Appendix No. 4 to this Documentation

Appendix No. 4 to this Documentation and Appendix No. 5 to the State Contract

on the provision of assessment services

Terms of reference for assessing the market value of a property and lease rights (rental amounts)

for real estate objects that are the property of the Russian Federation

Customer: Appraiser:

This assignment contains requirements for assessing the market value of the lease right in relation to a federally owned real estate object (objects), prepared in accordance with the current legislation in the field of valuation activities:

Federal Law “On Valuation Activities in the Russian Federation” dated July 29, 1998 No. 135-FZ (hereinafter referred to as Law No. 135-FZ).

Federal assessment standard “General concepts of assessment, approaches and requirements for assessment (FSO No. 1)”, approved by order of the Ministry of Economic Development of the Russian Federation dated May 20, 2015 No. 297 (hereinafter referred to as FSO No. 1).

Federal valuation standard “Purpose of valuation and types of value (FSO No. 2)”, approved by order of the Ministry of Economic Development of the Russian Federation dated May 20, 2015 No. 298 (hereinafter referred to as FSO No. 2).

Federal assessment standard “Requirements for an assessment report (FSO No. 3)”, approved by order of the Ministry of Economic Development of Russia dated May 20, 2015 No. 299 (hereinafter referred to as FSO No. 3).

Federal valuation standard “Real estate valuation (FSO No. 7)”, approved by order of the Ministry of Economic Development of Russia dated September 25, 2014 No. 611 (hereinafter referred to as FSO No. 7).

This Technical Specification, if the rental object has certain specifics that distinguish it from a typical real estate object, is applied in terms of the general requirements for the Valuation Report; the valuation methodology for such a rental object must be determined by the Appraiser independently, taking into account its features and specifics, including including using current methodological recommendations, which will also be indicated by the Customer in the corresponding assessment task

Assessment task

1. The object of evaluation is a real estate object and the right to lease (amount of rent) for it, the composition and other characteristics of which are specified in the agreement for the evaluation.

In addition, the Report must contain the following data:

1) Address of the property (or other location characteristics that uniquely identify the property):

Postcode, name of locality, district, street, house number, floor, room number.

2) Type of property: determined in the application for assessment.

3)

Book value of the valuation object (residual) (if any).

2. Property rights to the subject of assessment.

Owner (balance holder) of the property:

Property of the Russian Federation.__________________________________________________________

The purpose of the assessment is to determine the market value of the property being assessed.

4. Intended use of assessment results: assessment task - why this type of value is determined:

1) to establish the starting (initial) amount of rent for the transfer of property for rent at auction;

3) to establish the starting (initial) price for the sale of a real estate object to provide it for ownership at auction;

4) to establish the sale price of a real estate property for granting it into ownership in the exercise of preferential rights;

5) for the purpose of calculating the amount of unjust enrichment.

5.

Type of cost. Market price.

6. Date of assessment – “____” ________ 20 ____

The valuation date (date of valuation, date of determining the value) is the date as of which the value of the valuation object is determined. (Article 10 of Law No. 135-FZ, FSO No. 1).

7. Assessment period –“___” calendar days from the date of signing the agreement for the assessment.

8. Assumptions and Limitations, on which the assessment should be based, are indicated in the relevant section of the Terms of Reference.

9. Composition of the subject of assessment indicating information sufficient to identify each of its parts (if any).

10. Characteristics of the subject of assessment and its evaluated parts or links to documents available to the appraiser containing such characteristics.

11. Rights taken into account when assessing the object of assessment, restrictions (encumbrances) of these rights, including in relation to each part of the subject of assessment.

costs for eliminating environmental pollution and (or) reclamation of a land plot (FSO No. 7).

General terms

The following conditions must be taken into account in the assessment, unless otherwise expressly stated in the previous section.

1. The market rental rate for a property is determined on the assumption that there is no one-time initial payment for the right to lease.

2. Market rent in the general case, i.e. If no special lease terms are specified, the appraiser calculates for those lease terms that the market would consider to be the market norm. However, if the contractual terms of the lease differ from the market norm, then the market rent applicable to that lease must reflect those differences.

3. The rental rate is determined for the property in "as it is".

4. Rent is a payment directly to the owner of the object for benefiting from the useful properties of the thing (real estate).

Comments. Legal basis for rent assessment.

Valuation activity is understood as the professional activity of subjects of valuation activity aimed at establishing market, cadastral or other values in relation to objects of valuation.

(Article 3 of Law No. 135-FZ). Below are comments on why estimating market rents is a valuation activity and why market rents may be the result of an appraisal.

Types of cost

Types of cost are defined in Art. 3 of Law No. 135-FZ and clause 5 of FSO No. 2.

The purpose of the assessment is to determine market value of the subject of assessment.

When determining the market value of the valuation object, the most probable price is determined at which the valuation object can be alienated on the valuation date on the open market in a competitive environment, when the parties to the transaction act reasonably, having all the necessary information, and the value of the transaction price is not reflected in any extraordinary circumstances. circumstances, that is, when:

one of the parties to the transaction is not obliged to alienate the object of valuation, and the other party is not obliged to accept execution;

the parties to the transaction are well aware of the subject of the transaction and act in their own interests;

the valuation object is presented on the open market through a public offer, typical for similar valuation objects;

the price of the transaction represents a reasonable remuneration for the object of evaluation and there was no coercion to complete the transaction in relation to the parties to the transaction on any part;

payment for the valuation object is expressed in monetary form. (Clause 6 FSO No. 2).

The possibility of alienation on the open market means that the property being valued is presented on the open market through a public offer, typical for similar properties, and the period of exposure of the property on the market must be sufficient to attract the attention of a sufficient number of potential buyers.

The reasonableness of the actions of the parties to the transaction means that the transaction price is the highest price reasonably achievable for the seller and the lowest price reasonably achievable for the buyer.

The completeness of available information means that the parties to the transaction are sufficiently informed about the subject of the transaction and act in an effort to achieve the best terms of the transaction from the point of view of each of the parties, in accordance with the full amount of information about the state of the market and the subject of the valuation available on the valuation date.

The absence of extraordinary circumstances means that each of the parties to the transaction has motives for completing the transaction, while the parties are not forced to complete the transaction.

The transaction price represents a reasonable remuneration for the object of evaluation and there was no coercion on the part of the parties to the transaction on any part (Article 3 of Law No. 135-FZ).

Price is the amount of money requested, offered or paid by participants as a result of a completed or proposed transaction (clause 4 of FSO No. 1).

Objects of assessment

An exhaustive list of types of assessment objects is determined by Art. 5 of Law No. 135-FZ. The objects of assessment include:

Individual material objects (things);

The totality of things that constitute a person’s property, including property of a certain type (movable or immovable, including enterprises);

Ownership and other proprietary rights to property or individual items from the property;

Rights of claim, obligations (debts);

Works, services, information;

Other objects of civil rights in respect of which the legislation of the Russian Federation establishes the possibility of their participation in civil circulation.

The owner has the rights to own, use and dispose of his property. The owner has the right, at his own discretion, to alienate his property into the ownership of other persons, to transfer to them, while remaining the owner, the rights of ownership, use and disposal of property, to pledge property and encumber it in other ways, to dispose of it in another way (Article 209 of the Civil Code of the Russian Federation).

Under a lease agreement, the lessor undertakes to provide the tenant with property for a fee for temporary possession and use or for temporary use (Article 606 of the Civil Code of the Russian Federation).

Rent is of a compensatory nature, which is expressed in the obligation of the tenant to pay rent 1 . Thus, a lease is a transfer of part of the rights constituting ownership (rights of use and, possibly, possession) for a certain period of time.

The temporary nature of the use of the leased property is expressed in the limitation of the rental relationship for a period. Moreover, the period can be expressed by indicating 2:

the expiration of a period of time calculated in years, months, weeks, days or hours;

an event that must inevitably occur (for example, the beginning of navigation or a season).

The period may be indefinite. In this case, the lease agreement is valid until one of the parties refuses to fulfill the agreement. In this case, the contract is considered terminated upon expiration of a period of 3 months from the date of receipt of the refusal by the counterparty. The agreement may also provide for a longer period of notice of termination of the lease 3.

Rent is payment for the use of property. The procedure, conditions and terms for paying rent are determined by the lease agreement (Clause 1, Article 614 of the Civil Code of the Russian Federation). The rent, among other things, can be determined in a fixed amount of payments made periodically or at a time (clause 2 of Article 614 of the Civil Code of the Russian Federation).

If the property is transferred to the tenant on the right of possession and use, these rights become an independent property object, which can be called rental rights (lease right) and which can be the subject of independent transactions.

Thus, because the lease right can be the subject of independent transactions and, accordingly, have value; it can be interpreted as a property right, and therefore can be the object of assessment.

Despite the fact that the Civil Code provides for a contract of purchase and sale of property rights 4, lease rights cannot be the object of purchase and sale. As emphasized by paragraph 16 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 66, an exhaustive list of ways to dispose of the right to lease is contained in Art. 615 of the Civil Code of the Russian Federation: “The transfer of the right of lease to another person can be carried out only in the ways provided for in paragraph 2 of Article 615 of the Civil Code, that is, in the order of re-hiring, making a contribution to the authorized capital of a business company or partnership, making a share contribution to a production cooperative.” Therefore, this article establishes special rules for the transfer by a tenant of the lease right to another person, which do not allow assignment as a concession of a “pure” lease right, not burdened with any obligations.

The interest that a lessee acquires under a lease (lease right) represents the right to use and possess for a specified period of time under certain conditions.

Thus, for the purposes of assessing rent, a lease agreement should be interpreted as a set of agreements on the paid transfer of lease rights (a set of temporary property rights - use and possession or only use) for successive periods of time - payment periods. The number of such agreements is determined by the term of the lease agreement and the frequency of payment of rent. In this case, the transfer of lease rights, of course, occurs through the lease mechanism, and the compensated nature of the transfer of rights is ensured by the payment of rent.

Those. For each rental payment, the tenant is transferred the corresponding period of ownership of rental rights to real estate.

Then the rent should be interpreted as the price of the right to use or use and own real estate for a certain period (payment period). Accordingly, the rental rate is the price of the right to use and own a unit of area of a real estate property for a certain period.

In this interpretation, the rent is the cost of the right to lease during one payment period under the conditions specified in the lease agreement.

Those. the object of assessment is the right to lease real estate (the right to use or a set of rights to use and ownership) for one payment period under the conditions specified in the lease agreement. Accordingly, the type of value determined is market value.

Requirements for the order of work

Valuation is a set of logical procedures and calculations aimed at forming a substantiated conclusion about the value of the rights to the object being valued. In essence, this is a modeling of the ideas of potential rationally thinking and free-to-action buyers and sellers (tenants and lessors) about the usefulness of property, its dependence on its properties and their willingness to purchase this property (part with it) for an acceptable (according to their ideas) amount money.

The process of assessing the value of an object of assessment is a set of actions to identify and analyze physical, economic, social, etc. factors influencing the value of the object.

In accordance with clause 23 of FSO No. 1, the assessment includes the following stages:

a) concluding an assessment agreement, including an assessment assignment;

b) collection and analysis of information necessary for the assessment;

c) application of approaches to assessment, including the selection of assessment methods and the implementation of the necessary calculations;

d) coordination (if necessary) of the results and determination of the final value of the value of the valuation object;

e) preparation of an assessment report. The assessment report is drawn up as a document containing reliable evidentiary information and is transferred to the Customer.

The nature of the presentation of the process by which the result is obtained is as important as the rationale and accuracy of the final result. A conclusion about value must be based on market data, procedures and justifications that support the result obtained.

Questions that arise during the assessment process should be answered in a logical sequence. This should enable the assessment consumer to understand the assessment process and trust the conclusions reached. The report should provide the reader with a clear understanding of the views expressed by the appraiser.

In accordance with clause 3 of FSO No. 3, the Valuation Report is a document containing information of evidentiary value, drawn up in accordance with the legislation of the Russian Federation on valuation activities, including this Federal Valuation Standard, regulatory legal acts of the authorized federal body performing the functions of legal regulation of appraisal activities, as well as standards and rules for appraisal activities established by a self-regulatory organization of appraisers, of which the appraiser who prepared the report is a member.

The report is drawn up on paper and (or) in the form of an electronic document in accordance with the requirements of federal valuation standards, regulatory legal acts of the authorized federal body that carries out the functions of legal regulation of valuation activities (Article 11 of Law No. 135-FZ).

Requirements to the preparation of the Report provided for in clause 5 of FSO No. 3.

When preparing a valuation report, the appraiser must adhere to the following principles:

the report must contain information that is significant from the appraiser’s point of view for determining the value of the property being appraised;

information provided in the appraisal report that significantly affects the value of the appraisal object must be confirmed;

Requirements for the content of the Assessment Report are provided for in clause 8 of FSO No. 3

The assessment report must indicate the date of the report and its number. Regardless of the type of assessment object, the assessment report must contain the following information:

A ) assignment for assessment in accordance with the requirements of federal assessment standards:

1) object of assessment;

2) property rights to the valuation object;

3) purpose of the assessment;

4) the intended use of the assessment results and associated limitations;

5) type of cost;

6) date of assessment;

7) the period for conducting the assessment;

8) assumptions and limitations on which the assessment should be based (for more details, see section 1 of this technical specification);

9) the composition of the object of assessment, indicating information sufficient to identify each of its parts (if available);

10) characteristics of the appraised object and its appraised parts or links to documents available to the appraiser containing such characteristics;

11) rights taken into account when assessing the object of assessment, restrictions (encumbrances) of these rights, including in relation to each part of the object of assessment.

The assessment assignment may indicate other estimated values, including:

market rent (the estimated amount of money for which a property could be rented at the valuation date under typical market conditions);

costs of creation (reproduction or replacement) of capital construction projects;

losses (actual damage, lost profits) upon alienation of a property, as well as in other cases;

costs for eliminating environmental pollution and (or) reclamation of land.

b) applied assessment standards;

The assessment report must contain information about federal assessment standards, standards and rules of assessment activities used in the assessment of the subject of assessment.

V) assumptions adopted when assessing the object of assessment;

Compliance (compliance with legislation) and reliability (compliance with actual circumstances) of assumptions adopted during the assessment.

G) information about the appraisal customer and the appraiser(appraisers) who signed (signed) the appraisal report (including last name, first name and (if any) patronymic, location of the appraiser and information about the appraiser’s membership in the self-regulatory organization of appraisers), as well as about the legal entity with which the appraiser (appraisers) ) concluded (concluded) an employment contract;

e) information about all organizations and specialists involved in the assessment and preparation of the assessment report, indicating their qualifications and the degree of their participation in the assessment of the subject of assessment;

e) main facts and conclusions.

The main facts and conclusions section should contain:

the basis for the appraiser’s assessment of the appraisal object;

general information identifying the subject of assessment;

assessment results obtained using different assessment approaches;

the final value of the valuation object. It is mandatory to provide the total market value of the real estate object and the total market value of the lease right (rental amount) for such real estate object;

restrictions and limits of application of the resulting final value;

and) description of the valuation object indicating the list of documents used by the appraiser and establishing the quantitative and qualitative characteristics of the valuation object, and in relation to the valuation object owned by a legal entity - also details of the legal entity (including full and (if any) abbreviated name, date of state registration , main state registration number) and the book value of this valuation object (if any);

Availability of photographic records of the rental property.

Specifics of the lease right as an object of assessment.

In addition, the Report must present

h) market analysis of the valuation object, pricing factors, as well as external factors influencing its cost;

To determine the value of real estate, the appraiser examines the market in those segments that include the actual use of the property being valued and other uses necessary to determine its value.

Real estate market analysis is performed in the following sequence:

a) analysis of the impact of the general political and socio-economic situation in the country and region where the property being assessed is located on the market of the property being assessed, including trends that have emerged in the market in the period preceding the date of assessment;

b) determination of the market segment to which the valued object belongs. If the real estate market is underdeveloped and there is insufficient data to provide an idea of the prices of transactions and (or) offers with comparable real estate objects, it is possible to expand the study area to territories that are similar in economic characteristics to the location of the property being evaluated;

c) analysis of actual data on the prices of transactions and (or) offers with real estate objects from market segments to which the valued object can be classified under actual, as well as alternative options for its use, indicating the range of price values;

d) analysis of the main factors influencing the demand, supply and prices of comparable real estate, for example, rates of return, payback periods for investments in the real estate market, with intervals for the values of these factors;

e) main conclusions regarding the real estate market in the segments necessary to evaluate the property, for example, market dynamics, demand, supply, sales volume, market capacity, motivation of buyers and sellers, liquidity, price fluctuations in the market of the property being valued and other conclusions.

The scope of research is determined by the appraiser based on the principle of sufficiency (FSO No. 7).

And) description of the process of assessing the object of assessment in terms of applying the approach (approaches) to assessment. The report must describe the rationale for the choice of valuation approaches and methods used within each of the applied approaches, the sequence of determining the value of the object of the used valuation approaches and methods within each of the applied approaches, the sequence of determining the value of the valuation object, and also the corresponding calculations. . Moreover, such a description should allow the user of the assessment report to understand the logic of the process of determining value and the correspondence of the method (methods) chosen by the appraiser to the object of assessment, the type of value being determined and the intended use of the assessment results;

The main approaches used in the assessment are comparative, income and cost approaches. When choosing the approaches used in the assessment, one should take into account not only the possibility of using each approach, but also the goals and objectives of the assessment, the intended use of the assessment results, assumptions, completeness and reliability of the initial information. Based on the analysis of these factors, the choice of approaches used by the appraiser is justified.

Comparative approach

The comparative approach is a set of valuation methods based on obtaining the value of the valued object by comparing the valued object with analogous objects.

The comparative approach is recommended to be used when reliable and sufficient information for analysis is available on the prices and characteristics of analogous objects. In this case, both the prices of completed transactions and the prices of offers can be applied.

Within the framework of the comparative approach, various methods are used, based both on a direct comparison of the valued object and analogous objects, and methods based on the analysis of statistical data and information about the market of the object being valued.

When applying a comparative approach to real estate valuation, the appraiser takes into account the following provisions:

a) a comparative approach is used to evaluate real estate, when it is possible to select a sufficient number of analogous objects with known transaction and (or) offer prices for evaluation;

b) real estate objects that belong to the same market segment as the object being valued and are comparable to it in terms of pricing factors are used as analogue objects. At the same time, for all real estate objects, including the one being assessed, pricing for each of these factors must be uniform;

c) when conducting an assessment, the volume of market data available to the appraiser about similar objects and the rules for their selection for calculations must be described. The use in calculations of only part of the analogous objects available to the appraiser must be justified in the assessment report;

d) to perform calculations, specific indicators of value (comparison units) that are typical for a similar object, prevailing on the market of the object being valued, are used, in particular the price or rent per unit of area or unit of volume;

e) depending on the initial information available on the market, in the process of real estate valuation, qualitative valuation methods (relative comparative analysis, expert assessment method and other methods), quantitative valuation methods (regression analysis method, quantitative adjustment method and other methods), as well as their combinations.

When applying qualitative methods, real estate valuation is carried out by studying the relationships identified based on the analysis of transaction prices and (or) offers with similar objects or relevant information received from experts, and using these relationships to conduct an assessment in accordance with the technology of the method chosen for evaluation.

When applying the adjustment method, each analogue object is compared with the valued object according to price-forming factors (comparison elements), differences between objects are identified by these factors, and the price of the analogue object or its specific indicator is adjusted according to the identified differences in order to further determine the value of the valued object. In this case, the adjustment for each element of comparison is based on the principle of the contribution of this element to the cost of the object.

When applying regression analysis methods, the appraiser, using data from the market segment of the object being valued, constructs a pricing model that corresponds to the market for this object, from which he determines the estimated value of the sought value;

f) to compare the valuation object with other real estate objects with which transactions have been made or which are presented on the market for their completion, the following elements of comparison are usually used:

transferred property rights, restrictions (encumbrances) on these rights;

terms of financing of a completed or proposed transaction (type of payment, credit conditions, other conditions);

terms of sale (conditions atypical for the market, transaction between affiliates, other conditions);

market conditions (price changes for the period between the transaction and valuation dates, discounts to offer prices, other conditions);

type of use and/or zoning;

object location;

physical characteristics of the object, including the properties of the land plot, the condition of capital construction objects, the ratio of the area of the land plot and its built-up area, other characteristics;

economic characteristics (level of operating expenses, lease terms, composition of tenants, other characteristics);

the presence of movable property not related to real estate;

other characteristics (elements) affecting the cost;

g) in addition to cost, the comparative approach can be used to determine other estimates, such as rental rates, depreciation and obsolescence, capitalization rates and discount rates.

Income approach

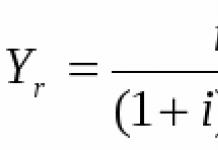

The income approach is a set of valuation methods based on determining the expected income from the use of the valuation object.

Within the framework of the income approach, various methods are used based on discounting cash flows and capitalization of income.

When applying the income approach, the appraiser takes into account the following provisions:

a) the income approach is used to value real estate that generates or is capable of generating income streams;

b) within the framework of the income approach, the value of real estate can be determined by the direct capitalization method, the discounted cash flow method or the capitalization method using calculation models;

c) the direct capitalization method is used to evaluate real estate assets that do not require significant capital investments in their repair or reconstruction, the actual use of which corresponds to their most effective use. Determining the value of real estate objects using this method is carried out by dividing the annual income from the object corresponding to the market by the total capitalization rate, which is determined based on the analysis of market data on the ratio of income and prices of real estate objects similar to the object being valued;

d) the discounted cash flow method is used to evaluate real estate that generates or is capable of generating income streams with arbitrary dynamics of their changes over time by discounting them at a rate corresponding to the return on investment in similar real estate;

e) the capitalization method based on calculation models is used to evaluate real estate that generates regular income streams with the expected dynamics of their change. Capitalization of such income is carried out at a general capitalization rate, constructed on the basis of the discount rate taken into account in the calculation of the capital return model, methods and conditions of financing, as well as expected changes in income and property value in the future;

f) the structure (taking into account taxes, return of capital, rate of change in income and asset value) of the discount rates and (or) capitalization used must correspond to the structure of the discounted (capitalized) income;

g) for real estate that can be rented out, rental payments should be considered as a source of income;

h) the valuation of real estate intended for running a certain type of business (for example, hotels, restaurants, gas stations) can be carried out on the basis of information about the operating activities of this business by separating from its value components that are not related to the real estate being valued.

Cost-effective approach

The cost approach is a set of methods for estimating the value of an appraised object, based on determining the costs necessary for the acquisition, reproduction or replacement of an appraised object, taking into account wear and tear and obsolescence.

The cost approach is primarily used in cases where there is reliable information that allows one to determine the costs of acquiring, reproducing or replacing the valued object.

Within the framework of the cost approach, various methods are used based on determining the costs of creating an exact copy of the valued object or an object that has similar useful properties. The criteria for recognizing an object as an exact copy of the subject of assessment or an object having comparable useful properties are determined by federal assessment standards that establish requirements for the assessment of certain types of assessment objects and (or) for special purposes.

When applying the cost approach, the appraiser takes into account the following provisions:

a) the cost approach is recommended to be used for the valuation of real estate - land plots built up with capital construction projects, or capital construction projects, but not their parts, for example, residential and non-residential premises;

b) it is advisable to use the cost approach to evaluate real estate if it corresponds to the most efficient use of the land plot as undeveloped and it is possible to correctly assess physical wear and tear, as well as functional and external (economic) obsolescence of capital construction projects;

c) the cost approach is recommended to be used when market activity is low, when there is insufficient data necessary to apply the comparative and income approaches to valuation, as well as to evaluate real estate for special purposes and uses (for example, linear objects, hydraulic structures, water towers, pumping stations, boiler houses , utility networks and other real estate for which there are no market data on transactions and offers);

d) in general, the value of a property, determined using the cost approach, is calculated in the following sequence:

determining the value of rights to a land plot as undeveloped;

calculation of costs for the creation (reproduction or replacement) of capital construction projects;

determining the entrepreneur's profit;

identification of wear and tear and obsolescence;

determining the cost of capital construction projects by summing up the costs of creating these facilities and the entrepreneur’s profit and subtracting their physical wear and tear;

determining the value of a real estate property as the sum of the value of rights to a land plot and the cost of capital construction projects;

e) for the purpose of determining the market value of a property using the cost approach, the land plot is assessed as undeveloped, assuming its most effective use;

f) calculation of costs for the creation of capital construction projects is carried out on the basis of:

data on construction contracts (agreements) for the construction of similar facilities;

data on the costs of construction of similar facilities from specialized directories;

estimate calculations;

information on market prices for building materials;

other data;

g) the costs of creating capital construction projects are determined as the sum of the costs included in the construction and installation work directly related to the creation of these objects, and the costs associated with their creation, but not included in the construction and installation work;

h) for the purpose of assessing the market value of real estate, the amount of profit of an entrepreneur is determined on the basis of market information using extraction methods, expert assessments or analytical models, taking into account direct, indirect and opportunity costs associated with the creation of capital construction projects and the acquisition of rights to a land plot;

i) the amount of wear and tear and obsolescence is defined as the loss of real estate value as a result of physical wear and tear, functional and external (economic) obsolescence. At the same time, wear and tear and obsolescence relate to capital construction projects related to the real estate being assessed.

The appraiser has the right to independently determine the need to use certain approaches to assessment and specific assessment methods within the framework of the application of each approach.

When conducting an assessment, it is possible to establish additional assumptions to those specified in the assessment assignment related to the intended use of the assessment results and the specifics of the assessment object.

The appraiser has the right to use a different calculation methodology and independently determine the method(s) of real estate valuation within each of the selected approaches, based on the principles of materiality, validity, unambiguity, verifiability and sufficiency. In this case, the assessment report must provide a description of the method(s) chosen by the appraiser, allowing the user of the assessment report to understand the logic of the process of determining the value and the compliance of the method(s) chosen by the appraiser with the property, the principles of assessment, the type of value being determined and the intended use of the assessment results.

To) description of the procedure for agreeing on assessment results and conclusions, obtained on the basis of calculations carried out using various approaches, as well as when using different methods within the framework of each approach, in order to determine the final value of the cost, or recognizing the result of one of the approaches as the final value of the cost.

Coordination of real estate valuation results obtained using various methods and approaches to valuation, and reflection of its results in the valuation report, is carried out in accordance with the requirements of FSO No. 1 and FSO No. 3:

In the case of using several approaches to assessment, as well as using several assessment methods within any of the approaches to assessment, preliminary approval of their results is carried out in order to obtain an intermediate result of assessing the object of assessment using this approach. When reconciling significantly different interim assessment results obtained by different approaches or methods, the report must reflect the analysis performed and the established reason for the discrepancies. A difference is considered significant when the result obtained by applying one approach (method) is outside the range of value specified by the appraiser obtained by applying another approach (methods) (if any).

After the approval procedure, the appraiser, in addition to indicating in the appraisal report the final value of the value of the appraised object, has the right to give his judgment on the possible boundaries of the interval in which, in his opinion, this value may lie, unless otherwise specified in the appraisal task.

The final value of the valuation object must be expressed in rubles of the Russian Federation.

If several valuation methods are used within any approach to real estate valuation, preliminary approval of their results is carried out in order to obtain an intermediate result of real estate valuation using this approach.

In the process of coordinating the intermediate results of real estate valuation obtained using different approaches, it is necessary to analyze the advantages and disadvantages of these approaches, explain the discrepancy between the intermediate results and, based on the analysis, determine the final result of the real estate valuation.

If there is insufficient market data necessary to implement any of the approaches to real estate valuation in accordance with the requirements of this Federal Valuation Standard and FSO No. 1, FSO No. 2, FSO No. 3, within the framework of the chosen approach, based on the available data, it is recommended to indicate indicative values ( value) of the value being assessed, which are not taken into account in the final approval, but can be used as a calibration measure for the final result of the real estate assessment.

After the approval procedure, the appraiser, in addition to indicating in the assessment report the final result of the assessment of the value of real estate, gives his judgment on the possible boundaries of the interval in which, in his opinion, this value may lie, unless otherwise specified in the assessment task.

The final value of the valuation object is subject to rounding to the nearest thousand rubles in accordance with the current rounding procedure, indicated for the entire rental object per year.

In the application The appendix to the assessment report must contain copies of documents used by the appraiser and establishing the quantitative and qualitative characteristics of the appraisal object, including title and title documents, as well as technical inventory documents, expert opinions, as well as other documents on the appraisal object (for example, photographs ) if available, in the absence of any documents in restrictive conditions and assumptions, the appraiser is obliged to reflect this fact.

The annex to the Report must contain Property inspection report, compiled by the APPRAISER based on the results of the inspection of the property, and signed by him, as well as, if necessary, by the tenant/user of the property (if any).

Requirements for description in the information assessment report,used in the assessment

The text of the assessment report must contain links to sources of information or copies of materials and printouts used in the report, allowing conclusions to be drawn about the source of the relevant information and the date of its preparation. If information when published on a website on the Internet information and telecommunications network is not provided with free access on the date of the assessment or after the date of the assessment, or in the future it is possible to change this information or the address of the page on which it is published, or the information is used, not published in a publicly available printed publication, then copies of the relevant materials must be attached to the assessment report.

Documents provided by the customer (including certificates, tables, balance sheets) must be signed by an authorized person and certified in the prescribed manner, and their copies are attached to the report.

If the value determined by expert opinion is used as information significant for the value of the valuation object, the valuation report must analyze this value for compliance with market data (if market information is available).

The final value of the cost can be presented in the form of a specific number rounded according to mathematical rounding rules or in the form of an interval of values, if such a presentation is provided for by the legislation of the Russian Federation or the assessment assignment.

The basis for the assessment of the object is the contract (Article 9). As a result of the changes made to Part 1 of the article by Federal Law No. 157-FZ of July 27, 2006, the agreement on the basis of which the assessment is carried out received the legislative name - “agreement for assessment”.

When concluding an appraisal agreement, the appraiser is obliged to provide the customer with information about the requirements of the legislation on appraisal activities, including the responsibilities of the appraiser, the requirements for the appraisal agreement and appraisal report, as well as appraisal standards. The fact of providing such information is recorded in the assessment agreement.

Mandatory requirements for an assessment agreement are reflected in Article 10 of the Law.

To conclude an agreement for an assessment, its simple written form is sufficient, which means that such an agreement does not require notarization or state registration (in the previously valid version of Part 1 of the article (i.e., before amendments were made by Federal Law of July 27, 2006 No. 157-FZ) directly stated that notarization of the contract is not necessary). Part 2 of Article 10 of the Law establishes a list of information that is subject to mandatory inclusion in the assessment agreement, i.e. conditions required for assessment contracts:

Object of assessment;

Type of property value (method of valuation);

The amount of monetary remuneration for conducting the assessment;

Information on compulsory insurance of civil liability of the appraiser;

The name of the SROO, of which the appraiser is a member, and the location of this organization;

An indication of the standards of assessment activities that will be applied during the assessment;

An indication of the amount, procedure and grounds for the occurrence of additional liability in relation to the liability established by civil law and Art. 24.6 of the Law, the appraiser or the legal entity with which the appraiser has entered into an employment contract. It should be noted that Part 2 of this article of the Law refers to the acceptance by a legal entity with which the appraiser has entered into an employment contract, to undertake obligations to additionally ensure the liability of the appraiser as a right, but not as an obligation; therefore, such a condition of the assessment contract is not mandatory.

The contract for the assessment concluded by the customer with a legal entity must indicate information about the appraiser or appraisers who will conduct the assessment, incl. Full name. appraiser or appraisers.

In relation to the assessment of objects belonging to the Russian Federation, constituent entities of the Russian Federation or municipalities, an agreement to conduct an assessment on behalf of the customer is concluded by a person. authorized owner to carry out transactions with objects.

According to FSO No. 1 “General concepts of assessment, approaches and requirements for conducting an assessment,” one of the requirements for conducting an assessment is the conclusion of an agreement for the assessment, including an assessment task. The assessment task must contain the following information:

a) the object of assessment;

b) property rights to the valuation object;

c) the purpose of the assessment;

d) the intended use of the assessment results and associated limitations;

e) type of cost;

f) date of assessment;

g) the period for the assessment;

h) assumptions and limitations on which the assessment should be based.

OBJECT OF EVALUATION. According to Law No. е35 -FZ Art. 5 . Objects of assessment– all objects of civil rights in respect of which the legislation of the Russian Federation establishes the possibility of their participation in civil circulation. The objects of assessment include:

Technical task

Investment object– the result of an investment project (newly created, reconstructed, restored real estate property).

Investment contribution of the Russian Federation- a real estate object involved in economic turnover on investment terms.

Share of the Russian Federation in the investment property– a share in an investment object transferred as a result of the implementation of an investment agreement into the ownership of the Russian Federation, expressed as a percentage or in physical terms.

4. Requirements for the Assessment Process

The valuation process must contain the research and analysis necessary to draw conclusions about market value and include problem statement, site inspection, data collection, processing of information received and presentation of conclusions and results of the work.

The assessment process should include the following main steps.

1. Statement of the problem.

1.1. Goals and objectives of the assessment.

1.2. Object identification.

1.3. Type of value determined.

1.4. Assessment dates.

1.5. Limitations and assumptions.

1.6. Choosing a Methodology

2. Collection of background information.

2.1. Information about the object of assessment.

2.1.1. Documentation.

2.1.2. Inspection and photographic recording.

2.2. General information (region, city, local environment).

2.3. Market of the object of evaluation.

3. Best and Best Use Analysis

4. Calculation of market value.

4.1. Cost-effective approach.

4.2. Income approach.

4.3. Comparative approach.

4.4. Coordination of results and determination of the final cost.

5. Report preparation.

5. general requirements for the assessment report

1. The report must meet the requirements of the current legislation on valuation activities:

Federal Law “On Valuation Activities in the Russian Federation” dated January 1, 2001;

Valuation standards mandatory for use by subjects of valuation activities, approved by Decree of the Government of the Russian Federation of July 6, 2001 No. 000;

Federal assessment standards:

FSO No. 1, approved by the Order of the Ministry of Economic Development and Trade of the Russian Federation dated 01.01.01. No. 000 “On approval of the federal assessment standard “General concepts of assessment, approaches to assessment and requirements for assessment (FSO No. 1)”,

FSO No. 2, approved by the Order of the Ministry of Economic Development and Trade of the Russian Federation dated 01.01.01. No. 000 "On approval of the federal valuation standard "Purpose of valuation and types of value (FSO No. 2)"

FSO No. 3 was approved by the Order of the Ministry of Economic Development and Trade of the Russian Federation dated 01.01.01. No. 000 “On approval of the federal assessment standard “Requirements for an assessment report (FSO No. 3)”;

Methodological recommendations for determining the market value of land plots, approved by order of the Ministry of Property of Russia dated January 1, 2001 N 568-r;

2. Requirements for the assessment and the content of individual sections of the report are presented further in the relevant sections of the assignment.

6. Statement of the problem

6.1. Purpose of the assessment

The purpose of the assessment is to determine the market value

6.2. Intended use of assessment results

The assessment results will be used to involve the object in economic turnover on investment terms

6.3. Object of assessment

The real estate object is subject to assessment (indicate the name, address, type of right being assessed and other identification characteristics) and the land plot related to it (indicate the cadastral number, area, type of right)

6.4. Property rights to the subject of valuation

This section describes all existing legal relations in relation to the object of assessment and its individual components. The types of rights and encumbrances, subjects of rights, urgency of rights, details of title and title documents are indicated.

If there are encumbrances, the amount of the investor's costs to eliminate these encumbrances, for example, the resettlement of residents from residential buildings located on the invested development sites, must be taken into account taking into account the current legislation on the resettlement of residents.

The Investor's obligations for the construction or reconstruction of social infrastructure facilities, as well as the share of a constituent entity of the Russian Federation or municipal entity in a future facility cannot be taken into account as encumbrances of the facility.

6.5. Type of value determined

To be assessed market price object of valuation, since according to current legislation, the economic turnover of objects owned by the Russian Federation must occur at market value.

6.6. Valuation date (date of valuation, date of determination of value)

The date of assessment (date of determination of value, date of assessment) should be understood as the date as of which the value is determined.

6.7. Assessment deadline

Term _____________________________________________________________

6.8. Assumptions and Limitations

These restrictions should not conflict with current legislation and obvious logic. For example, the value of existing use cannot be used or the value of rights to a land plot is not taken into account.

7. Collection of initial information about the object of assessment

7.1. Documents establishing the quantitative, qualitative and legal characteristics of the object

The appraiser must analyze the following documents to establish the quantitative, qualitative and legal characteristics of the object and include them in the appendix to the appraisal report:

1. extract from the federal property register about the real estate property;

2. a copy of the certificate of state registration of the right to real estate;

3. information about encumbrances on the real estate property with copies of documents confirming such encumbrances;

4. documents of technical accounting of a real estate object (technical passport prepared by an organization (body) for state technical accounting and (or) technical inventory of capital construction projects);

14. schedule for the implementation and financing of the investment project and other project documentation (if any).

7.2. Inspection of the object and photographic recording

The visual inspection carried out should allow for a comprehensive description of the visible pricing factors of the object and include the following components, which should be reflected in the description section of the object:

1. Location;

2. Constructive, space-planning characteristics;

3. Engineering communications;

4. Construction readiness;

5. Technical condition;

Photographic recording should include recording of the surroundings, entrances, front and rear facades of the building, premises with various structural and functional characteristics, construction readiness and technical condition, features of the object, as well as other significant pricing characteristics of the object if they are discovered. If, based on the results of the analysis of the most effective use, it is concluded that demolition of the object is necessary, photographic recording of the existing property can be presented in a minimal amount to confirm this conclusion. The results of photographic recording must be given in the report.

8. Description of the valuation object

The description of the valuation object must include the necessary and sufficient pricing factors of the valuation object.

The description of the property being assessed must contain the following sections: identification of the property being assessed, a description of the location, a description of the land plot and the existing property.

8.1. Identification of the object of assessment

In the identification section, the object of assessment is clearly and briefly formulated based on the task at hand. In particular, the name, address, and composition of the assessment object are indicated.

8.2. Location

The choice of boundaries for the description and analysis of the location is determined by the territorial boundaries of the influence of the external environment on the value of the object.

The most significant and typical location factors requiring description and analysis are the following:

Distance from the city center and local centers of influence (metro stations and central highways, busy streets);

Development of social infrastructure: availability of schools, kindergartens, cultural facilities, shops, etc.;

Surrounding development (density, height, functional purpose, level of consumer characteristics);

Presence of competing objects;

Transport accessibility of the facility for clients, suppliers and employees through public transport (characterized by distance to stops and the availability of various types of transport), accessibility for personal transport, characterized by the presence of parking lots and convenient entrances;

Engineering networks, provision of technical capacities;

Environmental conditions;

Urban zoning of the territory: differentiated land tax rates and land rental rates that determine mandatory payments for the use or ownership of a land plot;

Natural and climatic conditions (climatic, geological, hydrogeological);

Sales prices and pricing factors for them.

Investment activity indicators should be analyzed:

If there are design documentation for the object of assessment that does not contradict the identified urban planning restrictions and established market practice, it is advisable to use the development option for the object specified in this documentation as the main one in further analysis.

The analysis of the factors that form the cost should include an analysis of the functional purpose, the number of utility units, the level of consumer characteristics, physical condition, and functional requirements. The effect of adding value can occur due to the following factors: increasing the rental rate, reducing operating costs, increasing the rented area, increasing occupancy, reducing the risk of operating the asset, increasing the useful life.

All further calculations to determine the market value of the valuation object are performed for the most effective use option. If the most effective use of the property being assessed is the demolition of an existing facility and the construction of a new one, the further calculation methodology should correspond to the assessment of the land plot with unnecessary improvements, that is, elements that reduce the value of the land plot by the amount of the cost of clearing the land plot of these elements.

11. Cost approach

11.1. Features of application

A feature of the contribution objects is the discrepancy between their current use and the most effective use and significant avoidable wear and tear caused by missing improvements (the need for construction, reconstruction) and/or unnecessary improvements (the need for demolition, reconstruction). If, as part of the analysis of the most effective use, it is concluded that the existing facility is subject to demolition, then the assessment using the cost approach is reduced to calculating the value of the land plot using the comparative or income approach, which leads to the degeneration of the cost approach. In this case, a justification for not using the cost approach should be provided.

11.2. Valuation of land rights

The requirements are presented in the comparative approach section.

11.3. Reproduction/replacement costs

A feature of calculating the cost of construction in most cases is the presence of unnecessary improvements on the site, which, as a result of an analysis of the most effective use, are fixed for demolition or reconstruction, as well as missing improvements that require addition. In this case, it is not the costs of reproduction that should be calculated, but the costs of replacing the valued object.

Costs of replacement or reproduction here and throughout the report may be determined on the basis of estimates or the following references.

1. Regional reference book of construction costs (RSS-2007) - M.: “Center for Information Technologies in Construction”, 2006.

1. Public buildings. Aggregated indicators of construction costs. Series "Appraiser's Handbook". - M.: -INVEST", 2007.

2. Industrial buildings. Aggregated indicators of construction costs. Series "Appraiser's Handbook". Fourth edition, revised and expanded - M.: -INVEST", 2007.

3. Warehouse buildings and structures. Aggregated indicators of construction costs. Series "Appraiser's Handbook". - M.: -INVEST", 2007.

4. Residential buildings. Aggregated indicators of construction costs. Series “Appraiser's Handbook” - M.: -INVEST, 2003.

5. Backbone networks and transport 2007. Aggregated indicators of construction costs. Series “Appraiser’s Handbook” - M.: -INVEST, 2007

6. Quarterly interregional information and analytical bulletins KO-INVEST. “Price indices in construction” - M.: -INVEST.”

11.4. Construction readiness

For unfinished construction projects, construction readiness is calculated. Construction readiness is calculated as a weighted average value of the readiness of individual structural elements of the object, which is described and confirmed by photographic data and certificates of work performed.

The construction readiness of individual elements is described in the report based on data from as-built documentation and visual inspection.

11.5. Accumulated wear

Accumulated wear includes repairable and irreparable wear. Wear is caused by excessive improvements; missing improvements or improvements that require replacement. Reversible wear and tear is wear for which the contribution to the market value (added value) as a result of its elimination is greater than the cost of elimination. The change in value should be determined using a comparative or income approach.

Cumulative wear and tear is calculated using the following formula:

I=ΔSneustr+Sv+Zsuschustr–Znsuustr,

I – wear;

ΔСneustr – loss of value from irreparable wear and tear;

Zv – costs of reproduction of excess improvements.

Zsuschustr – costs of eliminating removable wear and tear in an existing facility;

Znsuustr – the cost of eliminating avoidable wear and tear in new construction.

6. Determination of future rent for certain periods of the forecast rental period by increasing the rent on the date of assessment, assuming the property is ready for the growth rate of rental rates.

7. Determination of the forecast sales price (reversion).

8. Determination of the discount rate for the period until the facility is put into operation.

9. Determination of the discount rate for the period of operation (renting).

10. Determination of the market value of the Russian Federation’s contribution to the investment project by reducing, by period, the difference in future income from the rental and sale of the investment object and development costs to the date of assessment with the appropriate discount rate.

13.2. Forecast period

When constructing cash flow based on a model that assumes receiving income from the sale of an investment property, the calculation horizon is determined by the period of sale of the last areas of the property. The sales schedule should be consistent with typical market conditions.

When constructing a rental model with deferred sale, the calculation horizon should be limited to a period of no more than 5 years from the date of the start of putting the facility into operation, but not less than the period for reaching the design load with stabilization of the flow.

13.3. Investment costs

When forecasting future investment costs, the following characteristics must be justified:

cost calculation method;

volumes and structure of work;

rate of change in costs;

timing and sequence of work.

The costs of connecting to utility networks are taken into account on the basis of documents submitted by organizations operating utility networks.

The scope of work to be performed should be based on the result of the best use analysis. Costs are calculated taking into account the requirements set out in the cost approach section.

Construction timeframes must be determined based on SNiP 1.04.03-85, 1.05.03-87 and, if necessary, adjusted to typical market conditions.

Investment costs should not be increased by the profit of the developer (entrepreneur), since this value is taken into account through the discounting procedure through the average market rate of return on capital (discount rate).

13.4. Recurring income

When forecasting future periodic income, the following indicators must be justified:

unit of comparison (measurement) of utility (income);

amount of payment (cost) per unit of utility;

structure and timing of income generation;

dynamics of income changes;

type of cash flow;

loss of income.

As a rule, the unit of comparison is the rental rate per unit of area per unit of time, typical for a given market segment. In particular, the unit of area can be a unit of total or a unit of usable area.

The rental rate must be obtained using the comparative method. When selecting and describing analogues, as well as making adjustments, the requirements specified in the comparative assessment approach should be taken into account.

Rental rates must include the following:

presence or absence of VAT;

terms of payment over time (quarterly, monthly, advance payment, etc.);

terms of payment of operating fees indicating their composition;

type of rented area (total, usable);

conditions for repairs (they are carried out at the expense of the tenant or landlord).

For the purposes of this calculation, one should proceed from the assumption that the project will be financed from the Investor's own funds without attracting borrowed capital. Cash flow must be calculated on a pre-tax basis - before income tax is calculated, due to differences in taxation of specific entities.

13.5. Recurring expenses

When forecasting costs, the following typical cost structure indicators for the market segment under consideration must be justified:

land payment;

administrative expenses;

insurance payments;

property tax.

Property tax is calculated based on the value excluding VAT at which the investment object will be placed on the balance sheet. Every year this value is reduced due to a reduction in the average annual residual value of property as a result of depreciation.

13.6. Reversion

Determination of the forecast sale price (reversion) can be done using the direct capitalization method or the comparative method.

13.7. Forecast of the rate of change of indicators

When forecasting all indicators, the following operations should be performed:

identify retrospective dynamics;

identify the factors that determine this dynamics;

predict changes in the factors that determine the dynamics, determining the impact of the retrospective on the future change in the indicator.

The rate of price changes should be taken into account the market analysis materials of leading analytical companies (for example, Colliers International, Knight Frank, CB Richard Ellis Noble Gibbons, Jones Lang LaSalle, Cushman & Wakefield Stiles & Riabokobylko, Swiss Realty Group, Blackwood, etc.).

13.8. Discount and capitalization rates

The capitalization rate for the operating period must be calculated using the market extraction method or justify the impossibility of using it. If it is impossible to use the market extraction method, the cumulative construction method is used. The discount rate for the operating period is calculated as the difference between the capitalization rate and the return on capital rate, taking into account the rate of market change. The capital return period is assumed to be equal to the remaining economic life of the object.

The discount rate for the development period (before putting the facility into operation) of an investment property is determined based on an analysis of the profitability of similar investment projects on the market and using the cumulative construction method. The discount rate on equity should be no more than 20% for pre-tax cash flow.

The capitalization rate for the post-forecast period (terminal) can be calculated by adjusting the capitalization rate for the current period taking into account the rate of its change in retrospect.

Discounting should be done in accordance with the distribution of payments over time, that is, if the flow is distributed evenly over time, then it should be discounted to the middle of the billing period.

14. Coordination of results and determination of final cost

Based on the results of applying individual approaches, weights are assigned to each approach according to the reliability of the result obtained by the approach.

To assess credibility, the following factors are analyzed for each approach:

Compliance with the seller's motivation; Matching buyer motivation; Compliance with the existing relationship between supply and demand; Compliance with the features of the object; Accuracy, sufficiency and reliability of source data.

If the discrepancy between approaches is more than 30%, the causes of the discrepancy should be analyzed and eliminated, or the unreliable result should be excluded from approval.

15. Determination of the share of the Russian Federation

The assessment report must contain a consultation section aimed at calculating the Russian Federation's share in the future investment object. The share is calculated as the ratio of the market value of the object to the current value of income from the project.

The legislation of the Russian Federation establishes only one payment that can be charged from the owner of a land plot in the process of obtaining a construction permit - a fee for connecting to engineering networks (Article 48 of the Town Planning Code of the Russian Federation). A subject of the Russian Federation or a municipal entity has no grounds for demanding compensation for costs of social infrastructure (schools, hospitals, etc.) by investors or the Russian Federation due to the fact that the financing of social infrastructure, in accordance with current legislation (184-FZ dated 06.10.99 ., 131-FZ dated 06.10.03) is an expenditure authority of the constituent entities of the Russian Federation and should be financed exclusively from their budgets.

In addition, financing social infrastructure facilities from the budget of the Russian Federation is a direct violation of budget legislation, since the Russian Federation does not have the authority to create such facilities, and federally owned facilities are subject to unconditional transfer to other public property. Violation of budget legislation (Article 42 of the Budget Code of the Russian Federation) is also expressed in the fact that part of the income arising from the use of property of the Russian Federation in this case is transferred to the budget of another entity, which can be defined as improper use of budget funds. In addition, a subject of the Russian Federation or a municipal entity has no reason to act as a subject of civil law relations in investment contracts when involving real estate of the Russian Federation in economic turnover on investment terms.

The list was compiled taking into account the requirements imposed by the Decree of the Government of the Russian Federation dated 01.01.01 No. 000 “On the procedure for adoption by federal executive bodies of decisions on giving consent to enter into transactions to attract investments in relation to federally owned real estate objects”

In accordance with Decree of the Government of the Russian Federation dated January 1, 2001 N 447 “On improving the accounting of federal property”

In accordance with Art. 46 of the Town Planning Code of the Russian Federation, a local government body is obliged, upon request from copyright holders, to issue a town planning plan for a land plot within 30 days without charging a fee, including information about the permitted use of the land plot, requirements for the purpose, parameters and placement of a capital construction project on the specified land plot.

Decree of the Moscow Government dated 01.01.2001 N 301-PP "ON THE RESULTS OF THE WORK OF THE COMPLEX OF ARCHITECTURE, CONSTRUCTION, DEVELOPMENT AND RECONSTRUCTION OF THE CITY OF MOSCOW FOR 2006 AND TASKS FOR IMPLEMENTING THE INVESTMENT PROGRAM FOR THE FIRST HALF OF THE YEAR AND 2007 IN GENERAL" (clause 11.2.9).

One of the basic principles of assessment: The appraisal of real estate. - 12th ed., Appraisal Institute (U.S.), 2001.

Smith, Ricardo, Marx, neoclassical theory.

Replacement cost is the cost of constructing a facility of similar utility.

VSN 53-86(r) Rules for assessing physical deterioration of residential buildings

The specified organizations are required to submit, upon request within 14 days without charging a fee, technical conditions stipulating the maximum load, connection times and validity period of the technical conditions or information about the connection fee indicating the connection tariff approved at the time of issuing the technical conditions as established by law Russian Federation procedure (Article 48 of the Town Planning Code of the Russian Federation and Decree of the Government of the Russian Federation dated 01.01.01 N 83 “On approval of the rules for determining and providing technical conditions for connecting a capital construction project to engineering support networks and rules for connecting a capital construction project to engineering support networks")

The capital structure does not affect the value of the company and, in particular, the effectiveness of the investment project (Modigliani and Miller)

font size

ORDER of the Ministry of Property of the Russian Federation dated 06/23/2000 112-р ON THE ASSESSMENT OF REAL ESTATE PROPERTY IN FEDERAL OWNERSHIP... Relevant in 2018

SAMPLE TERMS OF REFERENCE FOR THE ASSESSMENT OF REAL PROPERTY IN FEDERAL OWNERSHIP

Form SAMPLE TECHNICAL TERMS FOR THE EVALUATION OF REAL PROPERTY OWNED BY THE FEDERAL OWNER Ministry of Property Relations of the Russian Federation represented by __________________________________________________________, acting on the basis of the Regulations, hereinafter referred to as the Customer, on the one hand, and ______________________________ represented by (appraiser) ________________________ ________________________, acting on ( position) (full name) on the basis of ________________, hereinafter referred to as - Appraiser, on the other hand, have drawn up this technical specification for carrying out appraisal work in accordance with Agreement No. _______ dated "__" ___________ 200_ (hereinafter - Agreement ). 1. Object of assessment The object of assessment is _____________________________________. 2. Purpose of the assessment The purpose of the assessment is: _____________________________________________. 3. Type of determined value Type of determined value: _________________________________. 4. Date of assessment The assessment is carried out as of "__" __________ 200_ 5. Information about the object of assessment __________________________________________________________________ __________________________________________________________________ __________________________________________________________________ 6. Requirements for the assessment 6.1. Valuation should be carried out using the income, comparative (market) and cost (property) approaches in accordance with relevant valuation standards. The use, as well as the non-use of these assessment methods, must be justified by the Appraiser. 6.2. The assessment is carried out in the sequence and within the time limits specified in the Agreement. 7. Requirements for the assessment report 7.1. The assessment results must be presented to the Customer in the form of a written assessment report (hereinafter referred to as the Report). 7.2. The report must comply with the requirements of the Federal Law of July 29, 1998 N 135-FZ “On Valuation Activities in the Russian Federation” and contain: - the date(s) of the assessment; - date of preparation and serial number of the Report; - precise description of the subject of assessment; - basis for the assessment; - goals and objectives of the assessment; - type of value determined; - an indication of assessment standards and justification for their use when conducting assessments; - a list of data used in the assessment, indicating the source of its receipt; - assumptions and adjustments made during the assessment, as well as their justification; - the sequence of determining the value of the valuation object and its final value, as well as the restrictions and limits of application of the result obtained; - legal address of the Appraiser and a copy of the insurance policy confirming the civil liability insurance of the Appraiser; - other information that, in the Appraiser’s opinion, is essential for a complete and unambiguous interpretation of the assessment results. 8. Final provisions Any additions, changes and annexes to this technical specification are valid only if they are made in writing and signed by authorized representatives of the Parties. 9. Signatures of the Parties Customer: Ministry of Property Relations of the Russian Federation (Address) TIN __________________ First Deputy Minister / Deputy Minister _______________ (Full Name) Appraiser: (Organization) (Address) TIN __________________ __________________ _______________ (Position) (Full Name) .ABOUT.)