in the order of the Ministry of Finance of the Russian Federation No. 49 dated June 13, 1995.

Unfortunately, in the 1C 8.3 program there is no cash inventory report in the INV-15 form. This request has already been proposed to the 1C company. Perhaps someday they will finalize the program, but for now accountants have to take inventory of the cash register manually.

You can download the form and sample of filling out INV-15 at.

The fastest and most effective way to solve this problem is to order processing for the formation of INV-15 from a specialist. This processing will not only save a lot of time, but will also reduce the influence of the human factor, which will avoid errors.

Training video

See also video instructions for recording cash transactions in 1C 8.3:

A cash order is a document with which you can issue cash from the cash register. In this material we will tell you how it is formed in the accounting program “1C Accounting 8”.

The above document is used to reflect the following transactions:

Payment of necessary finances to the supplier (the type of transaction is called “Payment to the supplier”);

Return of money to the buyer (the required type of operation is “Return to the buyer”);

Issuance of funds on account (a type of operation called “Issue to an accountable person” is used);

Payment of wages (the type of operation is called “Payment of wages to employees” or “Payment of wages according to information”).

Depositing funds into a banking institution (type of operation - “Cash deposit to the bank”).

We have indicated the main ones, but there are also other operations for issuing money from the cash register.

In order to generate a cash receipt document in the 1C accounting program, you need to go to the tab called “Bank and Cash Desk”, and then in the section named “Cash Office”, select the document called “Cash Debit Order”.

The default transaction type for the new document is called “Payment to supplier”. If you need another operation, you can change it manually. In the example we offer, we will issue funds to an accountable person, so we need to select the type of operation as “Issue to an accountable person.”

Once done, we move on to filling out the document. From the directory called “Accountable Person”, in the “Recipient” line, select the accountable person who will receive the funds. Be sure to indicate the monetary amount.

In the line named “Cash flow item” you must indicate “Working with accountable persons”. If this item is not in the directory, then simply add it.

At the bottom of the document, you need to indicate the purpose for which the funds are issued. In the example we offer, these are business expenses.

And also fill out the application, where you indicate the statement of the accountable person, on the basis of which a certain amount of money will be issued. Let us note that according to the new procedure for conducting cash transactions (dated October 12, 2011 with number 373-P), which came into force in 2012, the cash register is issued to an employee of the organization for reporting on the basis of a statement written by him. The application must be drawn up in the approved form, which must include: a handwritten inscription by the manager of the organization, the amount of cash and the time for which it is issued, the date and signature of the manager of the enterprise.

After this, you need to post the document, look at the postings and, if necessary, print the cash receipt order.

To reflect the receipt of funds in 1C 8.3, we use the tab Cash desk – Cash documents – Receipt cash order (PKO). Let's create a cash flow by clicking the button Admission:

IN Receipt cash order(PKO) you can create the following types of operations:

Payment from the buyer. The receipt of funds from the buyer to the enterprise's cash desk is reflected. Let's fill out the tabular part of the document:

- date– date of the PQS document;

- Number – generated automatically, usually not edited;

- Counterparty– the buyer making a deposit of funds;

- Sum– amount of cash contribution;

- Contract/cash flow item– indicate the agreement, cash flow item. Method of crediting the advance;

- VAT rate and amount. If an invoice was issued for payment, then you need to indicate the invoice on the basis of which payment is made;

- When posting the document, posting Dt 50 Kt 62 is generated:

The printed form of the PKO is generated when you press a button

Retail revenue. For this type of operation, in 1C 8.3 we show the revenue of the retail outlet. In the header you must indicate the warehouse and the amount of revenue, with VAT details:

In 1C 8.3, this document is drawn up when funds are returned from an accountable person to the enterprise’s cash desk. Generates wiring DT 50 KT 71:

Issued in the event of termination of a contract or as a result of changes in contract prices. The document generates postings DT 50 KT 60:

– is issued in case it is necessary to withdraw funds from the bank:

- This operation is reflected only as cash transactions;

- The document generates postings DT 50 KT 51;

- The transaction is not reflected in the bank:

– transactions of receiving and issuing loans from third-party organizations other than banks are reflected. The type of contract is indicated Other:

The account for settlements with counterparties is also indicated:

– used to obtain a loan from a bank. Type of agreement – Other with indication of the settlement account:

The document generates transactions:

– serves to obtain the issued loan to other counterparties. We establish the type of agreement – Other and the settlement account in which the loan is accounted for:

Reflection of the receipt of funds to repay a loan issued to an employee:

When posting the document, postings DT 50 Kt73 are generated:

Other income - the operation is used in other cases. Printable form – printing of the Receipt Cash Order in the form (KO-1) is provided.

A sample of filling out and the procedure for filling out incoming and outgoing cash orders in 1C 8.3 is discussed in

Account cash warrant

The expense of funds in 1C 8.3 is formalized by the document Cash Expense Order (COS) using the button Issue:

Let's consider filling out a document in 1C 8.3 when reflecting the main types of business transactions.

Payment to the supplier – transactions of settlements with suppliers of goods, works and services are reflected. Generates transactions Dt 60 Kt 50. Similarly, we fill in the type of operation and all fields of the document as in PKO:

Printing RKO by pressing the Print button:

The printed form in 1C 8.3 is provided for the generation of a Cash Expense Order in the form (KO-2):

- – provided in cases of contract termination and price changes.

- Issuance to an accountable person – provided for the issuance of funds to an accountable person. Generates wiring DT 71 KT 50.

- Payment of wages according to statements– provided for when paying wages to employees, through the person responsible for payroll.

- Payment of wages to an employee – payment of wages to a specific employee.

- Cash deposit to the bank – intended for receiving and further depositing funds into a current account. Generates wiring Dt 51 Kt 50.

- Payments for loans and borrowings– intended for the issuance and repayment of loans and borrowings, both received and issued to third parties. We use the contract type Other and settlement account.

- Collection – intended for collection of funds from retail proceeds, collection to a current account. Generates transfer transactions en route Dt 57.01 Kt 50. The bank transaction is not recorded separately.

- Payment of deposited wages– the operation is intended for issuing deposited wages according to payrolls, which indicates the payroll where the wages were deposited.

- Other expenses – the operation is provided for other operations.

The nuances associated with the timing of PKO and RKO in 1C 8.2 (8.3) and filling out the details of the DDS article are discussed in our video lesson:

Advance report

Cash documents also include the document :

Fill in all fields of the document header. Wherein:

- On the tab Advances fill in the amount of the advance received;

- Tab Goods– a list of inventory items acquired by the accountable entity is indicated;

- Tab Other – services paid for by the accountable person are taken into account;

- Tab Payment– generated if the delivery is formalized in a separate document, generates postings Dt 60 Kt 71:

We post the document and print it:

Payment by payment cards

The document Payment by payment cards in 1C 8.3 can be found:

In this document we will consider the following types of transactions: Payment from the buyer and Retail revenue.

Payment from the buyer– applies when paying by bank card. Let's fill in the fields of the document:

- Type of operation;

- Counterparty, from whom the payment was received;

- Type of payment Agreement and amount of payment.

Based on this document, you can generate an invoice and:

Receipt to the current account generates cash receipt transactions and bank commissions. After posting the document, the following transactions are generated:

Retail revenue – payment accepted by a manual point of sale, accepted per day by bank cards:

The document generates transactions:

When paying at automated retail outlets with bank cards in 1C, use the document. The peculiarity of this operation is that the money comes not from the buyer, but from the acquiring bank. Using account 57.03.

To account for payments with bank loans and payment cards, you need to create a payment type in the directory:

- Bank loan;

- Payment card.

We indicate the bank from the directory of counterparties who are carrying out or issuing a loan, indicate the agreement and settlement account:

Operations with the fiscal registrar

The fiscal registrar in 1C 8.3 is designed for registering trade transactions and printing trade receipts directly from the 1C 8.3 program. To do this, you need to make the following settings at each workstation: Connected equipment, Administration section. Printing is done from the document Cash receipt order using the button Print receipt:

At the end of a cash register shift, it is possible to print reports:

- Report without blanking (X-report);

- Report with blanking (Z-report).

Printing reports in 1C 8.3 will be done from the form Fiscal registrar management In chapter Bank and cash desk.