In the program for preparing calculations for Form-4 FSS a regulated report is intended 4-FSS(chapter Reports - 1C-Reporting - Regulated reports).

To prepare the Calculation it is necessary in the workplace 1C-Reporting enter a command to create a new report instance using the button Create and select from the list of available reports Types of reports report 4-FSS.

In the starting form, indicate the organization and the period for which the Calculation is being prepared. Next, click on the button Open. As a result, the form of a new copy of the report for drawing up the Calculation according to FSS Form-4 is displayed on the screen.

In the header of the regulated report form, you must indicate the date of preparation of the Calculation (date of signing) in the field Signature date. By default it is considered that it is compiled Primary calculation, i.e. presented for the first time during the reporting period. To automatically fill in the Calculation based on infobase data, use the button Fill.

Calculation according to FSS Form-4 consists of:

Title page;

Section I "Calculation of accrued, paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred";

Section II "Calculation of accrued and paid insurance contributions for compulsory social insurance against accidents at work and occupational diseases and expenses for payment of insurance coverage."

All sections of the calculation are independent, so the order in which they are filled out does not matter.

Most of the indicators on the title page of the Calculation are filled in automatically.

The main indicators characterizing the policyholder (name, codes, registration number in the Federal Insurance Service of the Russian Federation, etc.) are filled in immediately when creating a report based on the directory data Organizations(chapter Main - Settings - Organizations) . If the cells with any information about the policyholder are left blank and these cells are not available for filling in manually (not highlighted in yellow), this means that the relevant data has not been entered into the information base. In this case, you need to add the necessary information in the directory Organizations, then press the button Update(button More - Update) toolbar update the report form.

The cells for the values of a number of indicators on the title page are highlighted in yellow. This means that the value in the cell is entered manually or (if the value is entered automatically by the program) can be changed manually. In particular, you must manually specify Policyholder code(it must be filled in with a choice from the list; such a choice is offered in the program).

All insurance premium payers in mandatory represent the Title Page, Tables 1 and 3 of Section I, Tables 6, 7 and 10 of Section II of the Calculation Form-4 of the FSS. If there are no indicators for filling out other tables of the Calculation (tables 2, 3.1, 4, 4.1, 4.2, 4.3, 4.4, 4.5, 5 of Section I, tables 8 and 9 of Section II), the corresponding tables are not filled out and not submitted.

By default, all sections and tables are shown in the report form. If individual tables are not filled out and presented in accordance with the Procedure, then you can set a mode for them in which they will not be displayed in the form of a regulated report - they will not be printed.

To prevent these tables from being displayed in the report form and printed, it is enough in the form Report settings(button More - Settings) on the tab Partition properties uncheck the boxes Show And Print for these tables.

If necessary, you can generate a printed form. Calculation can be done by clicking the button Seal located in the top command bar of the report form.

In a regulated report 4-FSS There is also the possibility of downloading the Calculation in electronic form, in a format approved by the Federal Tax Service of the Russian Federation. If the report must be uploaded to an external file, then the report form supports the upload function, and it is recommended to first check the upload for correct formatting of the report using the button Check upload. After clicking this button, an electronic report will be generated. If errors are detected in the report data that prevent the upload from being completed, the upload will be stopped. In this case, you should correct the detected errors and repeat the upload.

To download the Calculation for subsequent transfer through an authorized operator, you must enter the command Unload - Unload and indicate in the window that appears the directory where to save the Calculation file. The program assigns file names automatically.

You need to be careful when calculating contributions. If, for example, in January payment for December is reversed, then check yourself. If insurance premiums are recalculated in 1C ZUP 3.0, the contributions may be calculated incorrectly in 4-FSS.

Let's simulate an example. The employee was accrued sick leave in January for December. Accordingly, in 1C ZUP 3.0 the salary payment for this period was reversed and benefits were accrued. Since the employee was sick almost all of January, the salary for January did not cover the benefit:

When calculating wages for January, the employee was accrued 2,000 rubles in salary. At the same time, insurance premiums were accrued only from 2000 rubles to all funds. The reversal of 1C ZUP 3.0 was not automatically “seen” when calculating contributions for January:

In 1C ZUP 3.0 (8.3), insurance premiums are recalculated in a separate document. In the Taxes and Contributions section there is a document “Recalculation of insurance premiums”. You need to indicate the month of registration - January, the billing period is 2015 and click on the calculate button:

When recalculating insurance premiums, 1C ZUP 3.0 “sees” that it is necessary to recalculate contributions for the employee for the last year based on the base adjustment that occurred in the document:

4 FSS – Table 3

Next, fill out Form 4 – FSS. We look at the menu Taxes and contributions – Reports on taxes and contributions – Analysis of contributions to funds. From the Analysis of the contribution report, it is clear that in total payments were accrued in the amount of 1,876,068.21 rubles. If we compare it with 4-FSS, here the amount is different: 1,881,068.21 rubles:

The discrepancy is due to the fact that the reversal of salary payments in the amount of 5,000 rubles was not included in the database. Manual adjustment of 4-FSS in 1C ZUP 3.0 of line 1 of Section 1 of Table 3 will be required.

In this case, you need to look at what month the recalculation was made, and accordingly correct the amount from columns 4 or 5 or 6. In our example, the recalculation of contributions was in January, so January contributions with a base of 5,000 rubles do not go:

The amount of insurance premiums in Table 3 in 1C ZUP 3.0 was calculated correctly:

4 FSS – Table 6

You will also need to manually adjust the 4-FSS line 1 of Section 2 of Table 6 - the NS FSS database. At the same time, you need to not get confused and take into account that payments under GPC agreements are not shown in Table 6.

Now let's look at the report - Analysis of Social Insurance Fund contributions, total accrued:

The amount in line 1 of Table 6 will differ by the amount of GPC agreements:

You must first make a calculation: from the amount of 1,876,068.21 rubles. subtract the payment under GPC agreements - 12,000 rubles, you get the amount that should be:

This amount will differ from what is in 4-FSS Table 6 by 5,000 rubles. Therefore, we also adjust manually:

In Table 7 of Form 4-FSS, contributions from 5,000 rubles are taken into account correctly.

4 FSS – Table 1

1C ZUP 3.0 (8.3) provides the following documents for filling out specific lines of Table 1 of form 4-FSS:

In more detail, how to fill out the 4-FSS calculation in 1C ZUP 3.0 is discussed in the module.

Please rate this article:

Well, here comes another reporting company. Its peculiarity is that now all users of the 1C:ZUP 8 program have switched to working in the new edition of the program. In this regard, we decided to update our old article on filling out regulated reporting to the Social Insurance Fund and help you understand this report in the new program.

First of all, check whether the organization details necessary to fill out this report are filled out in the program. To do this, open the organization card in the menu Settings:

We check the correctness of filling out the section on the Social Insurance Fund:

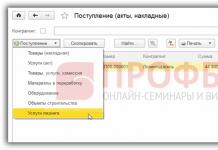

The amounts of accrued insurance premiums are filled into the report automatically, but we would like information about the transferred contributions: amounts, payment order numbers and their dates to also be entered into 4-FSS automatically. To do this, you need to make a special document for each payment order. You can find it in the section Taxes and fees:

We record each fact of transfer of contributions to the Social Insurance Fund in a separate document indicating all the payment details:

After this, you can proceed to filling out the report itself. In chapter Reporting and certificates go to block 1C-Reporting:

If the 4-FSS report has already been generated in the program, then when creating a new one, the form can be found on the tab Favorites:

If the report is not in the favorites, then we will find it in the general list of all reports:

If you keep everything in the program correctly, all details and documents are filled out correctly, then the report will be filled out automatically. And pay attention to the payment of insurance premiums too:

Those. if you are within a quarter, every time you transfer contributions to the budget, do not be lazy and fill out the document Payment of insurance premiums to funds, then you will spend a couple of minutes filling out the report.

Those who submit reports directly from the program immediately click on the button Send:

Well, immediately within 2-3 minutes we receive a protocol from the FSS about submitting reports, which the program immediately informs us about.

Eh, I love 4-FSS. If only all reports were like this. Although of course there is an even simpler form. For example, SZV-M, but that's a completely different story.

In the general list of reports, information about submitted or failed forms is also very informative and always at hand, right in the program:

Oh, if only everything in accounting life was so simple...

That's all I wanted to tell you about filling out 4-FSS in the 1C: ZUP program. If you have any questions, write. I will try to answer as much as possible, but you understand: now the busy time has begun.

We create a new 4-FSS report in 1C 8.3 Accounting 3.0:

Set the reporting period - half a year, click Create:

First, check the Title Page. In 1C 8.3 Accounting 3.0, the policyholder code is filled in automatically:

The first part of the code characterizes the tariff. In our case, the basic tariff is set:

The second part of the code characterizes the taxation system:

The third part of the code indicates a budgetary institution or other payer:

How to calculate the average number of employees and enter data on the average number of employees in 1C 8.3 (8.2), including how to check this calculation in 4-FSS.

OKVED code in form 4-FSS

The OKVED code in section I is indicated only by payers applying reduced tariffs. Enter the code for the main type of economic activity:

All insurers indicate the OKVED code in section II and enter the code for the main type of economic activity, which was confirmed by the Social Insurance Fund:

In 1C 8.3 Accounting 3.0, the OKVED code is filled out in both Section I and Section II. In order for Form 4-FSS to be filled out “perfectly” according to the established procedure, this code must be removed in Section I, since in our case the organization applies the basic tariff:

4-FSS – Table 3

Let’s check Table 3 to see how the basis for calculating contributions has developed. You can check the data using the accrued salary summary or the specialized report “Analysis of contributions to funds”.

The summary of accrued salaries in 1C 8.3 is located:

Select the Complete set of accruals, deductions and payments:

Set the period and click Generate:

Look at the Accrued line:

We see that this amount is reflected in form 4-FSS:

Payments that are not subject to contributions are not included in the 4-FSS reporting. For example,

- payments not related to employment relations or the concluded civil contract agreement,

- gifts under a gift agreement,

- payments to non-employees of the organization,

- dividends.

Analysis of contributions to funds in 1C 8.3 is located in the section Salaries and Personnel - Salary Reports:

In the window that appears, we look at the amounts Accrued in total, Not taxed, which fall into form 4-FSS:

You can also check the taxable contribution base:

We also check in line 8 those amounts from the base for calculating contributions that are subject to a special tariff. In particular, the amount of payments to foreigners temporarily staying:

If line 8 is completed, then you need to check the completion of Table 3.1:

Read how insurance premiums for foreign workers are calculated in 1C 8.3 programs.

4-FSS – Table 1

Table 1 is checked according to the data of settlements with the Social Insurance Fund, we compare it with account 69.01. If the SALT account has a debit balance on account 69.01, then the debt owed to the fund is reflected. If the credit balance is at the beginning, then this is the debt owed by the insurance premium payer:

In our case, this amount is reflected in Form 4-FSS in line 1 of Table 1:

Next, we look at the debit turnover for the subconto Insurance expenses are accrued benefits, which are reflected in line 15 of Table 1 of Form 4-FSS. In our example of filling out Table 1, a discrepancy arose:

This discrepancy in 1C 8.3 Accounting 3.0 is due to the fact that filling out 4-FSS occurs on the basis of a special register for the accumulation of benefits. Data in this register is entered either by document Sick leave or a document Contribution accounting operations. If the 1C 8.3 user forgot to enter the Contribution Accounting Transaction, then the benefits do not fall into line 15 of Table 1 of Form 4-FSS and Table 2.

Document Contribution accounting transactions in 1C 8.3 you can find :

In our case, in 1C 8.3, using the Payroll document, benefits were calculated for the birth of a child. The appropriate type of accrual and reflection in the debit of account 69.01 were established:

Accordingly, the following entry was made in accounting:

However, the Contribution Accounting Transaction was not entered. Therefore, a discrepancy arose. To eliminate the discrepancy, we will enter this document, fill in the data and post the document:

Debit turnover for subaccount Tax (contributions) accrued/paid on account 69.01 - this is the payment of insurance premiums, which is reflected in line 16 of Table 1:

Filling out the remaining lines of Table 1 is provided when registering special documents in 1C 8.3:

- Pages 1/12 and 9/19 – balance as of 01/01/30/06 according to the accumulation register “Settlements with funds for insurance premiums”;

- Page 2 – document “Payroll”, tab “Contributions”;

- Page 3 – document “Report of verification of insurance premiums”;

- Page 5 – manual operation. In this case, it is necessary to reflect both in accounting and in the accumulation register Settlements with the fund for insurance premiums:

- Page 6 – document “Receipt to current account”, account Kt = 69.01, type of payment = Received from the executive body of the Social Insurance Fund;

- Page 15 – document “Sick Leave”, document “Contribution Accounting Operation” of the “Child Care Benefits”, “Social Insurance Benefits” tabs;

- Page 16 – document “Write-off from current account”, account Dt = 69.01, type of payment “Tax (contributions) accrued/paid”.

4 FSS – Table 2

Table 2 of form 4-FSS in 1C 8.3 is filled out automatically based on the register of benefits. Everything that was accrued either by the Sick Leave document or by the Contribution Accounting Transaction document falls into Form 4-FSS.

When filling out Table 2 in 1C 8.3, you need to pay attention to line 16, where the amount of accrued and unpaid benefits, that is, delayed payments, is indicated for information. In 1C 8.3 Accounting 3.0, this line is filled in manually:

4-FSS – Table 5

In our case, in Table 2, Column 5, the amount was filled in, since there was payment for additional days off to care for disabled children, which is reimbursed by the Social Insurance Fund from the federal budget:

Accordingly, Table 5 was automatically filled in in 1C 8.3:

4-FSS – Table 6

In Table 6, the number of working disabled people and the OKVED code in 1C 8.3 are entered automatically, and the number of employees working with harmful factors is filled in manually, if necessary:

The data in Table 6 is checked using the report Analysis of Social Insurance Fund contributions of the Social Insurance Fund section:

In our example of filling out table 6, all amounts are the same:

Discrepancies between the third and sixth tables may arise if there were payments under GPC agreements. Since these payments are not subject to FSS NS contributions, they are therefore not included in Table 6.

Also, discrepancies between tables 3 and 6 may arise regarding payments to temporarily staying, highly qualified foreigners, since these payments are not subject to FSS contributions, but are subject to FSS NS contributions.

In other cases, the data in tables 3 and 6 must match. It is worth noting that in Table 6 there is no limit on the base for calculating contributions.

In Table 6, lines 5-8 indicate the size of the tariff, since discounts or surcharges can be established to the insurance rates of the Federal Social Insurance Fund, so if necessary, then in 1C 8.3 these lines are filled in manually.

4-FSS – Table 7

The data in table 7 is verified with SALT according to account 69.11:

The balance at the beginning is either credit or debit - respectively, either line 1 or lines 12-14. Credit turnover is accrued for the payment of contributions. Debit turnover is expenses by type Tax (contributions) accrued/paid, that is, payment of contributions:

Payment of contributions in line 16 in 1C 8.3 is filled out automatically from bank statements. At the same time, it is important to indicate the details of the payment document in bank statements: incoming number and date:

Details of the payment document are reflected in the report:

4-FSS – Table 10

Table 10 in 1C 8.3 Accounting 3.0 is filled out manually as of the beginning of the year. In our case, there are 3 certified workplaces for which a special assessment of working conditions was carried out:

The calculation for 9 months of 2017 is provided according to the new form 4-FSS, approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 as amended by Order of the FSS of the Russian Federation dated June 7, 2017 No. 275. We talk about compiling a report in the program "1C: Salary and Personnel Management 8 (ed. 3)".

Policyholders submit quarterly calculations to the territorial bodies of the FSS of the Russian Federation in form 4-FSS on paper no later than the 20th month following the reporting period, and in the form of an electronic document no later than the 25th following the reporting period (Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

Therefore, the calculation in form 4-FSS for 9 months of 2017 must be submitted no later than:

- October 20, 2017 – on paper;

- October 25, 2017 – in the form of an electronic document.

If the policyholder submits a calculation in Form 4-FSS in violation of the deadline established by law, he may be held accountable by the territorial bodies of the FSS of the Russian Federation in the form of a fine, the amount of which is determined separately for each type of compulsory social insurance (letter of the FSS of the Russian Federation dated March 22, 2010 No. 02-03 -10/08-2328).

Preparation for drawing up calculations according to Form 4-FSS

Preparation for drawing up calculations according to Form 4-FSS

When preparing a calculation using Form 4-FSS in programs, most indicators in all sections of the calculation are filled in automatically.

General information about the organization

To correctly fill out the calculation for the organization, the following must be indicated: full name, in accordance with the constituent documents, TIN, KPP, OGRN, OKVED codes, registration number of the policyholder, subordination code, registration address and information about the head of the organization.

The necessary information is indicated in the directory Organizations(chapter Setup - Enterprise - Organizations) (Fig. 1).

Information about the tariff of insurance premiums

The rate of contribution for compulsory social insurance against accidents and occupational diseases is established for the policyholder for each year by the territorial body of the Federal Social Insurance Fund of the Russian Federation, depending on the class of professional risk of the type of activity carried out by the policyholder. The established tariff rate for calculating insurance premiums for compulsory social insurance against accidents and occupational diseases is entered in the field Contribution rate to the Social Insurance Fund NS and PZ indicating the start date of its use.

Moreover, the rate is indicated taking into account the discount/surcharge (if it is established for the policyholder), i.e. the resulting rate at which insurance premiums for insurance against accidents and occupational diseases should be calculated.

Accounting for income for the purposes of calculating insurance premiums

For the correct accounting of income received by individuals for the purposes of calculating insurance premiums and for further filling out the indicators for calculating the base for calculating insurance premiums in the calculation, it is also recommended to check and, if necessary, clarify the settings of the types of accruals with which the program makes accruals to employees for worked and unworked time.

All payments and other rewards in favor of individuals in the program are calculated using accrual types (section Settings - Accruals). For each type of accrual on the tab Taxes, contributions, accounting in field Insurance premiums the type of income must be indicated for the purposes of calculating insurance premiums (Fig. 3).

When carrying out documents with the help of which accruals are made in favor of individuals (for example, documents Awards, Material aid), the corresponding type of income is recorded for the purposes of calculating insurance premiums. This data is used to determine the basis for calculating insurance premiums and filling out Table 1 of the calculation.

You can obtain data on the formation of the base for calculating insurance premiums using the report Analysis of contributions to funds(chapter Taxes and fees - Tax and contribution reports - Analysis of contributions to funds- report option FSS_NS).

When registering payments under GPC agreements, the need to charge insurance premiums for insurance against accidents and occupational diseases is indicated in the document Contract (works, services).

In addition, the program can register other income received by individuals from the organization. For such income, the following is indicated for calculating insurance premiums:

- when registering payments to former employees - in the directory Types of payments to former employees;

- when registering other income of individuals - in the directory Types of other income of individuals;

- when registering copyright agreements with individuals - in the directory Types of copyright agreements;

- when registering prizes, gifts from employees - if insurance premiums need to be calculated on the cost of the gift, then in the document Prize, gift checkbox is checked The gift (prize) is provided for by the collective agreement of the organization, in this case the income is recorded as income entirely subject to insurance premiums.

Calculation of insurance premiums

During the billing (reporting) period, at the end of each calendar month, policyholders are required to calculate monthly mandatory payments for insurance premiums based on the amount of payments and other remunerations accrued from the beginning of the billing period until the end of the corresponding calendar month, and the tariffs of insurance premiums, as well as discounts ( premiums) to the insurance tariff minus the amounts of monthly mandatory payments calculated from the beginning of the billing period to the previous calendar month inclusive (Article 22.1 of Federal Law No. 125-FZ). Insurance premiums are calculated separately for each individual.

Insurance premiums are calculated from employee income in the program using the document Calculation of salaries and contributions when completing the procedure for filling out a document or other document by which contributions were calculated ( Dismissal, Holiday to care for the child). The amounts of accrued insurance premiums for each individual are reflected on the tab Contributions document. When posting the document, the amounts of accrued contributions are recorded.

Based on these data, the calculation fills in information about the amounts of accrued insurance premiums in Table 2. You can obtain data for analyzing the amounts of accrued insurance premiums using the report Analysis of contributions to funds.

You can check the correctness of calculation of insurance premiums for a certain period using the report Checking the calculation of contributions(chapter Taxes and contributions - Reports on taxes and contributions - Checking the calculation of contributions- report option FSS_NS).

Calculation of contributions from payments in favor of disabled people

If the organization employs disabled people of groups I, II or III, in respect of whose payments insurance premiums for insurance against accidents and occupational diseases are paid in the amount of 60% of the insurance rate (clause 2 of article 2 of the Federal Law of December 22, 2005 No. 179- Federal Law), then it is necessary to fill out information about disability (Fig. 5).

In calculations using Form 4-FSS, the amount of accruals in favor of disabled individuals is shown separately in column 4 of Table 1.

Insurance Cost Data

Expenses for compulsory social insurance against accidents and occupational diseases made by the employer are counted towards the payment of insurance premiums for insurance against accidents and occupational diseases. Benefits for temporary disability due to an accident at work and occupational disease are fully reimbursed from the funds of the Federal Social Insurance Fund of the Russian Federation.

In the program, the accrual of such benefits is registered using a document Sick leave(chapter Salary - Sick leave- button Create or section Salary - Create - Sick leave). Based on data on the amounts assigned in the current month for temporary disability benefits in connection with an industrial accident and occupational disease, the program records the costs of paying benefits, which are subject to financing from the Federal Social Insurance Fund of the Russian Federation.

You can get data on accrued benefits using the report Register of benefits at the expense of the Social Insurance Fund(chapter Taxes and fees - Reports on taxes and contributions - Register of benefits at the expense of the Social Insurance Fund). Data on benefits is used when filling out table 3 of the calculation.

Information about paid insurance premiums

Policyholders are required to pay mandatory payments for insurance premiums no later than the 15th day of the calendar month following the calendar month for which the monthly mandatory payment for insurance premiums is calculated. If the specified deadline for payment of the monthly obligatory payment falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the expiration date of the deadline is considered to be the next working day following it (Clause 4 of Article 22 of Federal Law No. 125-FZ ).

The amount of insurance premiums to be transferred to the Social Insurance Fund of the Russian Federation is determined in rubles and kopecks (without rounding) (Clause 5, Article 22 of Federal Law No. 125-FZ).

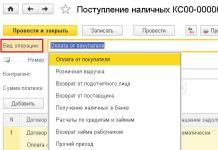

The fact of payment of insurance premiums in the program is reflected using a document (section Taxes and fees – Payment of insurance premiums to funds) (Fig. 6). Indicators of paid contributions are reflected in table 2 of the calculation. Payment of contributions accrued according to inspection reports is also recorded by document Payment of insurance premiums to funds.

Drawing up calculations according to form 4-FSS

Drawing up calculations according to form 4-FSS

The calculation according to Form 4-FSS consists of:

- Title page;

- Section "Calculation of accrued and paid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases";

- Table 1 "Calculation of the base for calculating insurance premiums";

- Tables 1.1 "Information required for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ";

- Table 2 "Calculations for compulsory social insurance against accidents at work and occupational diseases";

- Table 3 "Expenses for compulsory social insurance against accidents at work and occupational diseases";

- Table 4 "Number of victims (insured) in connection with insured events in the reporting period";

- Table 5 "Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year."

The program contains a regulated report for preparing calculations in form 4-FSS 4-FSS(chapter Reporting, certificates – 1C-Reporting) (Fig. 7).

To compile a report, you must be at your workplace 1C-Reporting enter a command to create a new report instance using the button Create and select a report with the name from the list of available reports 4-FSS by button Choose.

In the start form, indicate the organization (if the program maintains records for several organizations) for which the report is being compiled and the period for which it is being compiled. Next, click on the button Create.

As a result, the form of a new copy of the report is displayed on the screen for drawing up calculations according to Form 4-FSS (Fig. 8). To automatically fill out a report based on infobase data, use the button Fill.

Submission of calculations in form 4-FSS to the FSS authorities of the Russian Federation

Submission of calculations in form 4-FSS to the FSS authorities of the Russian Federation

All policyholders in mandatory represent the title page, tables 1, table 2, table 5 of the calculation in form 4-FSS.

If there are no indicators to fill out other calculation tables (tables 1.1, 3, 4), the corresponding tables are not filled out or submitted.

Insurers who have an average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceeds 25 people, as well as newly created (including during reorganization) organizations in which the number of specified individuals exceeds this limit, submit calculations in Form 4-FSS in the formats and in the manner established by the body monitoring the payment of insurance premiums, in the form of electronic documents, signed with an enhanced qualified electronic signature.

Insurers and newly created organizations (including during reorganization), whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period is 25 people or less, submit calculations on paper. However, such policyholders have the right to submit calculations in the form of electronic documents.

Insurers participating in the implementation of the pilot project do not fill out Table 3 and do not submit it (Order of the Federal Insurance Service of the Russian Federation dated March 28, 2017 No. 114).

Setting up the composition of the calculation

By default, all sections and tables are shown in the report form. If individual tables are not filled out and presented in accordance with the Procedure, then you can set a mode for them in which they will not be displayed in the form of a regulated report and will not be printed.

To prevent tables from being displayed in the report form and not being printed, click the button More located in the top command bar of the report form, and select Settings. In the shape of Report settings on the bookmark Partition properties checkboxes must be unchecked Show And Print for these tables (Fig. 9).

Checking the calculation

After preparing the report 4-FSS it should be written down.

Before transferring it to the FSS of the Russian Federation, it is recommended to check the calculation for errors. To do this, use the button Examination - Check reference ratios. After pressing the button, the result of checking the control ratios of the indicators is displayed. In this case, you can see either those control ratios of indicators that are erroneous, or all the control ratios of indicators that are checked in the report 4-FSS(by unchecking Show only erroneous relationships) (Fig. 10).

When you click on the required ratio of indicators, in the column Decoding the ratios of indicators, a transcript is displayed that shows where these numbers came from, how they came together, etc. And when you click on a certain indicator in the transcript itself, the program automatically shows this indicator in the report form itself.

In addition, you can check control ratios when printing and uploading, if in the report settings (button More - Settings- bookmark General) check the box Check the ratio of indicators when printing and unloading.

Print calculation

If necessary, you can generate a printed calculation form by clicking the button Seal located in the top command bar of the report form. When you click on the button, the report form will immediately be displayed on the screen for preview and additional editing, generated for printing sheets (if necessary). Next, click on the button to print. Seal.

In addition, from this form (preview), you can save the report as a file to the specified directory in PDF document format (PDF), Microsoft Excel (XLS) or in spreadsheet document format (MXL) by clicking on the button Save(Fig. 11). The program assigns a name to the file automatically.

Uploading calculations electronically

In a regulated report 4-FSS There is also the possibility of downloading the calculation in electronic form, in a format approved by the Federal Tax Service of the Russian Federation. If the report must be uploaded to an external file, then the report form supports the upload function, and it is recommended to first check the upload for correct formatting of the report using the button Check - Check upload.

After clicking this button, an electronic report will be generated. If errors are detected in the report data that prevent the upload from being completed, the upload will be stopped. In this case, you should correct the detected errors and repeat the upload. To navigate through errors, it is convenient to use the error navigation service window, which is automatically brought up on the screen.

To download a calculation for subsequent transfer through an authorized operator, you must enter the command Unload and indicate in the window that appears the directory where the calculation file should be saved (Fig. 12). The program assigns file names automatically.

Sending calculations to the portal of the Federal Social Insurance Fund of the Russian Federation

In programs 1C containing a subsystem of regulated reporting, a mechanism has been implemented that allows directly from the program, without intermediate uploading to an electronic presentation file and using third-party programs, to perform all actions for submitting calculations in form 4-FSS in electronic form with an electronic digital signature (if the 1C-Reporting service is connected ").