In 2017, the service life of certain fixed assets for depreciation purposes will change. The point is that it starts to work since 2017 new OKOF classifier. Our consultation on what an accountant needs to do in this regard.

OKOF since 2017

All accountants are required to use from 2017 new OKOF– All-Russian classifier of fixed assets. It was adopted by order of Rosstandart dated December 12, 2014 No. 2018-st. Its abbreviated name is OK 013-2014 (SNA 2008).

At the same time, the previous Classifier of fixed assets OK 013-94 ceases to be valid. It was approved by Decree of the State Standard of Russia dated December 26, 1994 No. 359.

In OKOF OK 013-2014, ten depreciation groups remain, as before. However, some assets were transferred to other groups. New classifier OKOF since 2017 You can view and download on our website here:

Consequences OKOF changes since 2017

All fixed assets from the Classification of fixed assets included in depreciation groups (approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1) are divided by codes from the All-Russian Classifier of Fixed Assets. That's why transition to new OKOFs from 2017 changed the depreciation period of some assets in tax accounting. In this case, one must be guided exclusively new OKOF codes from 2017 of the year. Changes to the current Classification of fixed assets for tax depreciation purposes were made by Decree of the Government of the Russian Federation dated July 7, 2016 No. 640.

View and download the changes in full OKOF 2017 and depreciation groups with explanation on our website you can use this link:

What has changed with the arrival OKOF in 2017 year

Please note that in the updated Classification of Assets for depreciation purposes:

- codes changed OKOF directory since 2017;

- some objects changed their depreciation group.

EXAMPLE

In 2016, for metal fences and fences the code according to the old OKOF is 12 3697050. Objects according to it can be included in 2 groups:

- fences made of metal and brick - 6th depreciation group (from 10 to 15 years incl.);

- just metal fences - 8th group (from 20 to 25 years incl.).

By virtue of transition from 2017 to new OKOF all metal fences moved to group 6. Their new code is 220.25.11.23.133. This means that their service life will be 10 years shorter.

How to use new OKOF since 2017

When the law requires an adjustment to the useful life of an asset if OKOF 2017 with decoding and depreciation group shows that the latter has changed?

We hasten to reassure: enterprises do not need to revise the depreciation rate if, according to the updated OS Classification, the asset falls into a different depreciation group and has a new useful life.

To old OS objects OKOF since 2017 but not spreading. It is relevant only for those assets that the company will put into operation from January 1, 2017. In this case, a new service life must be determined.

To prevent accountants from getting confused in old and new codes, Rosstandart approved a comparative table of old and new OKOF codes (order No. 458 dated April 21, 2016). Below is an example: on the left is the old code, on the left is new OKOF codes from 2017 of the year. And some objects have ceased to be fixed assets altogether.

Read and download the table of old and new codes in full OKOF since 2017 on our website using the following link.

All-Russian Classifier of Fixed Assets OK 013-94 - a regulatory document that represents the main classifier of fixed assets in Russia and was used until January 1, 2017 ( old (inactive) version).

The all-Russian classifier of fixed assets OK 013-94 is part of the Unified System of Classification and Coding of Technical, Economic and Social Information (ESKK) of the Russian Federation.

The All-Russian Classifier of Fixed Assets is often abbreviated as OKOF.

A comment

The all-Russian classifier of fixed assets OK 013-94 was approved by Decree of the State Standard of the Russian Federation dated December 26, 1994 N 359. This version of the classifier was used until January 1, 2017 (from this date a new version OKOF - is applied).

Order of the FEDERAL AGENCY FOR TECHNICAL REGULATION AND METROLOGY dated April 21, 2016 No. 458 approved direct and reverse transition keys between editions OK 013-94 and OK 013-2014 (SNS 2008) of the All-Russian Classifier of Fixed Assets.

OKOF is the main classifier of fixed assets (fixed assets) in Russia. Fixed assets are understood as durable means of labor (more than 12 months).

In modern documents the term “” is used. OKOF uses the term “fixed assets”, but with exactly the same meaning. The fact is that in Soviet times the term “fixed assets” was used for the same assets. OKOF inherited this term.

When developing the OKOF, the following were taken into account: the International Standard Industrial Classification of all Economic Activities (ISIC), the international Central Product Classification (CPC), the United Nations standards for international System of National Accounts (SNA), Regulations on Accounting and Reporting in the Russian Federation, as well as the All-Russian Classifier of Economic Activities, Products and Services (OKDP), for which ISIC and CPC are basic.

The objects of classification in OKOF are fixed assets.

Fixed assets are produced assets used repeatedly or continuously over a long period, but not less than one year, for the production of goods, provision of market and non-market services. Fixed assets consist of tangible and intangible fixed assets.

Material fixed assets (fixed assets) include: buildings, structures, machinery and equipment, measuring and control instruments and devices, housing, computer and office equipment, vehicles, tools, production and household equipment, working, productive and breeding livestock, perennial plantings and other types of material fixed assets.

Intangible fixed assets (intangible assets) include computer software, databases, original works of entertainment, literature or art, high-tech industrial technologies, and other intangible fixed assets that are objects of intellectual property, the use of which is limited by the ownership rights established on them.

OKOF for accounting and taxation

For taxation and accounting, OKOF is important because it is a complete and regularly updated Russian classifier. Built on its basis, approved. Decree of the Government of the Russian Federation dated 01.01.2002 N 1. is used to determine the object, which makes it possible to determine on the basis of which income tax is calculated. Classification can also be used for accounting purposes.

Example

We determine the depreciation group of the purchased household air conditioner. There is no such object (since it shows enlarged groups of fixed assets up to the class level). In OKOF we find under code 16 2930274 “Domestic air conditioners”. This type of fixed assets is included in the class "Household Appliances" with code OKOF 16 2930000.

The group of fixed assets with code 16 2930000 “Household appliances” belongs to the third depreciation group. This means that a household air conditioner belongs to the third depreciation group (useful life over three and up to five years).

All-Russian classifier of fixed assets OK 013-94

Each OKOF position includes a nine-digit digital decimal code (OKOF code), check number (CN) and name. The control number was calculated in accordance with the current methodology for calculating and applying control numbers to protect classifier codes.

The OKOF code structure consists of 9 characters (digits). There is a space between the second and third characters of the code.

The general structure of nine-digit codes for the formation of groupings of objects in OKOF is presented in the following diagram:

X0 0000000 - section

XX 0000000 - subsection

XX XXXX000 - class

XX XXXX0XX - subclass

XX XXXXXXX - view.

Groupings of objects in OKOF up to the level of subclasses are built according to the hierarchical method of classification, and at the level of types, facets (lists) are used, linking them to the lower level of the hierarchical structure of the classifier - to subclasses within the code interval allocated for a given subclass.

Sections represent the highest level of division, formed taking into account the classification of fixed assets adopted in the SNA.

OKOF has two section:

1- material fixed assets

2 – intangible fixed assets

Subsection represents the level of division of classification objects, taking into account their significance for the economy as a whole and established traditions.

Section 1 “Tangible fixed assets” contains subsections:

11 0000000 BUILDINGS (EXCEPT RESIDENTIAL)

12 0000000 STRUCTURES

13 0000000 HOUSINGS

14 0000000 MACHINERY AND EQUIPMENT

15 0000000 VEHICLES

16 0000000 PRODUCTION AND BUSINESS INVENTORY

17 0000000 WORKING, PRODUCTIVE AND BREEDING LIVESTOCK (EXCEPT YOUNG CATTLE AND CATTLE FOR SLAUGHTER)

18 0000000 PERMANENT PLANTS

19 0000000 MATERIAL FIXED FOUNDATIONS NOT INCLUDED IN OTHER GROUPS

Section 2 “Intangible fixed assets” contains subsections:

20 0000000 INTANGIBLE FIXED ASSETS

21 0000000 GEOLOGY - EXPLORATION WORKS

22 0000000 COMPUTER SOFTWARE

23 0000000 ORIGINAL WORKS OF ENTERTAINMENT, LITERATURE OR ART

24 0000000 HIGH INDUSTRIAL TECHNOLOGIES

25 0000000 OTHER INTANGIBLE FIXED ASSETS

Classes provide detail of classification objects and can be the lowest significant level of their classification. Classes of fixed assets are formed mainly on the basis of the corresponding classes of products according to OKDP.

In cases where the OKOF class consists of groupings represented in various OKDP classes, or has no analogue in OKDP due to the specifics of fixed assets, the OKOF class code has the following structure: XX 000X000.

Subclass reveals the selected class with the necessary detail.

View provides the detail of classification objects necessary to perform accounting functions, without switching to specific types of objects.

Example

15 0000000 VEHICLES - section and subsection (15)

Inside the subsection “VEHICLES”

15 3410000 Cars – class (15 3410)

15 3410010 Passenger cars – subclass (15 3410010)

Within the subclass “Passenger cars” types:

15 3410100 Passenger cars of an especially small class (with an engine capacity of up to 1.2 l)

15 3410101 Extra small class passenger cars for individual and official use

15 3410110 Small class passenger cars (with engine displacement over 1.2 to 1.8 liters inclusive)

15 3410020 Trucks, road tractors for semi-trailers (general purpose vehicles: flatbeds, vans, tractor vehicles; dump trucks) - subclass

Example

15 3510000 Vessels - class

15 3511000 Trade and passenger vessels - class

15 3511010 Self-propelled sea vessels - subclass

15 3511011 Dry cargo self-propelled sea vessels - subclass

15 3511102 Sea timber and cotton carriers - view

Example

We determine the depreciation group of construction equipment “formwork”. Formwork (from “deck”, “to formwork” - to cover with flooring from boards, etc.) is a set of elements and parts designed to give the required shape to monolithic concrete or reinforced concrete structures erected on a construction site.

There are no fixed assets in this class. Turning to OKOF, we find that “formworks” are listed under OKOF code 14 2924243. To determine the depreciation group, you need to determine which class or subclass the OKOF code 14 2924243 belongs to?

Based on the OKOF, we determine that this code belongs to class 14 2924000 “Machinery and equipment for the mining industry, construction and operation of quarries”, subclass 14 2924010 “Lifts and conveyors for mines, mining machines and equipment”.

Fixed assets with code OKOF corresponding to subclass 14 2924010 “Lifts and conveyors for mines, mining machines and equipment” belong to the 2nd depreciation group (useful life over two and up to three years).

OK 013-2014 (SNA 2008). All-Russian classifier of fixed assets (applicable from January 1, 2017)

OKOF has adopted the following code structure: XXX.XX.XX.XX.XXX

The first three characters correspond to the code for the type of fixed assets given in Table 1.

The following characters correspond to codes from the All-Russian Classifier of Products by Type of Economic Activity OKPD2 OK 034-2014 (KPES 2008) and can have a code length from two to nine characters depending on the length of the code in OKPD2. When positions from OKPD2 are included in OKOF, a classification object should be formed that can be used as fixed assets.

If fixed assets do not have corresponding groupings in OKPD2 or a different classification is required in OKOF, the fourth and fifth digits of the OKOF code have the value “0”. Such fixed assets include expenses for land improvement, expenses for transferring ownership of non-produced assets, scientific research and development, and others.

For example, in OKOF there is a grouping “230.00.11.10 Expenses for reclamation work”. For individual positions in OKOF, explanations are provided starting with the words “This group includes” (also includes, including includes, does not include).

SNA 2008 |

OKOF |

||

Alphanumeric designation |

Code |

Name of types of fixed assets |

|

AN111 |

Residential buildings |

RESIDENTIAL BUILDINGS AND PREMISES |

|

AN112 |

Other buildings and structures |

BUILDINGS (EXCEPT RESIDENTIAL) AND STRUCTURES, COSTS FOR LAND IMPROVEMENT |

|

AN1121 |

Non-residential buildings |

BUILDINGS (EXCEPT RESIDENTIAL) |

|

AN1122 |

Other buildings |

STRUCTURES |

|

AN1123 |

Land Improvements |

COSTS FOR LAND IMPROVEMENT |

|

AN113 |

cars and equipment |

MACHINERY AND EQUIPMENT, INCLUDING HOUSEHOLD EQUIPMENT, AND OTHER OBJECTS |

|

AN1131 |

Transport equipment |

VEHICLES |

|

AN1132 |

Information, computer and telecommunications (ICT) equipment |

INFORMATION, COMPUTER AND TELECOMMUNICATIONS (ICT) EQUIPMENT |

|

AN1133 |

Other machines and equipment |

OTHER MACHINERY AND EQUIPMENT, INCLUDING HOUSEHOLD EQUIPMENT, AND OTHER OBJECTS |

|

AN114 |

Weapon systems |

WEAPON SYSTEMS |

|

AN115 |

Cultivated biological resources |

CULTIVATED BIOLOGICAL RESOURCES |

|

AN1151 |

Resources of animals that produce products on a regular basis |

CULTIVATED RESOURCES OF ANIMAL ORIGIN THAT PROVIDE PRODUCTS REPEATEDLY |

|

AN1152 |

Resources of trees, crops and plantings that produce products on a regular basis |

CULTIVATED RESOURCES OF PLANT ORIGIN THAT PRODUCE PRODUCTS REPEATEDLY |

|

AN116 |

Costs associated with transferring ownership of non-produced assets |

COSTS OF TRANSFER OF OWNERSHIP OF NON-PRODUCED ASSETS |

|

AN117 |

Intellectual Property Products |

INTELLECTUAL PROPERTY OBJECTS |

|

AN1171 |

Research and development |

||

Accountants throughout Rus' have been trying to solve yet another puzzle since 01/01/2017.

From 01/01/2017 All-Russian classifier of fixed assets OK 013-94 has lost its force. A new classifier has come into force - OK 013-2014 (SNS 2008), approved by Order of the Federal Agency for Technical Regulation and Metrology dated December 12, 2014 N 2018-st "On the adoption and implementation of the All-Russian Classifier of Fixed Assets (OKOF) OK 013 -2014 (SNA 2008)".

On February 2, 2016, the Government Commission on the use of information technologies to improve the quality of life and business conditions approved the direct and reverse transition keys between the editions of OK 013-94 and OK 013-2014 (SNA 2008) of the All-Russian Classifier of Fixed Assets (hereinafter - OKOF).

The 1C company, as always, took care of its customers by including an OKOF replacement assistant in the functionality of the Government Institution Accounting 8 program at the beginning of 2016.

At December seminars in 2016, representatives of the Ministry of Finance of the Russian Federation explained that fixed assets received by the institution before 01/01/2017 should be transferred to a new OKOF using the transition key, without changing their depreciation group and useful life.

In the software products, it was recommended to replace the OKOF after submitting statistical reports, since according to clause 5 of the Instructions for filling out the federal statistical observation form N 11 “Information on the availability and movement of fixed assets (funds) and other non-financial assets”, approved by order of the Federal State Statistics Service dated November 24, 2015 N 563, to classify fixed assets in the report for the 2015 reporting year, the classifier of fixed assets OK 013-94, introduced on January 1, 1996, is used. by Decree of the State Standard of Russia dated December 26, 1994 N 359 and valid until 01/01/2017.

When carrying out recoding, methodological difficulties may arise when the old OKOF does not have a direct correspondence in the new one.

Two letters from the Ministry of Finance of the Russian Federation: Letter dated December 27, 2016 No. 02-07-08/78243 “On the introduction of a new All-Russian Classifier of Fixed Assets (OKOF) from January 1, 2017” and Letter dated December 30, 2016 No. 02-08-07/79584 to The addition to the letter of the Ministry of Finance of Russia dated December 27, 2016 No. 02-07-08/78243 on the transition to a new classifier of fixed assets in 2017 clarifies the situation in cases of lack of correspondence between the old and new OKOF.

Most institutions submitted statistical reports for 2016 and routinely recoded OKOF in the fixed asset inventory card.

And suddenly rumors began to appear that there was no need to recode fixed assets recorded on the institution’s balance sheet before 01/01/2017, it was necessary to leave them on the old OKOF.

In institutions where recoding was carried out, conversations began to arise that everything needed to be returned back, and the old OKOFs should be indicated in the fixed asset cards.

When clarifying the sources of information, it was discovered that some consulting information systems, in response to user questions about finding compliance with OKOF, began to give strange answers, namely: “No need to change anything! Leave everything as it is! Keep records for the new OKOF from 01/01/2017, and do not touch the old fixed assets at all!”

This opinion was joined by numerous lecturers at seminars held in various parts of the country, referring to the above letters from the Ministry of Finance, apparently interpreting the phrase in their own way: “If material assets, which in accordance with Instruction 157n relate to fixed assets, are not included in the OKOF OK 013-2014 (SNA 2008), then such objects are accepted for accounting as fixed assets with grouping according to the All-Russian Classifier of Fixed Assets OK 013-94.”

Why this phrase was adopted as a guide not to make any changes is completely unclear. It just says that it is NOT NECESSARY to regroup fixed assets in accounting, but that fixed assets should be left in the accounts in which they were accounted for before 01/01/2017.

But accountants have already had doubts, and in cases of a large number of fixed assets with OKOF that do not comply with the new edition, these doubts turned into a firm belief that nothing needs to be done, no recoding should be made, and in general, return everything to us, as it was!

In order to suppress incorrect information, we offer several undoubted arguments in favor of the fact that the OKOF of fixed assets recorded on the balance sheet of the institution before 01/01/2017 still needs to be changed.

In the section on line with code 040 "OKOF Code" the code of the real estate object is indicated in accordance with the All-Russian Classifier of Fixed Assets. The line to be filled in looks like this:

As can be seen in the figure, the OKOF structure of real estate assets must comply with OK 013-2014 (SNA 2008). And since real estate objects are not from the list of the most frequently acquired non-financial assets by an institution, and most likely, this section reflects information about real estate objects registered with the institution before 01/01/2017, therefore, there can be no question of the OKOF of these objects should not be recoded to new ones.

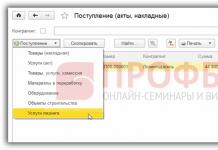

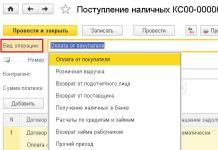

We remind you that to replace OKOF in fixed assets you should:

1.Download the new OKOF classifier

Section “Regulatory and reference information” - link to the navigation panel “All-Russian Classifier of Fixed Assets”

On the command panel, click the “Load classifier” button and in the window that appears, enter the path to the okof.xml file, which is located in the program update release folder.

Select the okof.xml file and click the “Open” button.

Then click on the “Download data” button.

The download of the directory will begin, which, depending on the location of the information base, as well as on the system characteristics of the computer, can take from several minutes to a long time.

Accounting of a government agency (rev. 1)

Menu item “Fixed assets” - “OKOF”

In the classifier window, click the “Load classifier” button, set the flag in the appropriate position and click the “Next” button

Using the “Add” button, specify the path to the configuration update release folder containing the okof.xml file and click the “Next” button.

After loading the classifier, click the “Finish” button

After downloading, the reference book “All-Russian Classifier of Fixed Assets” will contain two classifiers: OK 013-2014 and OK 013-94.

2.Use the OKOF replacement assistant

Accounting of a government agency (rev. 2)

Section "Administration" - subsection "Changes in legislation" - link "OKOF Replacement Assistant"

In the assistant window, click on the “Fill” button to fill out the tabular part with the list of OKOF from the elements of the directory “Fixed Assets” of the specified institution. If there is no corresponding position OK 013-2014 in the transition key, the required position should be selected from the classifier manually, having previously selected codes that are identical in meaning. It is recommended to secure such positions on commission.

Starting from 2017, the service life of fixed assets intended for depreciation will change. Since this year the new OKOF classifier (All-Russian Classifier of Fixed Assets) 2017 will be relevant, and therefore the accountant needs to make certain adjustments. These changes were adopted in accordance with the order of Rosstandart dated December 2014. In this regard, the previous classifier ceases to operate. As before, the new version has ten depreciation groups, but some of the assets have been moved to other groups. At the same time, working with the new OKOF codes in 1C is not at all difficult.

Let us remind you what OKOF and ENAOF are from the point of view of 1C terminology.

Directory "OKOF"

The directory contains an all-Russian classifier of fixed assets. The directory is used to classify fixed assets when accepted for accounting to determine the depreciation group. The OKOF code is indicated for the fixed asset in the OKOF field.

Directory "ENAOF"

The directory contains a classifier of fixed assets for which standard codes and annual depreciation rates are established. This directory classifies fixed assets for which depreciation is calculated according to ENAOF. For motor vehicles, depreciation rates are used as a percentage of the cost of the car per 1000 km. Code according to ENAOF is indicated for fixed assets in the Code according to ENAOF field.

Download OKOF and ENAOF

So, in the update folder, after installing the next 1C release, two files should appear: enaof and okof.

You can also download the okof.xml and enaof.xml files directly from our website. The files are suitable for any 1C configuration: Accounting, Integrated Automation, SCP, ERP.

- Download OKOF 2017 for 1C - file

- Download ENAOF - file

- Download OKOF in word - file

If you downloaded a file from our website, you will need to unzip it before installation.

Install and download the new OKOF and ENAOF

To update or install directly, go to the section called “Directories”, then select “OKOF Classifier” in the “OS and Intangible Materials” section.

On the form, click the "Download OKOF classifier" button

After the window appears in front of you, click here “Select file”, find the directory in which the classifier files are located, and select the file okof.xml or enaof.xml directly.

The new classifier is implemented in the form of a directory with a hierarchy of elements, so you can select any item as a value.

For fixed assets that began operating in 2017 and later, the OK 013-2014 classifier is available; it determines the corresponding position of these assets in the tax return. As for old fixed assets that were introduced before 2017, the following parameters are retained - norm and period. Only the codes change. There is no specific correspondence between the new and old code versions. For the transition, special keys are required, which are listed in the order of Rosstandart. You can see the transition table from old to new OKOF.

The ENAOF classifier did not change in 2017, but it still makes sense to check its relevance.

To load the ENAOF classifier, you must first click the "Open and read file" button, and if necessary, set the "Rewrite objects" flag. After the file has been read, click on the "Download" button.

Order of Rosstandart dated December 12, 2014 N 2018-st approved a new OKOF (OK 013-2014), which will come into force in 2017. The organization has many fixed assets, documents for which are often requested by the tax authorities.

What is the procedure for applying OKOF codes for fixed assets acquired from January 1, 2017, in the accounting and tax accounting of an organization?

From January 1, 2017, the determination of depreciation groups and depreciation periods for fixed assets will be carried out according to the new classifier OK 013-2014 (SNS 2008) "All-Russian Classifier of Fixed Assets", adopted and put into effect by order of Rosstandart dated December 12, 2014 N 2018-st.

Accordingly, for fixed assets that will be put into operation from 2017, useful lives will need to be determined by depreciation groups in accordance with the new codes. In this regard, the Classification of fixed assets included in, approved by Decree of the Government of the Russian Federation dated 01.01.2002 N 1, was amended by Decree of the Government of the Russian Federation dated 07.07.2016 N 640, which also come into force on January 1, 2017.

In order to simplify the transition to the new classifier, Rosstandart issued an order “On approval of direct and reverse transition keys between editions OK 013-94 and OK 013-2014 (SNS 2008) of the All-Russian Classifier of Fixed Assets,” which contains tables of correspondence between old and new OKOF codes ( the direct transition key establishes the transition from OK 013-94 to OK 013-2014 (SNA 2008), and the reverse transition key, on the contrary, establishes the transition from OK 013-2014 (SNA 2008) to OK 013-94).

Accounting

OKOF codes in accordance with the All-Russian Classifier of Fixed Assets, approved by Decree of the State Standard of the Russian Federation dated December 26, 1994 N 359 (from January 1, 2017 OKOF "OK 013-2014", adopted by order of Rosstandart dated December 12, 2014 N 2018-st), are used to determine useful life of a fixed asset for the purpose of calculating depreciation in tax accounting.

In accordance with the norms of the Decree of the Government of the Russian Federation dated 01.01.2002 N 1 “On the Classification of fixed assets included in depreciation groups”, the specified Classification of fixed assets has been applied since 2017 for tax accounting purposes. Since the wording of Resolution of the Government of the Russian Federation dated 06/07/2016 N 640 excludes the provision that this Classification can also be used for accounting purposes.

In accounting, in accordance with the provisions of PBU 6/01 “Accounting for fixed assets”, this is the period during which an object of fixed assets should bring economic benefits to the organization, that is, income, which in accounting is determined based on:

The expected useful life of this facility in accordance with the expected productivity or capacity;

Expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

Regulatory and other restrictions on the use of this object (for example, rental period).

Thus, in accounting, an organization has the right to independently determine the useful life of fixed assets, without relying on norms, classifiers or OKOF.

At the same time, there is no direct ban on the use of the Classifier of fixed assets established for tax purposes in accounting.

Accordingly, in our opinion, the organization has the right to use the Classification in question for accounting purposes, having established such a procedure in the accounting policy of the organization.

OKOF codes are also used when filling out federal statistical observation form No. 11 “Information on the availability and movement of fixed assets (funds) and other non-financial assets.”

Tax accounting

The useful life in tax accounting is determined by depreciation groups. The depreciation group is determined according to the Classification of fixed assets (Resolution of the Government of the Russian Federation dated January 1, 2002 N 1).

On January 1, 2017, a new Classification of fixed assets comes into force (Resolution of the Government of the Russian Federation dated July 7, 2016 N 640).

In accordance with this Classification, ten depreciation groups are provided. Each depreciation group has a specific useful life range. Within this range, the organization has the right to set the useful life for a particular fixed asset.

From January 1, 2017, as already noted, the new OKOF “OK 013-2014”, adopted by order of Rosstandart dated December 12, 2014 N 2018-st, comes into effect.

The new OKOF specifies in more detail and detail those included in depreciation groups. In order to determine the useful life, and, accordingly, the depreciation group, it is first necessary to clarify the OKOF code, and then, based on this OKOF code, determine the useful life of the fixed asset.

In accordance with paragraph 6 of Art. 258 of the Tax Code of the Russian Federation (see also letter of the Ministry of Finance of Russia dated June 22, 2016 N 03-03-06/1/36323) if the fixed asset is not mentioned either in the Classification or in the OKOF, then determine the depreciation group and, accordingly, the useful life use should be based on the technical documentation or recommendations of the manufacturer of this fixed asset.

In general, the sequence for determining the useful life of a fixed asset can be presented as follows.

The useful life of a new fixed asset is determined based on the depreciation group in accordance with the Classification of fixed assets. If a fixed asset is not included in the specified Classification, then its useful life should be determined using the OKOF code in accordance with the All-Russian Classifier of Fixed Assets. At the same time, if there is no corresponding OKOF code for a fixed asset, in order to determine the useful life of the fixed asset, one should rely on the technical documentation of this fixed asset.

The useful life of a used fixed asset is determined according to a similar scheme. Moreover, if the determination of the useful life is carried out on the basis of the Classification of fixed assets, the useful life should be adjusted to the service life specified in the acceptance certificate. If the useful life is determined on the basis of OKOF codes, then for fully depreciated fixed assets the useful life should be established based on safety requirements.

Prepared answer:

Expert of the Legal Consulting Service GARANT

Galimardanova Yulia

Response quality control:

Reviewer of the Legal Consulting Service GARANT

Queen Helena

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.