Step 1. Receiving the leased item

Step 2. Accounting for leasing payments

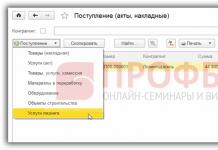

An advance leasing payment, like a regular service in 1C 8.3, is taken into account by the Receipt document (act, invoice). This document is created from the Purchases tab – then Receipts (acts, invoices) – click Receipts:

The object is identified on the lessor's balance sheet

From the list elements, select Services (act). In field Calculations if leasing is not the main activity, then you need to select accounting account 76.05:

For each individual service, you can adjust cost accounting accounts, as well as enter cost analytics:

Select Leasing Services in the operation selection list. Filling out these documents is not much different:

- The main thing that is necessary is to fill out the accounting accounts;

- Advance rules - do not count if the contract also includes monthly purchase price along with leasing payments;

- When receiving the original, you must set the Original received flag;

- Don’t forget to enter the details of the incoming invoice and register it using the Register button.

Step 3. Payment of advance payments

Client-bank is not used

In 1C 8.3, it is created in the Bank and cash desk tabs - then Payment orders and based on it we register. In the payment order:

- The type of transaction must be specified as Payment to supplier;

- The amount is indicated in full with the redemption price. The distribution of this amount will be in 1C postings;

- Check the Paid box;

- A debit from a current account is registered via Enter document debit from a current account:

We establish accounting accounts in the document if:

- The object is identified on the lessor’s balance sheet – 05;

- The object is identified on the balance sheet of the lessee - 07.2.

Set the Debt repayment value to By document. When selecting a document, do not forget to set the required accounting account:

The Confirmed by bank statement flag must be cleared and set when the payment goes through. Movements in 1C 8.3 are formed only after checking this box.

Client bank used

If you use , then you do not need to create a Payment Order document. The debit from the current account is filled out based on the uploaded payment order or manually:

- For the first option, you need to sort the documents in the payment order journal using the selection fields and find the required payment order.

- For the second option, use the command Write-off from the document register. When creating manually, do not forget to set the transaction type to Payment to supplier.

From the document Debiting from a current account, do not forget to register an advance invoice.

Step 4. Calculate depreciation

For a leasing object, it is necessary to register only if the object is identified on the balance sheet of the lessee.

Depreciation, as well as the recognition of leasing payments in the accounting system in 1C 8.3, are formed by the regulatory operation Depreciation and depreciation of fixed assets, as well as the operation Recognition of leasing payments in the accounting system when closing the month, respectively (Operations - Closing the month):

Important! Depreciation is accrued in the next month after acceptance for accounting.

Movements of the operation Depreciation and wear of the OS:

Recognition of leasing payments in tax accounting:

The depreciation sheet can be generated in the fixed assets and intangible assets tabs - then the fixed asset depreciation sheet:

Step 5. Status of settlements with the lessor

The status of settlements with the lessor in 1C 8.3 can be viewed using the Account Analysis report. Is the entire redemption price transferred to the lessor:

- Analysis of account 60.02 - shows how much leasing payments have been accrued and paid;

- The object is identified on the lessor’s balance sheet - analysis of account 05;

- The object is identified on the lessee’s balance sheet - account analysis 07.2.

Step 6. Transfer of ownership to the lessee

The object is identified on the lessor's balance sheet

There is no standard document in 1C 8.3 Accounting, so we will use the Operation document.

You can create an Operation document from the Operations section, where we select Operations entered manually, then click Create and select Operation:

The document must reflect the write-off from the off-balance sheet account, as well as reflect the depreciation of the fixed asset. The document Receipt (act, invoice) in 1C 8.3 registers the redemption value of the OS.

The acquisition of an OS in 1C 8.3 is documented in the document Receipt. It can be found in the Purchases or OS and Intangible Assets tab, in the latter the document is called Equipment Receipt.

Key points when preparing the Admission document (it doesn’t matter which link you use to create it!):

- The fixed asset is entered in the Equipment table;

- Payment accounts can be left as default;

- Don't forget to register your invoice:

The Receipt document records all advances at the purchase price, and also records the receipt on the lessee's balance sheet.

In the document Acceptance for accounting of fixed assets:

- OS event – indicate acceptance for accounting with commissioning;

- Identify the financially responsible person and indicate the location of the OS.

In the Non-current asset section:

- Type of operation – install Equipment;

- Receipt method – set the value to Purchase for a fee.

The bookmarks OS, BU, NU, Depreciation bonus are filled in according to the accounting data of the accepted fixed asset:

The object is identified on the balance sheet of the lessee

The transfer of ownership of the leased object in 1C 8.3 is formalized by the document Redemption of the leased object in the OS and Intangible assets tabs - further Redemption of the leased object. This document in 1C 8.3 is automatically filled in when selecting a counterparty agreement, if the document Acceptance of leasing has already been drawn up under the selected agreement. The table part can be filled out using the Fill button:

Let's consider an example of accounting for leasing in 1C Accounting 8.3, when fixed assets are listed on the balance sheet of the lessee.

First, we will receive the property. Let's go to the "OS and intangible assets" menu, then in the "" section select "Access to leasing". To create a new document, click the “Create” button in the window that opens. A new document window will open.

First, fill out the header of the document. Let's indicate there:

- organization;

- counterparty;

- agreement with the counterparty;

- indicate the settlement account 76.07.1 .

Upon receipt of 1C 8.3 on the lessee’s balance sheet, we make the following entries:

Registration of equipment and other property

After you have created the receipt of fixed assets, you need to take them into account. To do this, in the same section, select “ “.

Click the “Create” button and fill out the document:

- We indicate that we accept equipment for registration with;

- indicate the financially responsible person (MRP);

- indicate the location of the fixed asset.

Get 267 video lessons on 1C for free:

- type of operation - equipment;

- method of receipt - under a leasing agreement;

- Next, we select the counterparty, contract and equipment from the “Nomenclature” directory.

On the “Fixed Assets” tab, we indicate the property already from the “Fixed Assets” directory. Essentially, this is a fixed asset card.

Information for calculating depreciation is located on the “Accounting” tab. Here we fill in the following fields:

- accounting account: 01.03;

- accounting procedure: ;

- Next, we indicate in what order depreciation will be calculated.

I have it filled in like this:

On the “Tax Accounting” tab, as a rule, the same parameters are indicated.

Now the document can be posted. Please note that the data entered when accepting a fixed asset for accounting is reflected automatically in its card:

How to reflect the monthly lease payment

The leasing payment in the program is reflected as a receipt document in the “Purchases” menu. In the latest releases of 1C 8.3, the “Leasing Service” operation was added to it:

An example of postings for leasing services in 1C Accounting looks like this:

Leasing is a popular form of financing capital investments. After all, without incurring significant one-time costs compared to the value of the property, the lessee, having concluded a leasing agreement with the lessor and paying lease payments, will receive the necessary property for temporary possession and use (Article 2 of Federal Law No. 164-FZ of October 29, 1998).

We will show you with examples in our consultation how to keep accounting records for the lessee if the object is accounted for on the balance sheet of one or the other party to the agreement.

Leasing transactions if the property is on the lessor’s balance sheet: example

Let's imagine typical leasing transactions with the lessee, if the object is listed on the lessor's balance sheet, using the following example.

In accordance with the leasing agreement, the fixed asset object is transferred to the lessee for a period of 5 years. The total amount of leasing payments for this period is 3,540,000 rubles, incl. VAT 18%. Payments under the agreement are made monthly.

The leasing agreement also stipulates that at the end of its validity period the object is purchased by the lessee at the redemption price of 34,220 rubles, incl. VAT 18%.

| Operation | Account debit | Account credit | Amount, rub. |

|---|---|---|---|

| Leased property is registered off balance sheet | 001 “Leased fixed assets” | 3 540 000 | |

| Monthly lease payment transferred (3 540 000 / 60) | 76 “Settlements with various debtors and creditors”, subaccount “Debt on leasing payments” | 51 “Current accounts” | 59 000 |

| Monthly lease payment taken into account (59 000 * 100/118) | 20 “Main production”, 26 “General business expenses”, 44 “Sales expenses”, etc. | 50 000 | |

| VAT included in the leasing payment (50 000 * 18%) | 19 “VAT on purchased assets” | 76, subaccount “Debt on leasing payments” | 9 000 |

| Accepted for deduction of VAT on leasing payment | 19 | 9 000 | |

| ………… | |||

| Leased property was written off off-balance sheet due to the expiration of the leasing agreement | 001 “Fixed assets” | 3 540 000 | |

| 60 “Settlements with suppliers and contractors” | 51 | 34 220 | |

| Leased property was accepted for accounting at redemption value as part of inventory | 10 "Materials" | 60 | 29 000 |

| VAT is included on the redemption value of the property | 19 | 60 | 5 220 |

| Accepted for deduction of VAT from the redemption price | 68 “Calculations for taxes and fees” | 19 | 5 220 |

Leasing transactions if the property is on the balance sheet of the lessee: example

Let's present the accounting of leasing on the lessee's balance sheet (posting) using the example discussed above, supplementing it with information that depreciation on leased property is calculated using the straight-line method.

| Operation | Account debit | Account credit | Amount, rub. |

|---|---|---|---|

| The leasing object was accepted for accounting (3,540,000 * 100 / 118) | 08 “Investments in non-current assets” | 3 029 000 | |

| Presented VAT by the lessor | 19 | 76, subaccount “Rental obligations” | 545 220 |

| The object is accepted for accounting as part of fixed assets | 01 “Fixed assets”, subaccount “Property under lease” | 08 | 3 029 000 |

| Lease payment transferred (3,540,000 / 60) | 76, subaccount “Debt on leasing payments” | 51 | 59 000 |

| Monthly lease payment taken into account | 76, subaccount “Rental obligations” | 76, subaccount “Debt on leasing payments” | 59 000 |

| Accepted for deduction of VAT regarding the leasing payment | 68 | 19 | 9 000 |

| Monthly depreciation accrued (3 029 000 / 60) | 20, 26, 44, etc. | 02 “Depreciation of fixed assets”, subaccount “Property under lease” | 50 483 |

| ………… | |||

| The debt for the redemption value of the leased property is reflected | 76, subaccount “Rental obligations” | 34 220 | |

| The redemption value of the leased property is listed | 76, subaccount “Debt for redemption of property” | 51 | 34 220 |

| Fixed assets were transferred from leased to owned | 01, subaccount “Own fixed assets” | 01, subaccount “Property on lease” | 3 029 000 |

| Depreciation on leased property that has become the property of the lessee is reflected | 02, subaccount “Property on lease” | 02, subaccount “Own fixed assets” | 3 029 000 |

The concept of leasing appeared in our country relatively recently. This is a kind of form of lending to an enterprise when it purchases fixed assets. Leasing objects can be: equipment, structures, enterprises, transport, etc. In essence, leasing is a long-term rental of property with subsequent acquisition of ownership.

Lease purchase and registration

To record leasing on the lessee’s balance sheet, the 1C 8.3 program provides a special document “Receipt of leasing”, which can be found in “OS and intangible assets - Receipt of OS”.

Fig.1

Inside the document, please note that the accounting account is 76.07.1. We will also enter data on the purchased equipment into the tabular section. We indicate the accounting account 08.04.2* – “Acquisition of fixed assets”.

*Does not work on account 08.04.2 release 3.0.66.60.

Fig.2

We carry it out and check the accounting entries.

- Type of operation – equipment (in our example);

- Number/date – fill in the date, the number is entered automatically;

- MOL (material-responsible person) – we select and appoint an employee of the organization;

- In the location we indicate where the equipment will be used;

- OS event – in accordance with our task, we indicate what will be registered and put into operation.

After that, fill out the tabs that are below, the first of them is Non-current asset. We fill in the following information:

- Under a leasing agreement;

- Counterparty – lessor;

- Agreement – indicate our leasing agreement;

- Equipment is a leased item;

- Warehouse – indicate the warehouse where our equipment will be delivered;

- Our account is 08.04.2 “Purchase of OS”.

Fig.4

The OS tab is filled out from the directory of the same name, where we must create a new position. Click “+” and proceed to filling out the directory.

Fig.5

Fill in the following fields in the form that opens:

- Accounting group – vehicles;

- Name – we have “Car”;

- Included in the group - OS.

Fig.6

Click “Save and close.” A new position has appeared in the directory, so we feel free to continue filling out the tab by selecting our new fixed asset from the list; the inventory number is assigned automatically.

Fig.7

Filling out data for accounting purposes is carried out in the tab of the same name in the following fields:

- Account – 01.03 Leased property;

- The order is from the “Depreciation calculation” list;

- Method – Linear;

- In the accrual account we put 02.03 “Depreciation of leased property”;

- In the display of expenses, we set the debit of which accounting account the depreciation will be reflected. We have 20.01 “OS”.

- In the term, we indicate how many years we plan to depreciate this equipment; in our example, 10 years x 12 months equals 120 months.

Fig.8

On the next tab, fill in the tax data in the following fields:

- In order of inclusion in expenses – Depreciation;

- Initial cost - indicates the amount of costs excluding VAT of the lessor for the purchase of equipment. This information can be found in the leasing agreement;

- In the method of displaying costs for leasing payments, set “Depreciation” (account 20.01);

- On a monthly basis – 10 years x 12 months. That is, it turns out that the equipment is planned to be depreciated over 120 months.

Fig.9

We post the document and use the DtKt button to control the postings: Dt 01 – Kt 08 “The asset has been accepted for accounting.”

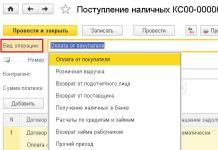

The lessor will issue a monthly invoice for leasing services. To reflect these services in the 1C 8.3 program, “Receipts (acts, invoices)” is used, which is located in the “Purchases” menu.

Fig.10

When creating a receipt, indicate “Leasing services”.

Fig.11

We begin to fill out the document, be sure to indicate the number and date of the act received from the lessor, the details of the leasing agreement, as well as the organizations of the lessor and the lessee. In the “Nomenclature” we indicate “Leasing payment”, in “Amount” - the amount from the lessor’s act (invoice). Fill in the invoice number and date and click the “Register” button.

Fig.12

Please also note that our accounting account for settlements with the counterparty is 76.07.2, and for advances – 60.02.

Fig.13

The receipt data is filled in, select Post. Records of expenses for leasing services are generated in accounting and accounting records. Click DtKt and check the generated wiring.

Fig.14

In accounting, leasing payments are not included as expenses, but are accounted for as a debit 76.07.1 Lease obligations. The cost of leased equipment is recorded as a credit to this account. Thus, after all leasing payments have been made under the leasing agreement, account 76.07.1 will be closed.

Although equipment purchased on lease is not the property of the organization, it still must be registered and depreciated accordingly. This is done through the routine operation of closing the month in “Operations - Closing the period”.

Fig.15

In conclusion, it is important to pay attention to the fact that for leasing transactions there is a difference between accounting and tax accounting, since in the latter leasing expenses are taken into account minus tax depreciation. The 1C 8.3 program will automatically calculate depreciation and leasing expenses, and also reflect the difference between accounting and tax accounting. To do this, in 1C 8.3 it is necessary to correctly draw up the accounting policy of the enterprise.

Let's consider an example of accounting for leasing in 1C Accounting 8.3, when fixed assets are listed on the balance sheet of the lessee. Receipt of equipment leasing First, let's do the receipt of property. Let’s go to the “Fixed assets and intangible assets” menu, then in the “Receipt of fixed assets” section, select “Receipt of leasing”. To create a new document, click the “Create” button in the window that opens. A new document window will open. First, fill out the header of the document. Let's indicate there:

- organization;

- counterparty;

- agreement with the counterparty;

- We indicate the settlement account as 76.07.1.

Next, fill in the “Equipment” tab. We will indicate what equipment we are bringing, quantity and price. Upon receipt of the lessee's balance sheet 1C 8.3, we make the following entries: Registration of equipment and other property After the receipt of fixed assets has been created, it is necessary to accept them for accounting.

If you need to change the reflection of leasing payment expenses, or make adjustments to depreciation accounting, you can use the document “Asset Depreciation Parameters” from the “Assets and Intangible Assets” menu. Select the appropriate type of operation when creating a new document, depending on what goals you are pursuing.

Depreciation of equipment Despite the fact that the equipment was purchased on lease and does not yet belong to us, we still registered it with our company. In this regard, depreciation will be calculated at the close of the month (monthly for this example).

This procedure is standard and if difficulties arise, you can refer to our other article, where everything is described in detail.

Accounting for leasing by the lessee

Closing the month: Depreciation and Recognition of Leasing Payments in Tax Accounting MENU: Operations \ Closing the period \ Closing the month. We are simply conducting the Closing of the month of MARCH 2015. There won't be anything special.

We will begin to accrue depreciation only from the next month after the fixed asset is put into operation. Leasing payments will also begin to accrue from next month.

Everything will happen only in APRIL 2015. Therefore, we are closing the Month of APRIL 2015. And now the first depreciation charge appears: The posting correspondence is clear.

Where did these numbers come from? According to accounting, our fixed asset “village” was credited to account 01 in the amount of 3,240,000 rubles (document Acceptance of fixed assets for accounting). The useful life in our accounting is 6 years = 72 months.

This means depreciation in accounting for one month: 3,240,000 / 72 = 45,000 rubles.

Capitalization of leased property to account 001

Important

Tab “Non-current asset”: The main thing here is to select the option “Under a leasing agreement” in the “Method of Income” field! This value was entered into the program specifically to automate leasing operations. Previously, there was no such OS Entry Method in the program.

Attention

After selecting “Method of receipt” = “Under leasing agreement”, the details “Counterparty” and “Agreement” will become available on the document form, which also need to be filled out. We fill them in with the data of our lessor. The remaining fields are filled in as usual.

Tab “Fixed Assets”: We won’t note anything special in filling out here. But just in case, you never know, let us remind you that when we create a new Fixed Asset (we call it “Vehicle Obtained on Leasing (Leasing Subject)”), we fill in its data to the minimum.

Because the basic data for filling out the fixed asset card is taken from the document Acceptance for accounting of fixed assets.

Accounting for leasing on the lessee's balance sheet in 1s 8.3 and example of postings

According to tax accounting, our fixed asset “village” was added to account 01 in the amount of 2,500,000 rubles (document Acceptance of fixed assets for accounting). Our useful life in tax accounting is 6 years = 72 months. This means depreciation in tax accounting for one month: 2,500,000 / 72 = 34,722.22 (2) rubles. But we also have an increasing special coefficient of 3 - the leased asset is depreciated very quickly for tax accounting purposes (document Acceptance for accounting of fixed assets \ Tax accounting tab).

depreciation in tax accounting for one month: (2,500,000 / 72) * 3 = 104,166.67 rubles.

Which is actually reflected in our tax accounting postings. But in addition to calculating depreciation, at the Closing of the Month we have the operation “Recognition of Leasing Payments in NU”.

And the postings for this operation are like this: The text in the Posting Contents reads as: “Adjustment of depreciation expenses by the amount of the excess over lease payments.”

Leasing in 1s:bukhgalteriya 8

Our depreciation in tax accounting is more than the monthly lease payment! And here the question arises: how do you want me to understand the Tax Code of the Russian Federation?! If depreciation were less than our monthly lease payment, then what would go into our expenses? First, depreciation. Secondly, the monthly lease payment minus depreciation. Let's add these two amounts: depreciation + monthly lease payment – depreciation = monthly lease payment. That is, the amount of the monthly lease payment would go into expenses! But our depreciation is more than the monthly lease payment.

Why don’t we take into account the entire amount of depreciation in expenses - after all, it is more than the monthly lease payment. And by the way, in ConsultantPlus, in the situation we are considering, this is exactly what is done.

And this is not bad: more expenses – less profit – less taxes.

How to account for fixed assets (leasing) in 1c, part 1

In the “Calculations” detail the account for accounting for debt on lease payments is indicated - 76.07.2 (76.27.2, 76.37.2) · In the tabular part in the column “Accounting account” the account for accounting of lease obligations is indicated - 76.07.1 (76.27.1, 76.37.1) We remember that in account 76.07.1 we keep the amount of all our rental obligations - A LARGE AMOUNT! On account 76.07.2 - we take into account the debt on current leasing (usually monthly) payments. This is a small amount if we pay it strictly according to the lease payment schedule, without delays.

Everything is filled in almost automatically. You just need to indicate the number and date of the Act on leasing payments. And don’t forget to register the invoice at the bottom of the Receipt of Goods and Services document.

Accounting for leasing on the lessee's balance sheet in 1s 8.3 step by step

It turns out an interesting thing: all depreciation deductions are like the cost of the leased item; all leasing payments are also an amount in the region of the cost of the leased item. Depreciation charges are written off as expenses. If leasing payments are also written off entirely as expenses, then it turns out that we will write off almost twice the cost of the leased item as expenses.

You can't live like that! Therefore, the lease payment is reduced by the amount of depreciation charges. Then everything is fair: depreciation and leasing payments in excess of the depreciation amount are taken into account.

Our monthly leasing payment is: 94,400 rubles, including VAT 14,400 rubles. That is, the monthly leasing payment excluding VAT = 80,000 rubles. The amount of depreciation for tax accounting with us: 104,166.67 rubles.

On the first tab of the document we will indicate the method of receipt of the fixed assets - under a leasing agreement. For the equipment itself, we will choose our Steepline 4SL03 CNC machine.

The division and warehouse are also indicated here. The account in our example will be 08.04.2. On the next tab - equipment, it is enough to indicate the main tool itself, which is located in the directory of the same name.

Inv. the number will be entered automatically. We will not describe in detail the creation of filling out the OS directory. You shouldn't have any problems with this. Next, let's move on to the next tab - “Accounting”. Correctly filling out the data contained on it is very important, because you will be setting up not only the accounting system, but also how depreciation will be calculated. The accounting account in our case is 01.03. We also indicated that we will calculate depreciation using the straight-line method (in equal parts). Depreciation will take place on account 02.03.

How to register leasing equipment in 1c account 001

It is necessary to indicate the initial cost for tax accounting purposes, which is equal to the amount of expenses of the LESSON (namely the lessor, that is, the other party - not us!) for the acquisition of the leased asset. “Method of reflecting expenses on leasing payments.” As we remember, this is an account and analytics where expenses are written off. In this case, for the purposes of NU. We called the “method of reflecting expenses on leasing payments” “Leasing payments”. From the inside it looks like this: Tab “Depreciation bonus”: We did not touch it in our example. That's why we won't look at it. The postings of the document “Acceptance for accounting of fixed assets” will be as follows: Let’s comment on these postings.

To do this, in the same section, select “Acceptance for accounting of fixed assets“. Click the “Create” button and fill out the document:

- We indicate that we accept equipment for registration upon commissioning;

- indicate the financially responsible person (MRP);

- indicate the location of the fixed asset.

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- type of operation - equipment;

- method of receipt - under a leasing agreement;

- Next, we select the counterparty, contract and equipment from the “Nomenclature” directory.

On the “Fixed Assets” tab, we indicate the property already from the “Fixed Assets” directory.

Capitalization of leased property to account 001 Good afternoon! I ask for help, I am faced with a question that is simple at first glance - at what cost should a leased car be credited to account 001, with or without VAT. There is no direct answer in the regulatory documents, explanations in the literature contradict each other. We are the lessee, the car is on the lessor’s balance sheet. Quote: Hello. The leased asset is reflected at the cost specified in the agreement Quote: Good afternoon! The primary document on the basis of which the leased asset is accepted for accounting on an off-balance sheet account is the acceptance and transfer certificate of the leased asset, drawn up by the parties to the leasing agreement.

It is logical to accept in the amount indicated in this document, that is, in accordance with the leasing agreement itself. A similar position is contained in the Letter of the Department of Tax Administration of the Russian Federation for the city.